Have you been planning to buy a luxury car or an SUV? Well, our recommendation would be to speed up that process because if you delay it further, you could end up paying a lot more than you would now. Here’s why.

GST Effect: SUVs And Luxury Cars Might Cost More, Soon

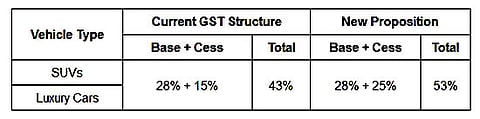

The GST council has recommended 25 per cent as the max cess for motor vehicles

Example 1: Toyota Fortuner 2.8L 4x4 AT

Current Price (ex-Delhi): Rs 29,17,700

Revised price if cess goes up: Rs 31,21,735

Effective price increase: Approx 7 per cent

Example 2: BMW 520d Sport Line

Current Price (ex-Delhi): Rs 49,90,000

Revised price if cess goes up: Rs 53,38,951

Effective price increase: Approx 7 per cent

Why such a massive change? In simple words, it is to counter the protests over hybrid vehicles that currently attract the same overall tax as SUVs and premium cars. Moreover, a review of the tax rates on hybrid cars has been completely ruled out. What a shame.

GST was implemented on July 1, 2017, and with it came a mixed bag of emotions, especially for the automotive industry. The joyous part of the bag comprised of decreased price tags for conventional cars which harness their firepower from an internal combustion engine. To offset that happiness amongst buyers and sane think-tanks in the country, the centre decided that hybrid cars deserve to be slapped with the steepest cess of 15 per cent over and above the highest GST slab of 28 per cent. Result? Technology that has been engineered to be less polluting has gone further out of reach. Hybrids are much more frugal and our test figures have proven that.

Source: cardekho.com