IS stability returning to Indian politics? That may be the message from the markets where in recent weeks, the benchmark 30-share BSE Sensitive Index has captured all attention. Since the end of January, the 50-share National Stock Exchange index has appreciated by about 50 per cent. And the Mumbai Sensex has made a gain of 30 per cent.

The fundamentals still disappoint. Apart from tight credit, many of the factors that justified a Sensex level of 3200 points in January—slowing industrial growth, poor corporate performance and worries about the government's ability to manage its finances—are still around. But what has definitely changed is expectations.

The positive talk from the new government, of kickstarting the economy, and easier liquidity, has warmed up the market. To the extent that the mood has reached a point where some FII analysts think the stocks are actually undervalued at a Sensex level of 4200. "Even if the Sensex were to cross its all-time high over the next 4-5 months, its component stock would still only be trading at 11-12 times projected (1998-99) earnings," says one FII analyst.

Apart from the 30 Sensex stocks, the other stocks have been falling almost continuously since the last bull market petered out in 1992-93. The size of a company is measured in terms of market capitalisation, the amount of money that would be required to buy up all stocks of a company at current prices. The Sensex stocks are large-capitalisation ones, and the revival is more pronounced in mid-cap stocks comprising the NSE index. And that's very significant.

Despite the markets' general agreement that 1997-98 will be one of the worst-ever years for corporate results, there have been several strong performances. Software stocks have been among the most high-profile, with scrips like Satyam Computers, Wipro, BFL Software and Mastek surging so powerfully that they hit the circuit breaker—a mechanism designed to halt runaway price movements on the exchanges.

Others, too, are making their presence felt. Once dismissed by most analysts as a deadbeat industry, thanks to reports of stagnant sales and mounting inventories, consumer goods have indeed staged a comeback. Innovative discounting schemes seem to have boosted sales without damaging bottomline growth.

Easier liquidity following the latest round of interest rate cuts and heavy activity by badla financiers (who fund operators who wish to postpone payments on committed trading decisions), has helped push the prices of a lot of shares upwards. "There is more money in the market coming through badla," agrees stock broker Pashupati Advani. Badla finance rates went up to 90 per cent in the week ending April 10. Ordinarily, such an implication of a serious shortage of funds in the market would have led to a crash. But the market continued its rise with barely a blip, something that rarely happens unless sentiment is very bullish.

Such technical factors, however, are rarely sustainable in their impact, and this worries market watchers like Devina Mehra of First Global Finance. "How long can you have easy liquidity in the economy if the slowdown in industrial growth persists?" she asks. "The government's monetary options are limited, and they have a huge revenue deficit to finance. The movement has been mainly technical in nature; nothing has fundamentally changed."

Paradoxically, the very fundamentals that caused falling stock prices are setting a corporate revival in motion. "Poor sales growth, and scarce capital have forced managements to cut costs and interest charges—a better way to boost the bottomline than through price increases alone. Many non-performing or non-core assets are being sold," argues Dhiraj Agarwal, director, S.S. Kantilal Ishwarlal Securities. And as the better companies readjust to economic reality, the market is rewarding them by re-rating them positively, which is happening right now.

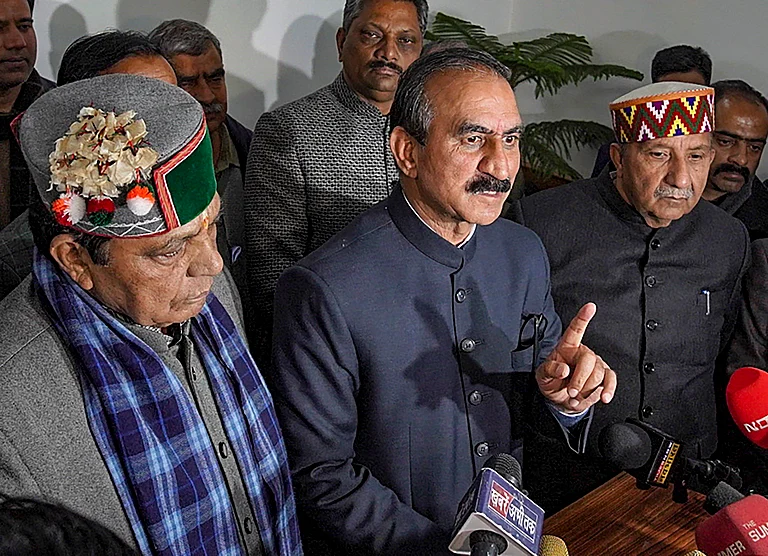

But stability remains a big if, and the market is already sizing up Jayalalitha's potential to destabilise. Says S.V. Prasad, chief executive of JM Fund Management: "The important thing is that there is a perception that the government will last, but stability certainly is a concern, given the pulls the government is subject to from some of its important coalition members."

Despite good performance by some sectors in 1997-98, Mehra doesn't expect fundamentals to carry through the rally. "We don't expect fundamentals to improve across the board until the 1999-2000 results. Meanwhile, the technical factors driving the market should hold up for another 2-3 months."

Similarly, a measure of protection given to commodity stocks through sops like higher tariffs has buoyed up their stock prices. But there's a flip side: because their performance will depend on their protection, these stocks will not be valued so much by FIIs and other institutional investors in the long term. The result: their share prices are unlikely to show much more than a short-term jump.

One unique trait about this rise is that FIIs have been largely peripheral. In fact they may have contributed to the fall during January—many FIIs with investments elsewhere in Asia found themselves suddenly overweight in Indian equity after the sharp declines in several of the region's currencies. To rebalance their overall portfolios, several of them had to sell while the market was at a low—and were unable to cash in on the rise that followed. As a manager with one such FII points out, this might actually be good news for investors: "Many of those who missed out on the last rally are just waiting for a market correction to get back into the market, which, of course, will push share prices back up, or at least keep them steady."

Much of the rise in mid-cap stocks has been due to the return of the retail investor to the markets. Institutions, especially FIIs, have been limited to buying mainly blue-chip stocks since many undervalued scrips were available in quantities too small to justify buying by such large investors. Moreover, as one FII analyst points out: "How do you justify buying Reliance at Rs 200 when you said a couple of months ago that at Rs 150 it wasn't worth it? And there aren't too many stocks that have lagged the rise but still look set for appreciation."

Market operators, however, have no such problems; where there's business, there they will go. And so, they are currently trading heavily in several underpriced, smaller stocks.It was only a matter of time before retail investors spotted the movements and began pouring money into these stocks.

The trigger for the rise in mid-cap share prices appears to have been the rash of asset sales and merger and acquisition deals that marked the corporate calendar over January and February. "There were about five major stories—among them the Raasi Cements takeover, Sterlite's attempt on Indal—but they gave rise to about 500 stories. Large punters started looking for value and retail investors were quick to follow suit," explains Agarwal.

One worry about sustainability has been that the market hasn't needed very much to swing it sharply. As Pashupati Advani points out: "It hasn't generally taken much to move the market; even about $30-40 million (Rs 120-160 crore) can trigger a major move." But greater depth in this market rise could get around that problem. "This rise is very clearly much broader," agrees Ajay Srinivasan of ICICI Asset Management. "625 stocks just hit the circuit breaker. Now, that's a sign of a really big rally."

Agarwal agrees: "Look at trading volumes. In the past when the Sensex has risen by a similar amount average, daily volume on the BSE would have been Rs 300 crore, and that on the NSE, about Rs 1,500 crore." Today, the average daily volume on the NSE is about Rs 1,600-1,700 crore, and on the BSE it has jumped to the Rs 1,500-1,700 crore range.

Moreover, the number of stocks accompanying the rise in the Sensex has gone up. Says SSKI's Agarwal: "In 1996 and 1997, when the Sensex also rose sharply, the movement was effectively restricted to less than a hundred stocks. Today, it's much more." It is this combination of depth and volume that could sustain the current rally for longer than those in 1996 and 1997. "I don't expect major trouble in the government for at least the next 18-24 months, during which time the Sensex could rise to the 4800-5000 level," he says. But along with the market, some worthless stocks could rise too. As Agarwal worries: "Ten good stocks go up, but another 20 bad ones will follow. Eventually this could create another bubble."

There seems little doubt that the rally isn't over yet. But the key to whether it will last lies with the government's ability to do what its predecessor couldn't: boost infrastructure investment. "If we see evidence of that happening over the next six months—higher government investment, more private sector project clearances—we could see a bull run all the way into 1999," concludes Agarwal. And that's definitely good news.