Over the years, insurance is probably the one financial product that has been mis-sold the most. One reason is lack of involvement of the buyer and the other reason is false explanations by the agent.

How To Protect Yourself From Mis-Selling

Have you just purchased an insurance product but are confused about its features, which don’t appear to be as good as explained by the agent? Well, you may be a victim of mis-selling.

What Is Mis-Selling In Insurance?

Mis-selling in insurance is selling a product to customers that turns out to be inappropriate for them. The final benefits of the insurance are not the same as promised at the time of sale and the policy doesn’t fulfill the customer’s purpose. It can be done in different manners such as forging benefits, exaggerating benefits, misrepresentation of the policy, miscalculating benefits, bundling insurance policies, or false promises of bonus and additional benefits.

Possible Causes Of Mis-Selling Complaints

Some of the main causes of mis-selling complaints include incorrect explanation of product features and benefits by salesperson sourcing the business. “Then there is incorrect premium paying term and policy term explained to the policyholder, especially in cases where a regular premium paying product is sold as a single premium product. The policy is sold to gullible prospects assuring loan / bonus / medical benefits/ gold coins / mobile towers / and more upon purchase of insurance policy. Also, tampering, forgery of proposal or other related documents is common. There is high attrition rate amongst sales teams and there is pressure on the salesperson to meet the sales target. This is also a reason,” explains Naval Goel, founder and CEO, PolicyX.com, an insurance web aggregator.

How Does It Impact The Customers?

Mis-selling impacts customers in multiple ways. Primarily, it causes financial loss as the premium paid gets wastes and the features or benefits are of no use to the customer. Sometimes, when a person finds out that the existing policy is not best suited to their requirements, they stop paying for it and the premium paid in the past gets wasted.

“The second loss is even bigger; when the customer’s family who was supposed to get these benefits or sum assured, is left with no support in the long run as the policy didn’t turn out to be as planned. It may leave them in despair as there is no financial support for them after the demise of the breadwinner,” says Goel.

Irdai Intervention

Insurance watchdog, Insurance Regulatory and Development Authority of India (Irdai), has been instrumental in resolving such issues. Most recently, it has issued a mandate to insurers to provide clear policy-related communication to prospective customers without any addition or subtraction. The communication should be based only on the basis of clauses mentioned in the policy.

“Second, the rule of the standardized script has been incorporated in every aspect of the insurance policy, including all benefits, services and key disclosures. It must then be instructed to every insurer/agent to strictly adhere to the script so that it becomes easy for customers to understand the details and they easily compare different plans based on standardized scripts,” says Goel.

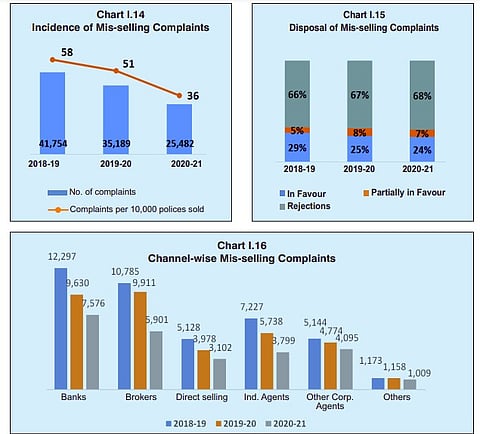

According to the Irdai annual report 2020-21, the number of mis-selling complaints have reduced from 41,754 in 2018-19 to 25,482 in 2020-21. Incidence of mis-selling complaints per 10,000 policies sold has also reduced over the years. The complaints being disposed in favour of the complainant has reduced from 25 per cent in 2019-20 to 24 per cent in 2020-21.

Things To Keep In Mind To Avoid Insurance Mis-Selling

The major cause of the mis-selling is that customers don’t read the policies themselves or seek any information about the plan, whether it is features or benefits or terms and conditions. Earlier, customers would always believe the information communicated by the agents, which was often given for vested interest such as earning bonuses, etc.

Customers can easily eliminate the risk of mis-selling by getting involved in the buying process. They can look at online web aggregators where the complete information about different plans is given transparently. Buyers can make the right selection by comparing plans, features, benefits and quotes given by different insurers.

The customer should also read the policy documents, especially the terms and conditions. These are the important details that are most often overlooked in the policy document. “Keep your life goals in mind all the time so that you buy the best-suited product. Take a second opinion if you aren’t sure about a product. And the biggest of all, no one should buy a plan just because their peer bought it. Insurance is a highly personalised thing that varies as per goals, income and other factors. One size fits all doesn’t work here. Hence always look for a policy that is closest to your goals,” adds Goel.