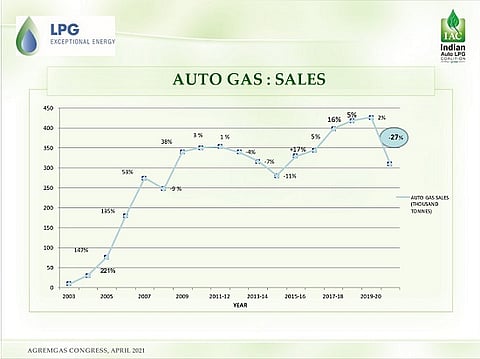

The forerunner of CNG vehicles in India, auto LPG is still finding favor within the country, albeit mostly in the southern states due to incentives for clean fuel vehicles. Last year, however, saw a dip in sales due to Covid-19 and government incentives to promote electric vehicles.

Auto LPG Still Finding Favour In India, Why Govt Not Helping To Boost It?

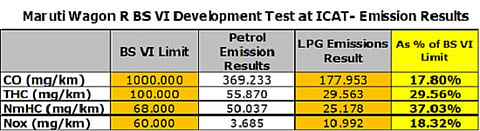

The auto LPG is the most low-hanging fruit to address vehicular pollution in cities like Delhi as its CO emission levels are less than petrol by around 20 percent.

Currently around 2.5 m LPG vehicles are running on Indian roads. Southern India leads the pack with almost 200,000 vehicles running on Auto LPG in and around Bangalore, 150,000 in and around Hyderabad and 120,000 in and around Chennai, says Suyash Gupta, Director General, Indian Auto LPG Coalition.

The higher demand in southern states has largely been influenced by subsidies initially provided by several state governments to promote the use of auto LPG. The fact that these vehicles are low maintenance, fuel efficient, and the cylinders are easier to refill have also found favour among owners in cities like Bangalore.

On the flip side, Gupta attributes the slow growth in sales of LPG vehicles to the fact that planners and government has been “always looking only at the aspirational future while we need to take stock of the present considering that auto LPG is the third most widely used transport fuel in the world after petrol and diesel. Of course, in terms of tonnage, CNG is used more than auto LPG, but for that the credit goes largely to India.”

Global Auto LPG consumption exceeds 26 million tonnes, but in India it is only about 0.35 million tonnes. India manufactures almost half its annual LPG requirement of around 27 million tonnes – including domestic and industrial use. South Korea leads the world in the usage of auto LPG at over 4 million tonnes annually.

In 2013-14, the price of auto LPG was marginally lower than petrol so automobile manufacturers within the country opted to keep up production of petrol vehicles and left it to the consumers to go in for installation of auto LPG kit, which cost around Rs 30,000. The scenario changed once the government started phasing out subsidies on transport fuel in India. Globally, the onset of US shale oil and gas production and emergence as the biggest exporter of auto LPG boosted its demand and adoption. Higher production not just in the US but also in the Middle East has led to auto LPG prices dipping from levels of $1200 per ton before 2014 to current levels of $500 to $600 per tonne.

“There is demand for auto LPG vehicles though their numbers are small. Three-wheelers constitute the bulk of auto LPG users accounting for 90% with 4 wheelers accounting for the rest,” says Saharsh Damani, CEO, Federation of Automobile Dealers Association (FADA).

The auto LPG is the most low-hanging fruit to address vehicular pollution in cities like Delhi as it’s CO emission levels are less than BS6 petrol (by around 20 percent). On the cost front too, auto LPG scores as it costs around Rs. 50-52 per litre depending on the states, which is 45-50% less than the retail price of petrol. In terms of mileage, it is almost at par with petrol vehicles, though in some cases the mileage may be 2-3% less depending on the vehicle and other factors.

When compared to CNG vehicles, automobile experts stress that auto LPG cylinders score as they weigh less due to their operating pressure being around 25 kg per cylinder as against 200kg to 300 kg of a CNG cylinder, impacting the performance of the vehicle.

At a time when vehicular pollution remains a major concern and infrastructure to boost sales and adoption of clean fuel remains a challenge, Gupta wonders why the government is not helping to boost auto LPG as is being done in many countries.