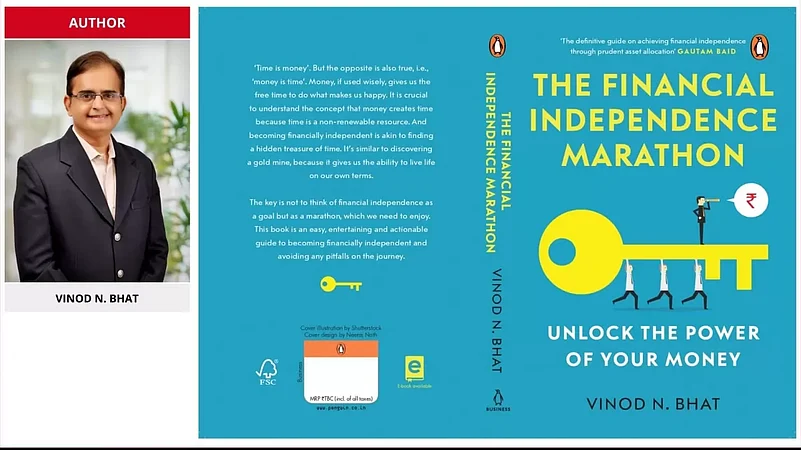

Time is money, goes the timeless adage. But equally true is the fact that money is time because, when used wisely, it frees up time for us so that we may pursue interests that matter to us. With money comes financial independence which is empowering in that it gives one the ability to live life on one’s own terms. However, what is important is to see this independence not as a goal, but as a marathon that one should enjoy. This is the advice coming from Vinod N. Bhat, a chartered financial analyst with 15 years of experience in the financial services industry and author of ‘The Financial Independence Marathon’.

Marathon is not just a word in the title of the book. Bhat loves running and is a marathoner himself. “If I close my eyes, the first image I see is almost always of Eliud Kipchoge, the Number 1 marathon runner in the world today and one of the greatest long-distance runners of all time, running in his characteristic smooth flow,” says Bhat.

Having taken to running as an activity over a decade ago, he has already run a number of full and half marathons. “Long distance running gives me a lot of joy as it gets me into a meditative state. For me, running a full marathon is a great analogy for my life as it usually involves action, drama, pain and joy! That was the primary motivation for the title of the book,” he adds.

The Financial Independence Marathon: The Gist

Here is an excerpt from the book which, according to Bhat, best explains what the book is all about

“Most of us always want quick returns in whatever we do,” says Bhat, as he explains why he finds this excerpt the most representative of the entire book. “Even when it comes to finance and investments, most people want to make the maximum amount of money in the shortest time possible. It is like we want to run a fast 100-metre sprint. Because of that, we take unnecessary risks, live with undue stress and end up making losses on our investments. However, the right mindset is to think like we are running a long marathon. That means we need to pace ourselves, enjoy our financial independence journey and cross the finish line,” he adds.

The Inspiration

The inspiration for the book came from Bhat’s experiences with his family members, relatives and friends, as well as the insights from over 400 meetings and sessions that he has done with individual investors, high net worth individuals, financial advisors and mutual fund distributors into the common basic mistakes that many people make with regards to managing their finances. “I felt there was a real need to help people avoid making these mistakes and I could guide them by sharing my thoughts in the form of a book,” says Bhat.

While the book has helped others, it has definitely had some benefits for Bhat at home. His wife, quite averse to taking risks, kept her savings in fixed deposits for almost two decades. “After reading the first few chapters [of Bhat’s book], she realised that her money in FDs was losing value due to inflation and decided to invest part of her savings in mutual funds,” Bhat recalls. His “Eureka” moment: “I felt that if my wife could be positively influenced by my book, it would be useful for everyone else too, especially women as many of them still tend to leave financial decision to the men in their home.”

What Next

Being someone from the finance sector, Bhat is clear that his next book will be related to the subject. “I like to think and I like to write, especially on topics that can have an impact on society. ‘Behavioural Finance’ seems like an excellent topic to take up next as our mindset and behaviour is as much, if not more, important as knowledge of finance for us to reach our financial goals,” he says