Evergrande, the largest real estate borrower in the world with overall liabilities exceeding $300 billion (22.5 lakh crore), is on the brink of a default. On September 16, the real estate behemoth suspended trading on its onshore bond after a domestic ratings cut. As a result, China’s junk bond or high yield debt market is now offering a record 14.4% yield.

Will Evergrande Woes Bring The Great Fall Of China?

Evergrande is the largest property company in China and owns more than 1,300 projects in 280 cities holding approximately 2% of the Chinese real estate market.

Evergrande is the largest property company in China. It owns more than 1,300 projects in 280 cities holding around 2% of the Chinese real estate market. According to various reports, Evergrande sits over unfinished projects worth over $1 trillion. As many as 1.5 million people are waiting for delivery of their homes, even as the realty developer has failed to clear dues of its employees and suppliers for months.

Investors believed that the sheer size of Evergrande makes it too big to fail. But they faced a rude shock last week when the company hinted that it may default on its $80 million interest payment due on September 23. The government has not shown any intent to rescue the company so far.

According to a research report from Harvard University in joint association with Tsinghua University, real estate contributes to about 29% of China’s economic output. Evergrande's deteriorating financials are the result of a slowdown in the property market. China’s residential property slowdown deepened in August when home sales by value slumped by 20% from a year earlier according to Bloomberg calculations based on National Bureau of Statistics data. According to industry estimates, 60- 65 million units are currently lying vacant in China.

Why foreign investors were lured to China

According to Barclays, bonds worth $16.5 trillion are in negative yield across the globe- amounting to over 5% of the total global debt of close to $300 trillion. A negative bond yield is when an investor receives less money at the bond’s maturity than the original price for the bond. A negative bond yield is an unusual situation in which issuers of debt are paid to borrow.

All of Germany’s sovereign debt is trading at a negative yield, France’s debt is trading below zero on maturities up to 12 years, Spain’s up to 9 years and Italy and Greece up to 7 years. Negative yielding bonds have consistently grown after the Great Financial Crisis of 2008-09.

Over the years, insurance companies, pension funds, asset management companies, and sovereign wealth funds have gravitated towards China to earn a positive yield on their bond investments.

Before the current crisis, real estate developers in China were giving a yield of over 10% on their bonds, attracting marquee global investors.

Foreign investors and Evergrande bonds

According to UBS, currently, the Chinese offshore bond market has a total debt outstanding of $209 billion out of which 70% are high-yielding bonds. Based on UBS estimates, the total liability of the Chinese property sector is close to $4.7 trillion. The offshore bond market, therefore, accounts for only 4.5% of total financing for the sector.

UBS noted that with a total outstanding of $19 billion of offshore bonds, Evergrande has 9% exposure to the total offshore bond market and 12% of the high-yielding offshore bond market.

Investors like BlackRock- the world’s largest asset manager, Paris-based Amundi- Europe’s largest asset manager, UBS Asset Management, Ashmore Group, HSBC Holdings, Fidelity, PIMCO, Goldman Sachs Asset Management are the few large bondholders of Evergrande.

The beginning of the fall

Evergrande woes began in 2020 when China’s Central Bank- People’s Bank of China (PboC) started capping developers’ borrowing and directed lenders to focus on ‘Three Red Lines’. The move was initiated to curb speculation in real estate activity. The Three Red Lines are a set of thresholds on three financial ratios namely Liabilities (ex-advance) to Total Assets, Net Debt to Equity and Cash to Short Term Debt.

The Central bank stated that only those companies that keep their ratios within the threshold would get permission to increase the debt next year. PBoC puts a maximum cap of 15% increase in debt for successive years.

At the end of the June 21 quarter, Evergrande breached all of these metrics.

Moreover, Z-Spreads, a measure of credit, liquidity and optionality risk on a bond, increased for Evergrande's whole host of bonds due in 2023. An increase in Z-Spread means an increase in risk and vice versa.

Evergrande’s conspicuous behaviour

After breaching the Three Red Line metrics and widening Z-Spread, Evergrande’s management tried to allay investors’ fear. Evergrande said it reduced debt from $110 billion (at the end of 2020) to $88 billion at the end of the June quarter. What the company conspicuously missed was to explain about commercial bills and trade payables which are not technically counted as debt as they are short-term in nature, but both these numbers are counted as liabilities on the company’s balance sheet.

Evergrande liabilities have hardly reduced from December 2020, stated BondEvalue.

On June 23, Fitch downgraded Evergrande to B from B+. Fitch's report stated that Evergrande’s balance sheet relies on Trust finance with approx. 40% of total debt in trust loans, a less stable source of funding. Its lower leverage (Net debt/adjusted inventory), high trade payables, lower liquidity and weaker access to funding channels were other reasons for rating cuts. Following Fitch, Moody’s also downgraded the company to B2 from B citing weakened funding access.

Bloomberg on July 8, reported that Evergrande has ramped up issuance of commercial bills suggesting that it is facing a liquidity crunch as banks and investors have avoided long-term funding to the developer. Yields on some bills have climbed as high as 36%, it reported. As per company disclosure in 2020, liabilities of the company involved 128 banks and 120 other types of institutions, and issuance of commercial bills suggests that the scope of financial maneuvering is limited for the company.

What experts say

Speaking with Outlook Money from Toronto, Ritesh Jain, a global macro investor and trend watcher said, if Evergrande is not bailed out then it can potentially freeze global high yield credit markets with credit spreads blowing up. “Evergrande alone is not my worry but the systemic repercussion and resultant tightening of liquidity conditions in a slowing global economy is my worry,” he said.

Rich Excell, an experienced global macro portfolio manager said the size of Evergrande liabilities isn’t the issue. The Chinese government has $3.2 trillion of forex reserves. It can easily bail out not only Evergrande but most of the struggling real estate developers. “The issue is the ‘signaling’ of why the government is letting them go bust,” he said.

Impact on China if Evergrande default

As per various media reports currently, around 60 to 65 million units are vacant representing more than 21% of all homes in urban China. Any default would start a selling frenzy in the housing market pushing down prices further. As real estate accounts for a large store of wealth for Chinese citizens, a deep price cut would severely impact consumption.

According to Bank of America, Evergrande is the largest high yield dollar bond issuer in China, accounting for 16% of outstanding notes. Evergrande collapse may push the default rate on the country’s Junk dollar bond market to 14% from 3%. Such a spike in default rate could spill over to the rest of the high yield market in China and other bond markets.

Experts believe that the High yield credit market may go for a toss in case of Evergrande default and contagion may spread to other markets like equity market and investment-grade corporate bond markets.

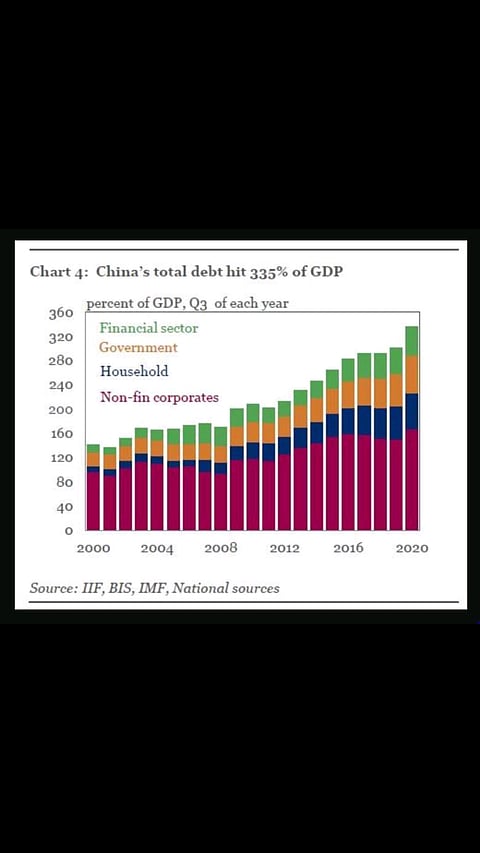

China’s economy is highly leveraged. According to the Institute of International Finance, the total debt of China stands at $92 trillion and the debt to GDP ratio at the end of June quarter stood at 353%. With such a high GDP to debt ratio, any slowdown due to real estate companies' default could put China in a tough spot as the government has less space for fiscal maneuvering.

Impact on India

Commodity exporting companies from India, mainly steel and iron ore, would be the major loser if China witnesses an economic slowdown. Tata Steel, the highest return provider in the Nifty Index, performed badly last week. Other stocks in the risk zone are Hindalco, Vedanta, Coal India, and NMDC.

If China depreciates the Yuan, then Indian companies in sectors like textile, tyres, chemicals (where India and China both compete for the international market) will face intense competition from Chinese companies.

China is the largest buyer of most of the products coming out of emerging markets. It buys energy from Russia, semi chips from Taiwan, food from Brazil, capital goods from Korea, shipping services through Singapore, iron ore from India. When China sneezes, EM catches a cold. Not only emerging markets but approx. 50% of revenues for the European luxury goods sector have been coming from China.

In an August report, S&P estimated that over the next 12 months, Evergrande will have over 240 billion yuan ($37.16 billion) of bills and trade payables from contractors to settle. According to Fitch's analysis, the developer’s trade payables stood at 667 billion Chinese Yuan.

Impact on rest of the world

Around 50% of revenue for Europe’s luxury goods sector comes from China. Any slowdown in China will impact European luxury markets. European powerhouse Germany exports over 10% of its total export to China. Any slowdown in China will make economic recovery hard for already aging and slowing Europe.

China holds over $1.1 trillion US bonds and treasury notes. To pay dollar-denominated liabilities of Chinese real estate companies, China may choose to either sell this debt or devalue the yuan. In both the conditions, the tension between the US and China may be stretched further.

China is the largest buyer of most of the products from emerging markets. It buys energy from Russia, semi chips from Taiwan, capital goods from Korea, food from Brazil, shipping services from Singapore, iron ore and other commodities from India. It’s the biggest trading partner for most Asian countries.

This week is crucial for financial markets across the world, with everyone hoping for a government-bailout for Evergrande. But as the saying goes- "Hope Is The Most Dangerous Four-Letter Word In Investing". We think investors should hedge themselves for any event.

Tags