Budget 2018: Arun Jaitley May Announce Relief For Common Man, Expected To Tweak Income Tax Slabs

Jaitley may also increase the Section 80C limit to Rs 2 lakh from the current Rs 1.5 lakh and not beyond that and the rationale being it will promote savings and investments.

Budget 2018: Arun Jaitley May Announce Relief For Common Man, Expected To Tweak Income Tax Slabs

Budget 2018: Arun Jaitley May Announce Relief For Common Man, Expected To Tweak Income Tax Slabs

In the last Union Budget before the General Elections in 2019, Finance Minister Arun Jaitley is likely to tweak income tax slabs and rates to bring down the burden on individuals, while there is unlikely to be any change in the current taxation of dividends.

Jaitley may also increase the Section 80C limit to Rs 2 lakh from the current Rs 1.5 lakh and not beyond that and the rationale being it will promote savings and investments. However, many are of the view that the Union Budget won’t be the sole platform for launching reforms and there would be a string of positive measures from the Narendra Modi-led NDA government during the course of the year.

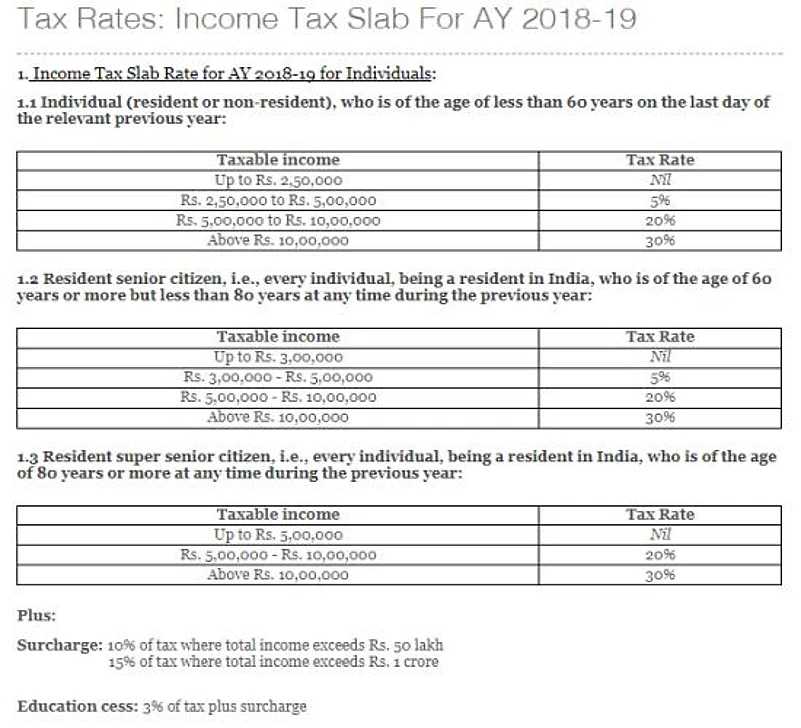

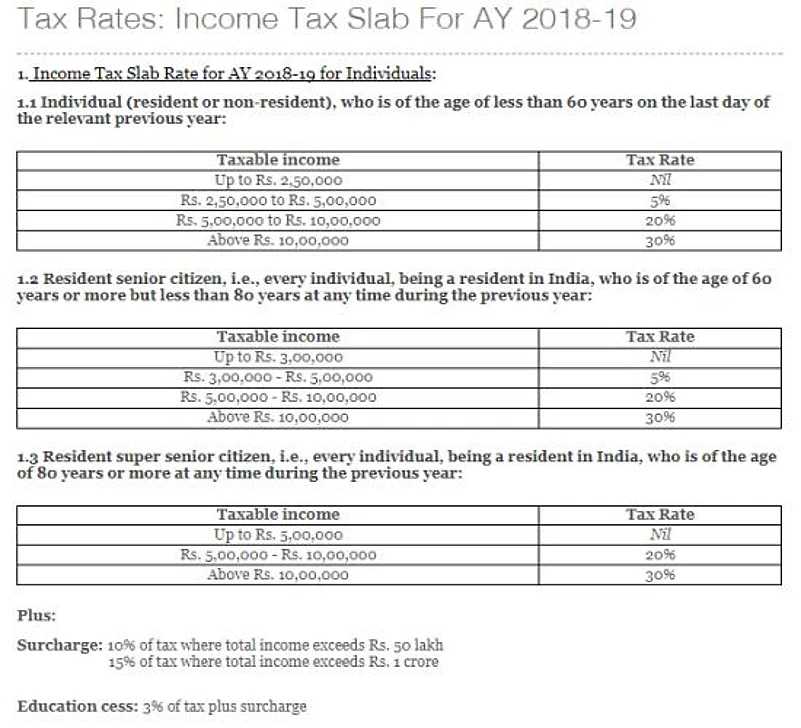

In the last Budget in 2017, the government did not change income tax slabs/rates but gave a rebate of up to Rs. 2,500 for taxable salary up to Rs. 3.5 lakh. Under the Income Tax Act, there are many exemptions that can reduce your tax liability.

(Source: Taxman.com)

In a pre-budget survey by tax consultant EY, a wide majority of 69% of the respondents felt that the threshold limits for taxation would increase further in order to boost disposable income in the hands of the people.

About 59% of the respondents were of the view that multiple outdated deductions would be replaced with a standard deduction in order to reduce the tax burden of employees.

The survey includes the views of 150 CFOs, tax heads and senior finance professionals and was conducted in January.

About 48% of the respondents said they expect the finance minister to lower corporate tax rate to 25% , but the surcharge would continue.

Most of the respondents (65%) do not anticipate a change in the current taxation of dividends at this stage. About 24% of the respondents feel that with a view to lowering the overall burden on the corporate sector, the government may lower the rate to 10%.

"The pre-Budget 2018 EY Survey with business decision makers reveals a consensus amongst India Inc for stability and consistency in tax policies and a moderate tax structure. There seems to be little expectation of any major direct tax overhaul after the transformative introduction of GST earlier in the year," EY India National Tax Leader Sudhir Kapadia said.

(With PTI inputs)

Published At:

MOST POPULAR

WATCH

MORE FROM THE AUTHOR

PHOTOS

×