Go Fashion, which owns the brand Go Colors, is likely to debut with a 65-70 percent premium on the bourses on Tuesday, given the IPO subscription and demand in the grey market.

Chennai-based Go Fashion commanded a premium of around Rs 520 in the grey market on Monday, a day before the listing of Go Colors shares in the secondary market, according to dealers.

Go Fashion mopped up Rs 1,014 crore from the public issue that was subscribed 135.46 times during November 17-22. Non-institutional investors had put in bids 262.08 times the portion set aside for them and qualified institutional investors’ reserved portion was subscribed 100.73 times. Retail investors bought shares 49.70 times the portion reserved for them.

According to a report in Moneycontrol, here is what grey market trends suggest:

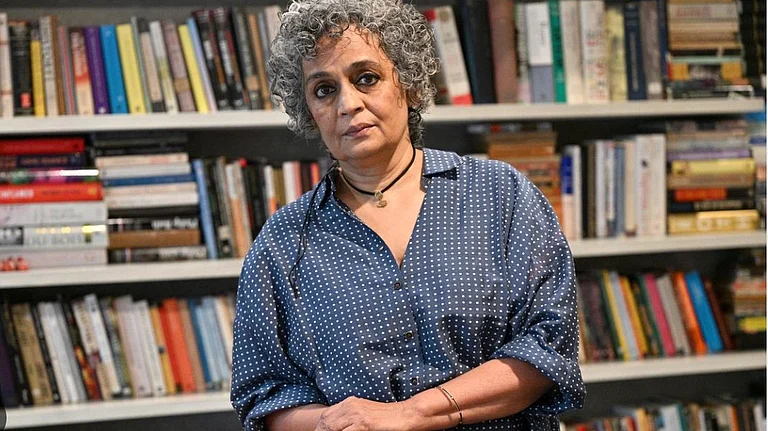

Abhay Doshi, Co-Founder of Unlisted Arena

The COVID-19 outbreak impacted the company severely and the focus should now be on the performance post-reopening of the economy. The issue looked richly priced, however, due to a smaller allocation to retail applicants in IPO, it may generate huge fancy on the listing.

Owing to the decent subscription, a magnificent listing is expected. In my view, the issue should list somewhere above Rs 1,100, a premium of about 50-55 percent.

Gaurav Garg, Head of Research at CapitalVia Global Research

We expect the listing at Rs 1,170, which gives a gain of around 70 percent. He pointed out that the company has not been profitable since FY19 but has had healthy operating cash flows. In FY21, the company posted a loss of Rs 3.54 crore as against a profit of Rs 52.63 crore in previous year, on a revenue of Rs 250.66 crore, down from Rs 392 crore.

Manoj Dalmia, Founder and Director at Proficient Equities

Go Fashion stock could list in the range of Rs 900-1,190 on bourses. One can expect a premium of 50-60 percent over the issue price depending on market conditions, he said.

Prashanth Tapse, Vice-President (Research) at Mehta Equities

Looking at the strong HNI and QIB subscription demand for the largest women’s bottom-wear brands in India, we can expect a strong listing gain with a 65-70 percent premium on the upper end of the IPO price of Rs 690.