India ranks second in crypto adoption, mostly young investors constitute a larger section of crypto investors. However, women form only a small part of this growing group. While there was a growing number of female crypto investors at the beginning of the year 2021, as reported by Mint, the trend seems to have retarded gradually.

Only 15% Crypto Investors In India Are Women, Situation No Different Globally

Women investors in India are gradually taking to cryptocurrencies but the number is considerably low as high volatility is a big deterrent for investors who prefer stability. Women investors prefer an investment with stability.

Lower Number Of Investors On National and Global Level

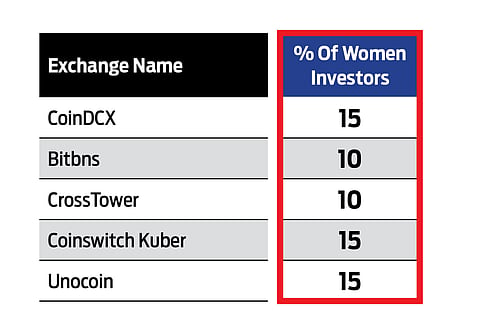

According to CoinDCX, an Indian crypto exchange, only 15 per cent of their current investors are women. This section of female crypto investors is majorly comprised of women from metro cities like Delhi, Bengaluru, Hyderabad, Pune and Lucknow

As per the data of other crypto exchanges, the percentage of women investors has been considerably low. Unocoin and Coinswitch Kuber also noted that hardly 15 per cent of their investors are women. The number is even low as per the data of Bitbns and CrossTower (launched three months ago), which report that they have only 10 per cent of women investors on their platforms as of December 2021.

The trend is no different on a global level. Women form only a small percentage of the total number of crypto investors.

A 2021 survey by Independent Reserve’s Cryptocurrency Index (IRCI) conducted over 2,000 Australians found that the number of women who currently or have previously invested in cryptocurrencies has risen but still is less than one-fourth of all—the number has gone up from 10.3 per cent in 2020 to 20 per cent in 2021. Even in the US, the number of female crypto investors is considerably low as compared to the number of male investors, according to a study conducted by CNBC and Acorn, an investing platform.

Risk-aware Nature

Various studies into investing behaviour have found that women tend to take more time to study the options and are risk-averse or risk-aware. Age also plays a role. For example, a survey conducted among 28,000 women by digital platform Groww found that young women investors in India have bigger risk appetites than older investors—those in the age group of 18-25 years are three times more likely to choose a high-risk, high-return asset class like stocks over traditional investment options like a fixed deposit.

Priya Ratnam, 34, a Bengaluru-based woman cryptocurrency investor and also CEO of Avisa Games Guild, a gaming company says there are few women role models for crypto investors, “which deters the enthusiasm”.

Ratnam adds that while cryptocurrency investing is dominated by men, the risks are there for everyone, irrespective of gender. “Cryptocurrencies involve a lot of volatility and security risk. There are lots of delays in withdrawals/deposits and operational issues, which are concerning for investors,” she says.

Cryptocurrencies are a new asset class and need a lot of understanding before a person can make an informed decision. Moreover, there has been a growing concern among crypto investors in India, till the government comes up with the crypto regulation bill. “Investing that kind of time in researching cryptos could be an issue for women who have a lot of family responsibilities,” she says. Ratnam adds that it has been a roller-coaster ride for her. “Buckle up properly to make the ride smooth. Plan and manage things strategically as women do.”

In a blog on femmemoney.com, Elena Nair, a US-based Certified Financial Education Instructor, says that women tend to trade less frequently (in all investment options). “The key to successful investing is remembering that you’re in it for the long term and women are better in the trade as they do it less frequently,” she writes.

Research, Safety Come First

Fundamentals of investing remain the same across asset classes, and genders. Research is important before investing in anything. “Investing in crypto assets requires research into the blockchain protocols and the related tokens. Both men and women curious about Web 3.0 may consider investing in crypto assets as part of their overall investment objective. Before investing, it is important to do thorough research,” says Kristin Boggiano, co-Founder and president of CrossTower, a digital currency exchange.

While crypto exchanges do not provide any specific incentives to encourage women to invest in cryptocurrencies, some have launched initiatives to educate female investors about the new digital world. “We will continue to induct more women into the financial ecosystem and assist them in making informed decisions through our investor education initiatives,” says Sharan Nair, chief business officer, Coinswitch Kuber.