Apart from MBOs, CDC is exploring options to directly take over companies, especially psus, that are up for sale. It had aggressively bid for cmc. As Peck confirms, CDC was one of the two bidders, the other being the Tata group that finally got control of cmc. Sources who are involved in the deal say that CDC may be bidding for the state government's stake in Punjab Tractors.In both cases, CDC's aim was the same: to own the shares, take part in the decision-making process and decide whether it wishes to change the existing management.

But the change of tack in some instances has been a trifle too aggressive. Some cases have revealed that the VCs are turning into predators and attempting hostile takeovers. About a year ago, the stockmarket was talking of a VC who was picking up huge stakes in an IT education firm. However, when the news leaked, the VC stopped short of the 15 per cent mark, after which it would have been forced to make an open offer. This kind of hostility is visible even when the VCs deal with crises in startups they have funded earlier. Like their US counterparts, they are becoming majority owners, bringing in professional managers and asking the original promoters to quietly get out. The most recent case is that of Talisma, a customer relationship software firm, where Oak Investment Partners gained majority control and promoter Pradeep Singh had to resign as chairman but still retains a small stake.

In the software and BPO sector, too, there are other deals being clicked by VCs. But these are typically where the funds are trying to take advantage of strong front-end operations of US firms, which either wish to set up low-cost backends in India or tie up with Indian firms. For example, Jumpstartup's last five deals have been in American firms. "The only space I see opening up for startups in the Indian tech sector is product development. The future could see Indian firms with sales of $1 million being sold for $60 million," predicts Ganapathy Subramanian, MD, Jumpstartup.

But until that happens, cross-border deals will be in vogue. Take the case of Warburg Pincus, which, earlier this year, pushed the merger of an Indian IT firm, Apar Info Tech, with the Israel-based Ness Technologies. Now, Warburg had a stake in both firms and it wanted Ness, which has a huge marketing setup in the US, to acquire a low-cost, back-end, offshore base in India (Apar). Explains Arun Natarajan, editor, TSJ Media, which brings out an online newsletter that tracks VC trends: "VCs are more interested in US companies with back-end operations here."

All this does not mean that VCs are not looking at startups at all. The flavour of the month is biotech firms. Agrees Sarath Naru, MD, APIDC Venture Capital, which launched India's first biotech fund (Rs 150 crore): "As yet there are very few mature companies in the biotech space so you have to fund startups. Even with Rs 5 crore you can fund the startup requirements of a biotech enterprise." However, Natarajan feels that not much has happened in this sector in the past two years. Except for some deals like that of the Bangalore-based Strand Genomics, which raised $4.6 million from WestBridge Capital Partners, UTI Ventures and angel investors.

Then there are other sunrise sectors, which have attracted the VCs. In media, the most recent deal was when Standard Chartered Private Equity invested nearly Rs 50 crore in NDTV. And GW Capital, whose portfolio includes media, healthcare (super-speciality hospital chains) and biotech (Biocon), invested in a film distribution firm, Shingar Films. Money has also flowed into retail with both departmental stores and multiplexes reaping the benefit. But according to sources, the VC pie is still loaded in favour of the BPO sector, which accounts for 90 per cent of their existing investment portfolios.

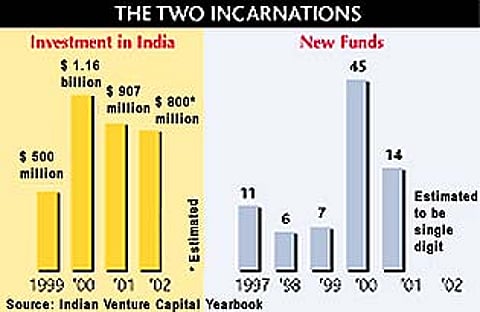

The question in such circumstances is: will the BPO boom turn out to be like the dotcom one for VCs? Saurabh Srivastava, chairman, Indian Venture Capital Association, is optimistic: "Indian VCs have still not had a seven-year cycle," which is typically when they mature and make money. Well, one only hopes that they aren't heading for a seven-year ditch.

Ace Ventura

The dotcom bus t has made the venture capitalists wiser. Now, they only fund ventures which they can control.

Published At:

Tags