The Age Of Reason

Will UPA-II bite the bullet on pension for all?

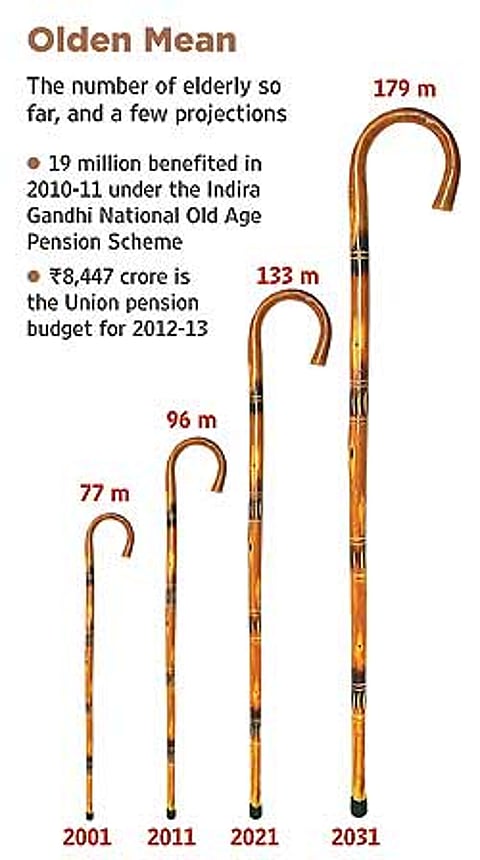

Twenty million of our elderly have access to formal pension schemes, and 19 million are currently said to be covered under the Indira Gandhi National Old Age Pension Scheme. Which still leaves 60 million of the elderly poor in the lurch.

Mauritius, Namibia, Botswana and Bolivia are some of the countries that have implemented universal pension schemes. South Africa and Kenya are trying to do the same, while China introduced a rural pension scheme in 2009. Even Nepal went for a universal pension scheme in 1995. So, why can’t India?

There is no reason it shouldn’t, feels K. Raju, joint secretary at the National Advisory Council. The IAS officer from Andhra Pradesh had been a principal secretary in the Y.S.R. Reddy government and was responsible for the spectacular implementation of the pension scheme launched by the CM. ysr had universalised the scheme in the state, raising the number of beneficiaries from 18 lakh to 72 lakh in one go. It translated into an average of 24,000 beneficiaries, all voters, in each of the 292 assembly constituencies in the state. “The administration went all out to ensure leakages were plugged and the beneficiaries received the pension by the first of every month,” recalls Raju. He believes the scheme was one of the key reasons for the Congress win in the 2009 state elections and for ysr’s success.

Union minister for rural development Jairam Ramesh, for instance, needed no convincing. “There is no doubt it can be a major step in ensuring support to UPA; it could turn out to be as successful as NREGA,” he told Outlook. The minister also shot off a letter to the prime minister, recommending increasing the pension from the current Rs 200 paid to bpl elderly to Rs 500 for all.

Money remains the key bottleneck. While a universal pension of Rs 500 every month would require Rs 40,000 crore next year, the amount would jump to a whopping Rs 1.92 lakh crore were it to be raised to a more ‘reasonable’ Rs 2,000 a month. Economist Jean Dreze is openly sceptical and doubts if the government would ever agree to spend that kind of money on a welfare scheme for the elderly, specially since the flagship Food Security Bill is yet to be passed. Of course, a decline in growth rate can’t become an excuse to stop welfare schemes for the citizens, he adds.

Economist Prabhat Patnaik demurs. “If the government can give Rs 5,00,000 crore as tax relief to the corporate sector, why can’t it provide Rs 1,92,000 crore for universal pension of Rs 2,000?” he asks.

If someone appears hopeful, it’s Aruna Roy: “The most important assurance that emerged from this series of meetings was the universal acceptance that targeting of services is very problematic, and that a universal entitlement with exceptions is a much better principle to peg delivery programmes on.”

With just two years to go for the next general election, welfare schemes could bring some relief for the UPA. Experts predict that the pension scheme has the potential to duplicate the success of the flagship NREGA programme, which turned fortunes in favour of UPA-I. However, though it’s hard to miss the political benefits the government is likely to reap, cynics within the ruling Congress say the present mood in the government does not seem in favour of the scheme. Politics or pragmatism, which will win?

Tags