The Covid pandemic compelled people across age groups to rely on digital platforms for various activities. Be it banking activities or buying groceries, gradually more people are shifting to online modes. While there has been a sharp increase in various banking activities, digital lending apps have gained a lot of prominences. While lending digitally is still at a nascent stage for banks compared to physical modes, digital lending has gone up significantly for non-banking financial companies (NBFCs) in 2020, after the outbreak of Covid, says a recent report by the Reserve Bank of India (RBI).

NBFCs – Preferred Choice For Digital Lending

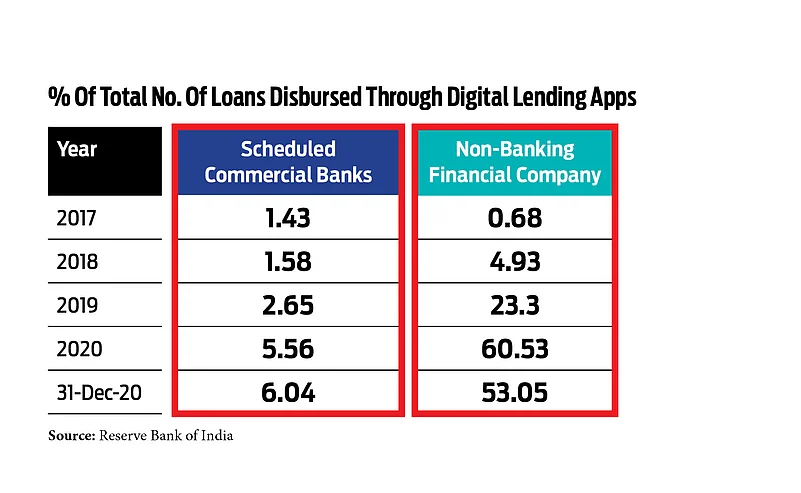

The percentage of the total number of loans sanctioned by NBFCs through digital lending platforms increased more than 55 per cent between 2018 and 2020. While there was a considerable rise in the number between 2018 and 2019 as well, as Covid started spreading by the end of 2019, the number spiked in 2020.

“NBFCs follow a more flexible approach to disburse/process a loan. Banks have a physical presence and work on the traditional model, whereas NBFCs work on a hybrid model, which makes their journey a little smoother,” says Mahesh Shukla, founder and CEO, PayMe India, a digital lending platform.

The percentage of the total number of online loans sanctioned by NBFCs reduced slightly by the end of 2020, but it rose slightly for banks. After the

outbreak of Covid, there has been an alarming rise in the number of online banking frauds in India. This could be a reason for the fall in the number of loans disbursed by NBFCs digitally and the increase for banks, though other factors also apply.

“As of now, there are a few lenders who are not recognized or regulated, because of which a few people have faced services issues. That could be why some people moved to banks,” says Shukla.

While both NBFCs and banks lend, they do so under different frameworks. “NBFCs have taken a cautious approach due to uncertainties. They have a higher cost of borrowing than banks and hence need to be cautious about cash flows. Also, several NBFCs saw an increase in non-performing assets (NPAs) during Covid, leading to liquidity and asset liability mismatch,” says Sameer Aggarwal, founder and CEO, Revfin, a digital lending platform.

In 2017, there was not much difference between banks (0.31 per cent) and NBFCs (0.55 per cent) in terms of their share in the total loan amount disbursed digitally. However, NBFCs were lagging in terms of the number of loans, with a share of 0.68 per cent vis-à-vis 1.43 per cent for banks, says the report. Things took a turn when Covid spread and NBFCs made great strides in lending digitally. “NBFCs have deeper specialization in customer segments and geographies. They use digital apps for sourcing, which gives them alternative sourcing options in their areas of expertise. Also, NBFCs have a simpler and faster decision-making process, which is convenient for digital lenders,” says Aggarwal.

The majority of loans disbursed digitally by NBFCs are personal loans followed by the category of ‘others’, which primarily include consumer finance loans.

Banks Preferred For Long-Term Loans

NBFCs have a higher share in the number of loans disbursed digitally, but when it comes to loans of longer tenure, people seem to prefer banks through digital lending apps.

For banks, around 87 per cent of the disbursed amount (Rs 0.98 lakh crore) has a tenure of more than one year. For NBFCs, only 23 per cent of the loans, amounting to Rs 0.05 lakh crore, fall in this bucket. On the contrary, loans with tenure of less than 30 days have a maximum share in the case of NBFCs (37.5 per cent, totalling Rs 0.9 lakh crore) vis-à-vis just 0.7 per cent for banks (amounting to Rs 0.007 lakh crore), states the report.

“Banks have the ability to raise low-cost long-term capital through deposits and other means. This makes it easier for them to lend over a longer duration. Most NBFCs are able to raise short to medium term debt only. Longer-term debt can be very expensive for NBFCs,” says Aggarwal.

Be Cautious Of Fraudulent Apps

While more and more people are taking loans digitally, RBI has cautioned customers to be aware of fraudulent apps. The report mentions that there were approximately 1,100 lending apps available for Indian Android users across 80+ application stores (from January 1, 2021 to February 28, 2021).

“There is a need to facilitate identification of bad actors in (the) digital lending space by enforcement agencies in a timely and less frictional manner. The payment system regulation should refine ‘travel rules’ for narration of One Time Password (OTP) and SMS/ e-mail alerts sent to users in connection with conducting payment transactions through any digital mode under PSS Act (Payment and Settlement Systems Act),” says the report. ‘Travel rules’ include information required to be collected, retained and included in every fund transfer transaction initiated by a financial institution on behalf of a customer, and which should ‘travel’ (be passed along) to each successive financial institution in the chain.