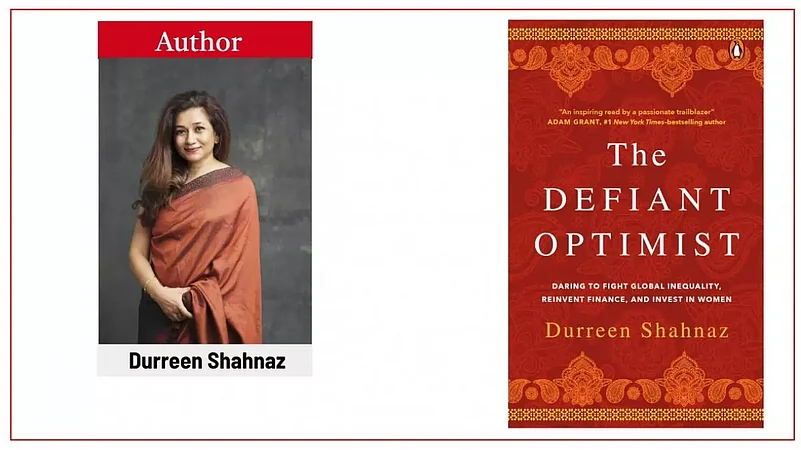

Wealth and power, globally, is concentrated in the hands of a small portion of the population, with just 1% managing, manoeuvring and manipulating the global financial system, which is worth over $160 trillion, writes Durreen Shahnaz in her book The Defiant Optimist: Daring to Fight Global Inequality, Reinvent Finance, and Invest in Women.

Close to 2 billion women from the Global South barely appear either as major investors or investees in the all-powerful global financial markets, Shahnaz writes.

The book, she says, is inspired by women and the 99% who are left out a financial system that controls the world. It is about her journey in making finance, which is “one of the most powerful systems in the world”, work for these 99% people. An entrepreneur herself, she lucidly brings out the challenges faced by this minority as she recounts her observations and experiences during interactions with people struggling to find their feet in the world of business.

“My goal in writing this book is to encourage people to think about women as powerful solution providers, rather than passive victims or recipients of aid,” she says. “In the book, I talk about my life journey in pursuing my north star of a more equitable world and the discoveries I make along the way. It is for anyone who enjoys a memoir with a healthy dose of learning in it from the world of finance and economic development,” says Shahnaz.

An excerpt:

…But I wasn’t convinced that development work could bring about systemic change or do away with the uneven power dynamics of the have and have-nots. Would it make those who hold power give a damn about the powerless? During college, I had met countless economists in Washington, D.C, people who worked at the World Bank and the International Monetary Fund. Not one of them had really solved economic disparities in the countries they served. Not one had brought respect and dignity to women and underserved communities. I thought of the women I knew growing up, most of whom had no options other than to marry and at most teach. I had the chance to change that pattern here.

Maybe it was time to think about things differently, I thought to myself. Maybe I needed to learn the system that controls everything before I could dismantle it and change it to make it work for all. Then again, who was I to dare to take on the great financial systems of the world? My head was spinning. First, I had to get a job offer, I reminded myself as I walked into the restaurant; then I could think about these existential questions.

Winning the War

The “eureka” moment for Shahnaz was when she realised how one needs to lose some battles to win the war. “The ‘war’ for me was to create a financial system that works for the 99%. I lost many battles getting to the victory but the battle scars were worth the journey,” she says.

She hopes the book will help readers dive into the complexities of macroeconomic systems and learn about how financial markets can actually promote social justice, rather than perpetuate inequality. “Ultimately, my hope is that this book transforms perspectives and inspires readers to take action, making a significant social impact in their communities and beyond,” she says.

What next

Next on Shanaz’s agenda is making the world “orange”. “Orange is the colour of the fifth of the 17 sustainable development goals laid down by the United Nations. It relates to gender equality—for women, girls and gender minorities,” she explains. Her company, IIX Global, started issuing ‘orange bonds’, a form of sustainability financing issued to finance projects that promote gender equality, last year

“We are bringing gender equality and climate action together with our work and putting ‘orange bond’ in the market, creating orange tagging for financial products in the market and putting out orange seals for businesses to show that they are practising gender equality and climate action through their operations,” she says.