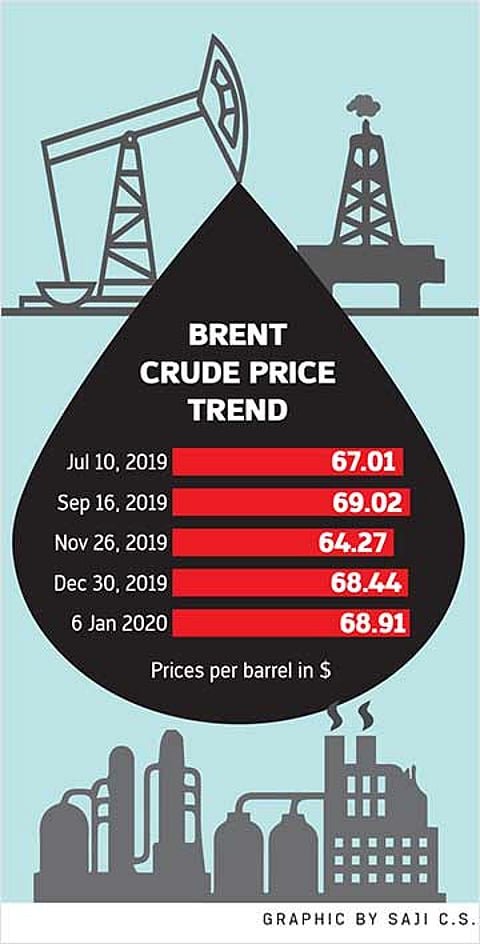

Rise in global oil prices following developments in West Asia could not spell more gloom for the Indian economy, which is facing challenges on many fronts, including fiscal deficit and slowing economic growth. Higher crude oil prices—prices have risen 18 per cent during the October-December quarter and around $6 or 10 per cent during December—means a higher import bill for India, which depends on overseas supply for over 80 per cent of its crude oil needs.

War Clouds Loom Over India Revival Story

Spikes in oil prices, declining exchange rate and large fiscal deficit are likely to exacerbate the slowdown and raise the cost of living

“Tension in oil producing areas in the world impacts India,” said Dharmendra Pradhan, Union minister of petroleum and natural gas, at a public function recently. The impact will be more because of India’s rising fiscal deficit, which stood at Rs 8.08 trillion or 114.8 per cent of the budgeted target for the current fiscal year, according to government data for April and November 2019, released on December 31.

“Any rise in oil prices is bad news for us, especially as we are already staring at a large fiscal deficit,” says Sunjoy Joshi, chairman, Observer Research Foundation. “If our balance of payment position goes out of kilter, then there may be a problem. Oil prices will be critical as they may lead to further slowdown in the economy, and the situation gets compounded in case of a sudden spike in global oil prices.”

International Energy Agency’s (IEA) ‘World Energy Outlook’ had in December projected that prices should stabilise at the present levels, and rise only towards the end of 2020. But that was projected in a business-as-usual scenario without anticipating US actions against Iran or Tehran vowing vengeance. With the geopolitical scenario changing in the past few days, economists and energy experts are no longer sure where oil prices may go—there was a 10 per cent spike over the weekend following the US strike. “Geopolitics rather than demand and supply will impact oil prices more,” says Joshi, an energy expert. “As we are heavily dependent on the Gulf region for our oil and gas supplies, we are bound to be affected. So far prices have been generally benign at $60 to $64 per barrel, and nobody expected them to cross $78 until this crisis happened.”

Prices up ahead are difficult to predict. Much depends on what US President Donald Trump will do—his election campaign is about to begin and he will try to mop up all his support domestically. Much also depends on what the global reaction will be to the recent geopolitical events. “This is double whammy, with oil prices on the rise and a depreciating exchange rate at the same time. So there will be a pass-through impact on both fronts,” says Rajat Kathuria, director and chief executive, ICRIER. “This development has come at an inopportune moment when our macro parameters are not good. It will also adversely impact our current account deficit as well as exports.”

As taxes form a large part of petroleum product retail prices, high oil prices could mean larger revenues for the central and state governments if they decide to pass on the impact of higher global prices to the consumers. That would have both direct and indirect impacts on not just industry, but also the common man. Energy prices are reflected in the wholesale price index and over time on the consumer price index.

“We will have both first- and second-round impacts on inflation in the short term,” says N.R. Bhanumurthy, professor at the National Institute of Public Finance and Policy. “Previously, the second-round impact used to be delayed because the fiscal was able to absorb part of the shock. Now that may not be possible given the government’s fiscal position. Now all the actors—consumers, government, industry—will have to absorb the shock.”

So the pass-through impact of oil prices on domestic production and services will definitely pass on to the commodities and consumers. Already, aviation fuel prices and domestic gas prices have gone up. Petrol and diesel prices, which reflect international prices after a fortnight, may soon follow suit. On the industry front, higher cost of fuel and power is bound to have an adverse impact, even as fiscal constraints have squeezed government plans of pushing infrastructure spend.