From falling of rupee to Reserve Bank of India (RBI) Governor’s resignation, 2018 has been an eventful year for the Indian economy. Outlook takes a look back at the spiral trip that the year has been.

Fall Of Rupee

From PNB Scam To RBI Tussle, Business Stories That Made Headlines In 2018

2018 has been an eventful year for the Indian economy, Outlook takes a look back at the spiral trip that the year has been.

The Indian rupee witnessed its worst fall in 2018 in over five years. Currently, the Indian rupee is the worst performer among Asian currencies. Breaking all records, the Indian rupee depreciated 13 per cent in 2018 and has touched a historic low of 72.32 against the US dollar.

Urjit Patel’s Resignation

Amid the friction between the government and the central bank over policy decisions, Urjit Patel resigned as the Reserve Bank of India (RBI) governor on December 10.

Citing personal reasons, Patel became the fourth governor in a span of 43 years in the bank’s history to demit office before the completion of his term.

On December 11, former finance secretary and current member of the finance commission Shaktikanta Das was appointed as the new RBI Governor.

UK Court Orders Vijay Mallya’s Extradition

A UK Court on December 10 ordered that liquor tycoon Vijay Mallya be extradited to India and referred the case to British Home Secretary Sajid Javid for signing the extradition order. Mallya, who is wanted in India on alleged fraud and money laundering charges amounting to an estimated Rs 9,000 crores, has been on bail since his arrest on an extradition warrant in April last year.

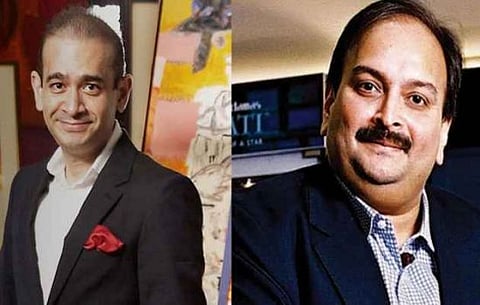

PNB Scam

The much talked Nirav Modi-PNB scam, which came into light in February 2018, got the entire nation enraged. The fugitive billionaire duped the Punjab National Bank (PNB) among others, of over Rs 13,000-crore and fled the country In June.

The fraudulent transactions were carried out by Modi and his uncle Mehul Choksi since 2011 to raise billions of dollars in foreign credit.

Chanda Kochhar’s Exit From ICICI Bank

Chanda Kochhar stepped down on October 4 as the CEO of ICICI Bank after her plea for early retirement was accepted by the bank. This came as Kochhar and her family members faced allegations of quid pro quo and conflict of interest with respect to a loan extended to certain entities, including the Videocon group.

The board decided to appoint Sandeep Bakhshi as Managing Director and Chief Executive Officer.

RBI VS Government

The lending restrictions imposed on 11 out of 21 state-owned banks by the central bank have been an area of tension between the government and the RBI. While the government sought a relief in the lending rates to help MSMEs who are in need of liquidity, the RBI held its ground focusing on the cleaning the NPAs.

While another major bone of contention has been the emergency fund of the RBI.

IL&FS Crisis

IF&LS (Infrastructure Leasing & Financial Services) meltdown sent shock waves in the stock markets when the non-banking financial corporation defaulted on payments to lenders in September 15.

The key shareholders of IL&FS include LIC, SBI and Central Bank of India.

IL&FS, where LIC is the largest shareholder with 25.34 per cent stake, has a debt burden of over Rs 90,000 crore.

Indira Nooyi Steps Down

Pepsico's Indra Nooyi, steps down as its chief executive officer on October 3, after 12 years at the global beverage giant.

Chennai-born Ms Nooyi was named Chief Executive Officer (CEO) of Pepsico in 2006. PepsiCo's board of directors in August had announced that they unanimously elected veteran Ramon Laguarta, 54, to succeed Indra Nooyi, 62, as CEO.

GST Below 18% Slab

The government on December 22 streamlined the Goods and Services Tax (GST) with a view to make it more people-friendly. The GST council reduced the rates on 23 items from 18 per cent to 12 per cent and 5 per cent. Many items including television, computers and various auto parts will be cheaper now. Some items in the 5 per cent bracket have been moved to 0 per cent.

Qatar Leaves OPEC

The Organisation of the Petroleum Exporting Countries (OPEC) had shaky ground, after Qatar on December 3, suddenly announced it would sever ties with the oil cartel.

Qatar's Energy Minister Saad al-Kaabi had said that Doha would leave OPEC on January 1 to focus its efforts on natural gas. Qatar joined in 1961, just a year after the organisation was founded. Natural gas is far more important than oil to Qatar’s economy.

GDP Data Base Year Changed

The BJP government on November 28 issued a revised Gross Domestic Product (GDP) data.

The new data lowered growth under the previous Congress-led UPA. The BJP government moved to a new base year of 2011-12 from the earlier 2004-05 for national accounts.

The base year of national accounts had been revised earlier in January 2010. Change of base year to calculate GDP is done in line with the global exercise to capture economic information accurately. After the base year is changed, the GDP in previous years is revised according to the new base year for a fair comparison.