Investors invest with the hope of making good returns. But among the various asset classes available today, cryptocurrencies, which have a market capitalisation of about $2.2 trillion, have emerged as one of the most fast-moving and volatile in 2021. By one estimate (investopedia.com), there are more than 8,000 cryptocurrencies in existence as of December 2021. The asset class has a high number of investors, too—more than 300 million crypto users in the world, according to Singapore-based crypto information provider platform triple-a.io.

Know About 10 Crypto Coins That Gave Highest Returns In 2021

GALA gave returns of 32,000 per cent-plus. Axie Infinity, The Sandbox, Terra, Polygon and Solana followed. Here’s a look at the top 10 cryptocurrencies that have given the highest returns in 2021. But do high returns in just one year make them investment-worthy?

“Year 2021 has been a crazy ride for the cryptocurrency spectrum. We have witnessed a lot of tokens making unfathomable gains and a massive number of tokens going bust,” says Edul Patel, CEO and co-founder of Mudrex, a global algorithm-based crypto investment platform.

Highest Returns

There are various ways to look at returns, and especially for a volatile asset like cryptocurrencies, where prices fluctuate wildly, calculating returns can be complicated. “If you consider point-to-point profits on investment in crypto assets, you will notice astronomical returns on occasion,” says Ajeet Khurana, a crypto project advisor and investor.

Astronomical returns are a fact. In 2021, Ethereum-based cryptocurrency Gala (GALA) has given the highest returns, of more than 32,000 per cent, among the top 100 cryptocurrencies of coinmarketcap.com. Axie Infinity (AXS) comes in second with 18,000 per cent, while The Sandbox (SAND) has gained 16,000 per cent. Terra (LUNA), Polygon (MATIC), Solana (SOL), Fantom (FTM), Kadena (KDA), Harmony (ONE) and Decentraland (MANA) have given returns between 4,000 per cent and 15,000 per cent (data source: Giottus Cryptocurrency Exchange).

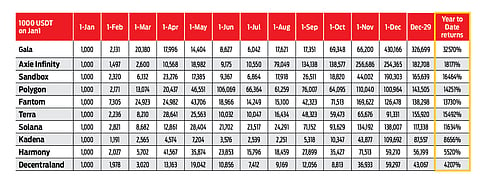

What does this mean for investors? Let's say that an investor had bought Tether (USDT) for $1,000 on January 1, 2021. Tether is a stablecoin backed by an equivalent amount of US dollars. In one month, on February 1, with Gala, the value would have been $2,131, while on March 1, it would be much higher at $20,180. But on April 1, the value would be down to $17,996. The slide would have continued through May, June and July. By August things would be looking up again, and the rise would have continued at a heady pace. On December 29, the investor would have seen her $1,000 in Gala crypto become $326,699.

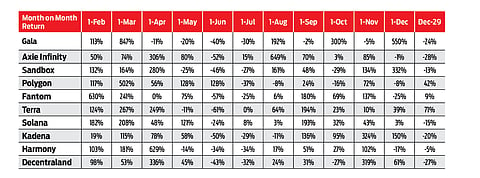

See the two tables to get an overall view of the month-on-month returns of the top 10 cryptos by returns and also how $1,000 in USDT would have fared if invested in these 10 coins on January 1, 2021 (data source: Giottus Cryptocurrency Exchange).

The returns are phenomenal, but that is not the whole story. The prices of the coins fluctuate wildly and the time of exit will determine the real returns.

“I have noticed that many traders try to time the market by making frequent buys and sells. In doing so, they often lose a lot of money even in a rising market,” says Khurana.

Is There A Future?

Just because a coin has given astronomical returns in 2021 doesn't mean that it will do the same for 2022. It may be that none of them are in the running in the next year.

"Investors should keep in mind that the industry is new and we don’t know which tech or company will take the lead. Today, Ethereum may be the leader, but Solana and others are rising. It may also be that none of them will exist or lead (in future). Some other player may emerge. All of them or someone could become the next Google or Microsoft of the Web 3 revolution and those who are early investors at this stage will be the next generation of billionaires," says Kumar Gaurav, founder and CEO of Cashaa, a crypto banking platform.

Stay Mainstream

According to various reports, about 15 million Indian retail investors have placed bets on digital tokens, with an investment of about $6.6 billion. About 90 per cent of domestic retail investors were added in 2021 alone, according to media reports.

A large part of the buzz is around meme coins. "The frenzy for meme tokens will likely prevail throughout the coming year," says Patel. However, experts warn against investing in meme coins, despite the high returns, because they are extremely unpredictable. "Unless an investor has the ability to engage with the core communities of various projects and take a view on where the technology is headed, it is best to stay mainstream and into the top few largest cap tokens such as Bitcoin and Ethereum," advises Khurana.

However, even mainstream cryptos are highly volatile. One of the ways to absorb that is to invest with a long-term view. "That is the only way to withstand volatility," says Khurana.