India’s biggest tax reform since Independence—the Goods and Services Tax or GST—is all set to become reality with a midnight inauguration on June 30, not at a marketplace, but inside Parliament’s hallowed Central Hall. On the ground however there’s a sense of chaos. The GST promises to tie the country into a single market for manufactured goods and services by doing away with multiple local and state levies. Countless small traders among almost eight million businesses must get on smoothly to an entirely new taxation system.

The Taxmen Strike At 12

Ahead of the GST launch, businesses scramble to get their tax math right. How will life change from July 1?

The GST has taken a long time coming. From being first proposed by the BJP-led Atal Bihari Vajpayee government to the first serious appeal for a national consensus on the issue in the 2006 budget speech by the then finance minister P. Chidambaram, the GST has seen two missed windows, one in 2010 and then in April this year.

The change is mind-boggling. Once up and running, the GSTN or GST Network will be a mighty tax system and the largest commercial, real-time taxation software globally. Currently, millions of businesses—manufacturers, wholesalers and retailers—who qualify to pay sales tax, must pay at least 17 different state and central levies. A truck rolling with goods stops from state to state to pay these taxes. Border check gates are dens of corruption.

Although India is politically one country, it acts like 29 different economies, with each state imposing its own welter of taxes, apart from a slew of central taxes. The GST is a big deal because it’s an agreement between all states to levy uniform tax rates and not charge for the same good twice.

The launch at Parliament’s Central Hall will be witnessed by MPs, dignitaries and former PMs Manmohan Singh and HD Deve Gowda. The midnight launch seems like the government’s bid to dress the occasion as ‘freedom day’ for businesses, just as Jawaharlal Nehru had ushered independence with his historic midnight speech in 1947 form the same venue.

So, how will life change for businesses from July 1? Each of the 8 million sales tax-paying business units in 29 states must now register with the GST Network (GSTN) portal which will print tax credits and receipts in real time for millions of goods traded round the clock.

Several industry associations say they lack the preparedness needed. For a firm, getting on to the new system means filing their sales tax returns on the 10th of every month. Given the panic, the government has relaxed the deadlines for filing of GST returns for the first two months. They will have time until August 20 and September 20.

Nearly 6.5 million (80 per cent) of those who need be on the GSTN have already migrated with a provisional registration. They will now get a permanent GST ID. The GSTN will make human intervention in taxation negligible.

Businesses know that there are gains from a uniform tax system, but are apprehensive. Ask Delhi’s Ajay Kumar, a manager at the Transport Corporation, a firm that operates 10,000 trucks. Each time one of their truck travels from say, UP, to Kerala, it has to negotiate taxmen of at least six states. “We expect harassment at the state borders to go. Let’s see,” he says. Kumar and his team of six has been trained on a new software compatible with the GSTN, the complex, backend IT-infrastructure that is the backbone for the new system.

Here’s where things stand. The GSTN portal opened for enrolment for firms that need to be GST-compliant by June 25. It was previously open from November 8 to April 30. “There’s no need to rush as they will get 30 days to do so,” says revenue secretary Hasmukh Adhia.

To be sure, not everything has been wrapped up. The GST Council—the panel comprising state finance ministers and Union finance minister Arun Jaitley—met for the 17th time on June 18. It will meet again to thrash out some outstanding issues hours ahead of the midnight rollout on June 30.

To begin with, for a smooth rollout, the government has deferred more procedures that it previously estimated. Take the e-way bill for instance. For seamless movement of trucks from one state to another, the e-way—an electronic receipt co-generated by the trucker, the buyer and the supplier—is crucial. E-commerce firms need to keep two records: tax collected at source and tax deducted at source in their business chains. These things now stand deferred. “There is sufficient time so that businesses find it easy to comply and so that there isn’t a sudden load on the GSTN I-T system,” an official with knowledge of the development says.

Findings on the ground show there’s panic among traders, especially small-scale ones. “Nearly 57 per cent of the retailers and traders believe GST will have a positive impact but only 30 per cent are aware of the various slabs under it,” says Pankaj Krishna, CEO Brickworks, a market research firm which carried out a survey focusing on small traders.

Praveen Khandelwal, who heads the Confederation of All India Traders, says his worry is small traders, many of who are yet to register.

The GST not only promises to eliminate multiple local-level taxes, but it will make business change gear to a value addition-based tax system. A retail-end bicycle seller, for instance, will get a tax credit for those parts of the bicycle—such as spokes and tyres—for which tax had already been paid by the previous manufacturer. That’s why the GST is a destination-based tax where no component will get taxed twice.

And dodging sales taxes will become difficult. With both ends of the supply chain mapped into a national software, there’s little chance a taxpayer can go missing in between. A stray manufacturer who hasn’t registered into the system will find it difficult to operate in a value-chain that’s fully GST-mapped.

GST experts like Arvind Datar, a tax lawyer from Chennai, foresee big teething problems. “For a diagnostic firm which operates in 10 states, the number of procedural filings would stand at 490. E-way stands deferred. We needed a single tax, not 4 different slabs in the name of GST,” says Datar. It could take months for firms to get used to the new system.

Chief economic adviser Arvind Subramanian, who has authored a detailed paper on the implications of the GST, has declared that the tax will be “revenue neutral”. This means that although taxes on some items will go up and some taxes will go down, the average tax collection will even out.

“As a result, it will have no direct impact on the budget,” says Marie Diron, senior vice-president, sovereign risk group at Moody’s. “In particular, GST will remove one hurdle to the smooth movement of goods and services and focus on the location decisions of corporates on operational considerations rather than tax regimes.”

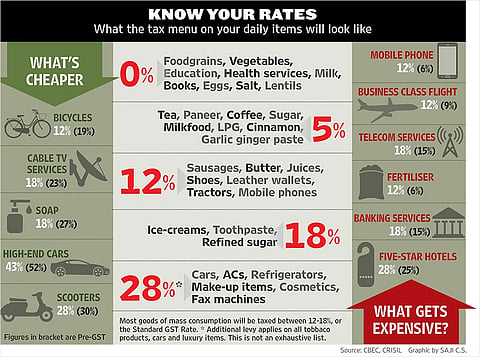

Consumers need to know that although there will be four different GST slabs—5, 12, 18 and 28 per cent—a majority of 1,500 commonly consumed items will fall under the 12-18 per cent bracket— what is being called the “standard GST rate”.

Some items won’t get taxed at all and so must be considered as zero-tax slabs. An additional surcharge will apply to high-end luxury goods and sin goods, such as tobacco products.

Sample this: Toothpaste gets taxed at 18 per cent, for instance, while air conditioners, cars and refrigerators will be taxed at 28 per cent. Economy airline tickets will be at 5 per cent, but business class will attract a 12 per cent GST. Unprocessed food-grains, milk, fruits and vegetables as well as services such as education and health will be exempted.

Nearly 160 countries, which implemented a GST-like tax, such as Canada and Australia, faced a one-time jump in inflation. But according to FM Arun Jaitley, the prices will even out and the GDP will gain about two per cent.