Budget-E-Aam

P. Chidambaram's diagnosis of the economy is spot on. Only his prescription is tepid.

Education: Rs 32,352 cr 34%

Health and Family Welfare: Rs 15,291 cr 21.9%

Bharat Nirman Rs 24,603 cr 31.6%

***

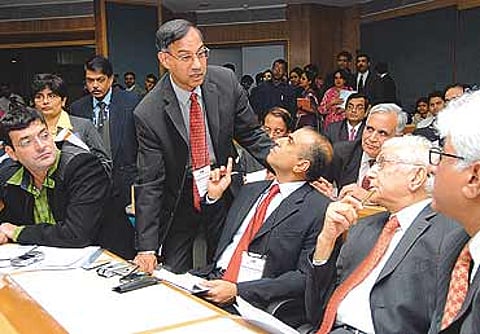

"This budget has to be judged in the political and economiccontext. My job is to deliver it and it’s your privilege to judge it."

-P. Chidambaram at his post-budget press conference

Let's now take each sector to analyse whether PC's allocation tools will help or not. Agriculture is a constant worry since at an average annual growth rate of 2.3 per cent, it can drag down the economy anytime. As it has done in the past 15 years. So, the FM has tried to boost production and productivity in the sector by ensuring availability of quality seeds, further hiking farm credit and usher in a second green revolution based on knowledge and R&D-based initiatives.

But M.S. Swaminathan, the doyen of the first green revolution, doesn't believe it will happen with this year's budget proposals. "The people and farmers know what ails agriculture but the government acts in a fragmented manner. The budget is unlikely to address the economic and ecological issues facing Indian agriculture," he says. Adds Deepak Puri, CMD, Moser Baer, "Today, Indian farmers are small and marginal because of their landholdings and they need to be supported."

In a similar vein, Dhruv Sawhney, CMD, Triveni Engineering, feels the key to higher agricultural growth in the near future lies in the government's ability to woo investments and technology and that "the need of the hour is more radical measures". Rakesh Mittal of Bharti Enterprises adds that there have to be more incentives for private investments in the farm sector to support areas like cold chain and food processing. "This was missing in this year's budget," he says.

Even in the health sector, while the incentives for in-house R&D and concessions for clinical trials have been welcomed, there is still a feeling of being let down by the finance minister. Says Malvinder M. Singh, CEO and MD of Ranbaxy Laboratories, "What is missing is infrastructure status for health services." Prathap C. Reddy of Apollo Hospitals thinks the FM hasn't been able to realise the full potential of private healthcare contributing to a healthy India. "More incentives are needed to develop healthcare infrastructure," he contends. Bert Paterson, MD, Aviva Life Insurance, is unhappy there is nothing to attract FDI in healthcare. "There is nothing for the long- term development of life and health insurance, and the pension industry," he says.

In education, the next area of concern, the long-term vision is to push India to become a knowledge-based economy. And help solve the impending manpower crisis in both manufacturing and services. One can see the cracks in the system and several consultancy firms have admitted that although India may produce lakhs of engineers, most of them can't be recruited in software and BPOs. This is one reason why Chidambaram wants to reduce school dropouts and also focus on higher education. Several leading MNCs look at education-related measures as the way forward for India to emerge as a knowledge economy. Royce L. Caplinger, managing director, Lockheed Martin, says, "We are looking at India as a source of educated, trained and English-speaking workforce. The continuing emphasis on education provides the necessary foundation." As global research shifts to India, many more will join the Lockheed queue.

Yet again, can 1,00,000 scholarships of Rs 500 a month per family to send their children to study help solve the systemic problems? School dropouts are common when children move from eighth to the ninth class for a simple reason—money. Rural households, and even the poor urban ones, need to desperately augment incomes. Unless the FM can find ways to do that, no amount of incentivisation will work. To generate employment, schemes like the rural employment guarantee aren't enough. In fact, they make the system more corrupt, leading to leakages, wastages and inefficiencies.

If making India a knowledge economy was indeed the objective, the IT sector can't understand the logic behind "retrograde" steps like imposition of MAT and FBT on ESOPs. According to Nasscom's Kiran Karnik, this can affect investor confidence and growth in IT, which is India's biggest exporter and organised employer. "We are concerned with selective pass-through status for venture funds, which is allowed for biotechnology and nanotechnology segments, but not for BPOs which account for three-fourths of such investments," he explains. He adds that the service tax on leased property will affect technology startups.

Now, we come to another of PC's obsessions—infrastructure. Here again, the policymaking seems to work in fits and starts. There's no long-term blueprint, and no vision to attract the $320 billion that's required to improve it. Some experts feel that India needs $150 billion in the next few years only to ensure that infrastructure remains decent, and doesn't get clogged. But the government is happy announcing grand projects and giving lofty soundbites. For instance, even Chidambaram admitted that the move to use bulging forex reserves to fund infrastructure will pick up slowly in the next fiscal and lead to a usage of $5-6 billion.

In a politically-charged atmosphere, where the current high prices are being held responsible for Congress' drubbing in Punjab and Uttarakhand, inflation had to be one of the top agendas for the finance minister. But what does he do to curb prices? He imposes a dual excise duty structure on cement, hoping that manufacturers will lower prices just to take advantage of the lower duty rate. Well, the cement makers are saying that they will merely pass on the burden of higher duty to the consumer, thereby fuelling inflation. And higher cement prices are in no way going to deflate rising housing prices.

The FM also bans forward trading in wheat and rice; but, as he said, he wasn't responsible for it, he merely announced it after the decision was taken by the Forwards Market Commission. To assuage his political critics who have been clamouring for a ban on forward trading in all food commodities, he has appointed a committee that will submit a report in a few months. He's hoping that the inflation dragon will be slayed by then. But then isn't that anti-reforms? Doesn't the cement policy smack of good old socialism?

Since the FM is losing revenues in several areas—like reducing the peak import duty rate—he has found old and novel ways to boost them. He taxes cigarettes, bidis and paan masala—something that almost every FM has done since the 1970s and 1980s. He hikes the dividends distribution tax, the impact of which will be borne by individuals, and not companies who will merely pass it on. Thinking that ESOPs are only given to senior management, which is totally wrong in the knowledge sectors, he imposes FBT on them. And he hikes the education cess by one per cent with the lame excuse that he needs to provide more resources for the social sectors.

Instead, given the revenue buoyancy and frenetic growth, he could have simplified the tax structure and reduced the rates. "The expectations were that the finance minister would streamline the tax structure and, perhaps, bring the rate down to encourage greater compliance," says Ramesh Sobti of ABN Amro Bank. He could have removed anomalies in the import and excise duties. He could have given a roadmap for the introduction of the much-favoured goods and services tax (GST) regime. (One has to admit that he did say that VAT will come into effect soon and he has managed a consensus among the various states, and VAT is a precursor to GST.)

Let's end on a good note. Despite the political constraints, and the pressures to increase allocations, the finance minister managed to rein in both revenue and fiscal deficits. He was obviously helped by the 9-plus per cent growth and a 27.8 per cent increase in tax revenues. He did the fine balancing act between politics and economics, although most of the economics too was with an eye towards the forthcoming state elections in Uttar Pradesh and Gujarat. He has managed to please all, except the industry and, it seems, the intellectuals.

But Chidambaram has still a few aces up his sleeve. For the 2007-08 fiscal, he has only accounted for a 17.2 per cent growth in revenues, much lower than what was estimated for this year. Reading between the lines, one can make out this is because he's expecting a lower GDP growth, in the 7.5-8 per cent range. Many economists believe this is an indicator that the economy is overheated and that the growth momentum built over the last few years is petering out. But if the economy does keep its momentum, which is what the FM is betting on, it will enable him to surpass all his targets next financial year.

And that will be a great asset because starting next year, we will witness consecutive 'poll budgets' in the run-up to the general elections in mid-2009. Therefore, Chidambaram needs that revenue and fiscal buffer to ensure that his budget arithmetic does not go awry. He needs India to grow at 9 per cent, or even more. His only fear: if he can't control inflation, he will be forced to take steps that will stymie growth. And then, it will be goodbye to all the aces and the rabbits in the reformer's hat.

Tags