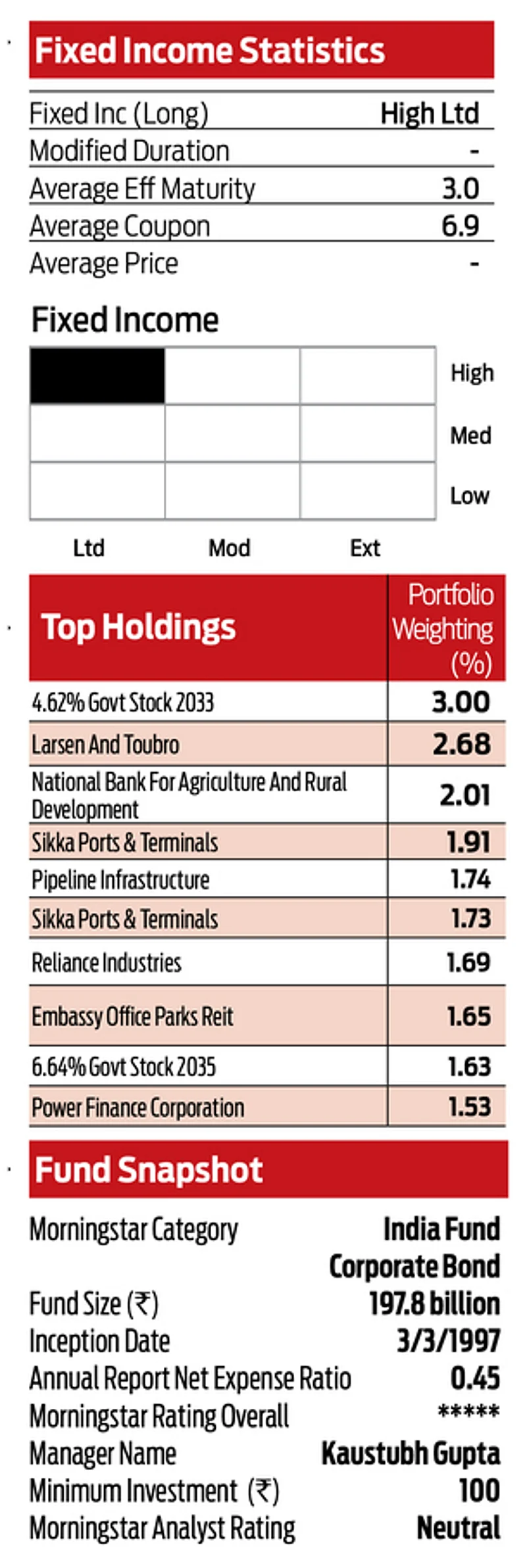

The Aditya BSL Corporate Bond Fund is amongst the oldest funds to be launched in its category and was previously run as a short-term bond fund. The fund’s current construct focuses on investing in high-quality debt papers and has at least 80% of the portfolio invested in these papers. Kaustubh Gupta had been a co-manager of this fund since April 2017 and took over the responsibilities as the primary manager in April 2021. The four portfolio managers at the asset management company (AMC) work in a cohesive manner and are supported by a strong fixed-income team of 12 analysts whose expertise lies across various segments of the fixed income markets.

The core of the strategy lies in investing in high-quality corporate bonds across the yield curve. The manager also takes a duration view based on the interest-rate directional movements. In line with its philosophy, the strategy allocates a portion of its assets to government securities and state development loans (SDLs) in addition to investing in AAA/AA rated debt papers. Gupta can vary his allocation towards these based on their valuations and relative spreads, keeping in line with the fund’s mandate.

On the macroeconomic front, the team tracks headline indicators and tends to follow a market-linked strategy as opposed to a pure macro-based strategy. It has also been placing an increased emphasis on the promoter’s background and ability to service debts. On the corporate bond side, the fund house uses internal ratings as opposed to relying on external credit ratings. The ratings are presented to the investment committee, after which issuers can be invested into but only after they make the grade on the internal research process.

Given their focus on quality and liquidity, analysts tend to undertake an in-depth evaluation of the management, corporate governance practices, financial standing of the issuers, liquidity, and risk. The team undertakes a detailed competitor analysis with a view to segment, evaluate, and categorise peer holdings across different maturity buckets.

Allocation to duration and credit are typically based on in-house views and are reflected across all their strategies, in line with individual mandates. SDLs are used from a tactical perspective, and allocation to these papers can change significantly based on the additional alpha that they can provide.

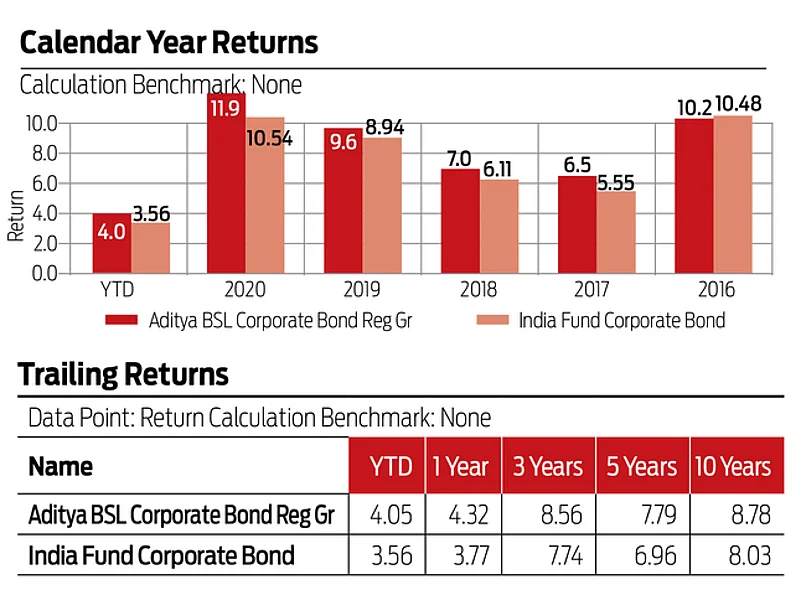

(Returns data as of December 20, 2021)

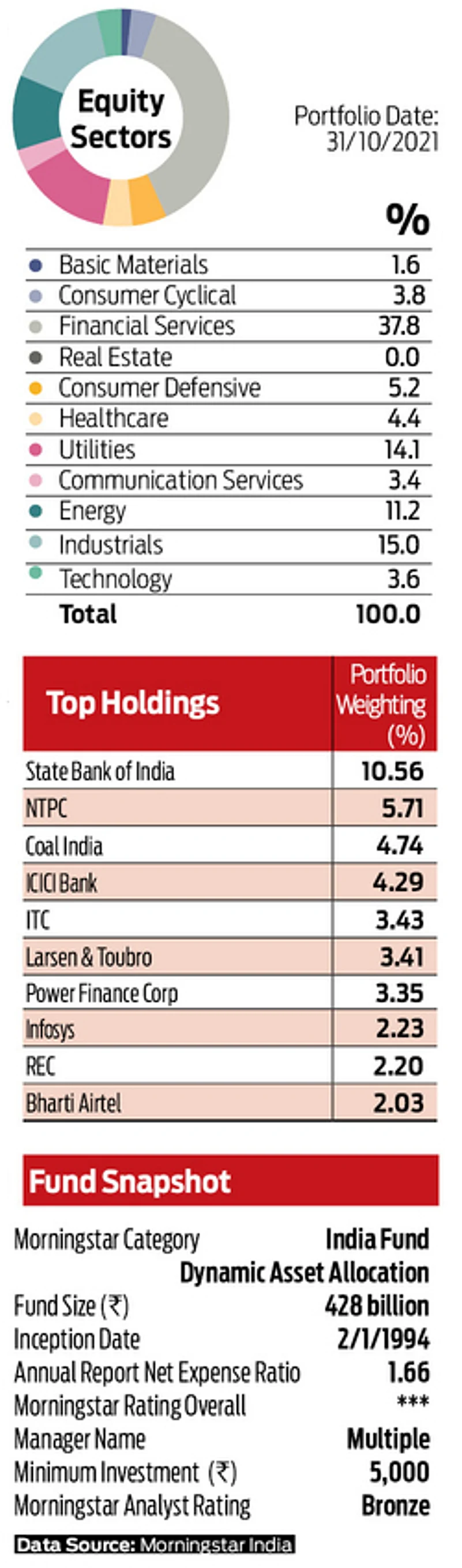

HDFC Balanced Advantage Fund

This fund is a part of the dynamic asset-allocation Morningstar Category, whose investment mandate allows the funds to freely invest across equity and fixed-income instruments without any limitation. As per the fund house, this fund will continue to be managed in the way it has traditionally been run. Hence, the equity allocation will hover in the range of 65-80% of the portfolio.

Fund Manager Prashant Jain is an extremely skilled and experienced investor who has one of the longest track records in the Indian mutual fund industry. Jain has a big influence on HDFC AMC’s investment strategy in his role as CIO, which is a positive. The analyst team comprises seven members with an average experience of 18 years.

The strategy is defined in such a way that the equity component drives the performance, while the fixed-income component provides stability to the portfolio. For the equity portfolio, Jain ferrets out quality companies with robust business models and competitive strengths. Though the bottom-up style is more prominent, the top-down factors aren’t ignored either. Jain is valuation-conscious and freely uses relative and absolute valuation methods while picking stocks.

On the fixed-income side, the premise is safety, liquidity, and returns while investing. So, the approach here is to provide stability to the portfolio by focusing on generating regular interest income for the fund, rather than chasing outsized returns. As for duration, Jain adopts a strategic approach (by forming a long-term view on interest rates) and doesn’t take tactical bets. He forms a long-term view on interest rates, ignoring short-term fluctuations and accordingly positions the fixed-income portfolio. The willingness to be patient with high-conviction yet underperforming holdings and relatively unconventional fixed-income portfolio contribute to this being a unique process. Though it has the potential to deliver good long-term performance, it is tagged with inherent biases along with higher volatility

The fund continues to be an aggressively managed balanced fund rather than a true dynamic asset allocation fund, which is an important aspect for investors to look at while investing in it.

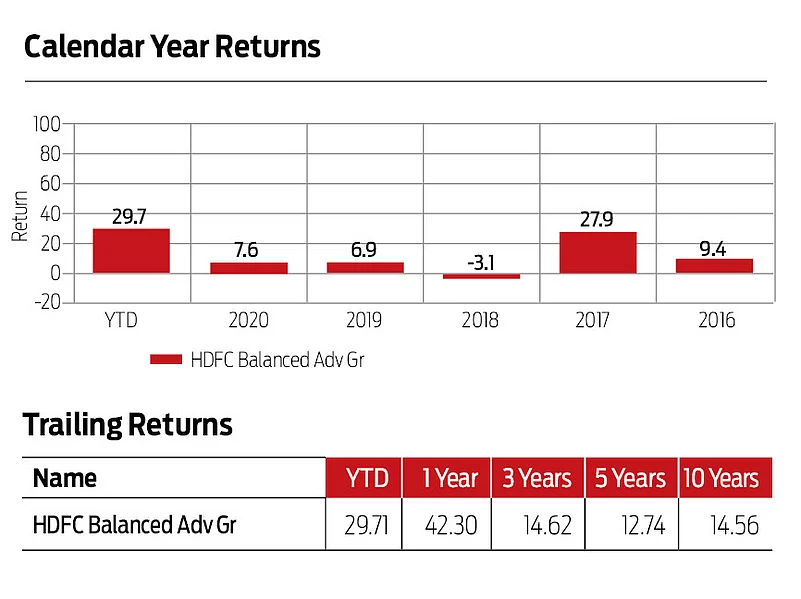

(Returns data as of November 20, 2021)