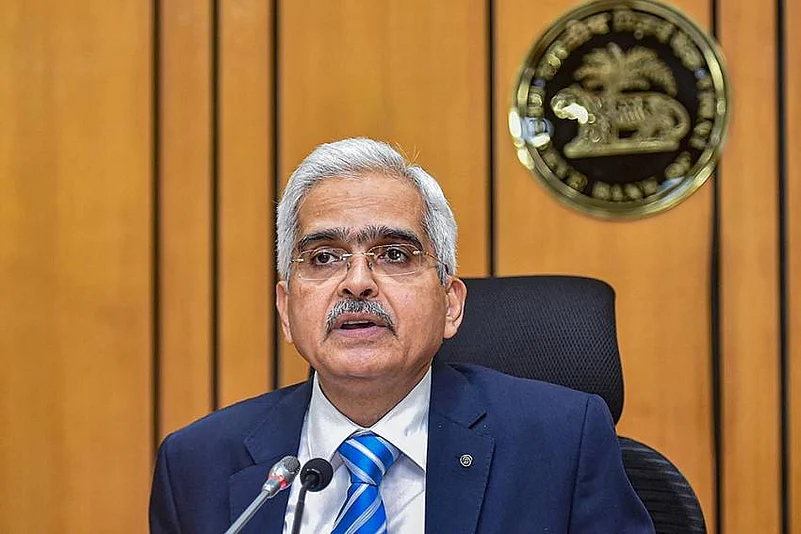

Reserve Bank of India (RBI) Governor Shaktikanta Das on Friday said the central bank will ensure adequate liquidity in the system to ease the financial stress caused due to COVID-19 crisis. RBI reduced the reverse repo rate by 25 basis points to 3.75 per cent.

He also said that to begin with the RBI will be giving an additional Rs 50,000 crore through targeted long-term repo operation (TLTRO) to be undertaken in tranches. Besides, he announced a re-financing window of Rs 50,000 crore for financial institutions like Nabard, National Housing Bank (NHB) and SIDBI.

Earlier, the RBI had reduced the repo rate to a 15-year low of 4.40 per cent by announcing a steep cut of 75 basis points on March 27, only two days after the national lockdown was imposed on March 25.

Addressing the media for the second time since the Narendra Modi government imposed a national lockdown from March, 25, Governor Das announced a reduction in reverse repo rate by 25 basis points from 4 per cent earlier to 3.75 per cent now. The reduction in reverse repo rate is among one of the slew of announcements made by the RBI governor.

"The mission is to minimise the epidemiological damage in the country due to COVID-19. I want to convey the RBI's resolve and the way forward," said Das. He also said that this is not the last of the announcements on financial support during the crisis, stating that the central bank will come up with responses in the future in the interest of the economy based on evolving situations.

Pointing out that the RBI is monitoring all macro parameters on a continuous basis, he said, economic activity has come to standstill during lock down. The impact of Covid-19 is not captured in index of industrial production (IIP) data for February, he said, adding that contraction in exports in March at 34.6 per cent was much more severe than global financial crisis of 2008-09. He said vehicle production and sales declined sharply in March and so did electricity consumption.

Here are the additional measures announced by the RBI:

- Liquidity management: Will undertake TLTRO 2.0 operations. LTRO of Rs 50,000 crore to begin with in many tranches for NBFCs

- 50 per cent of the funds in TLTRO 2,0 is for small and medium-sized NBFCs

- A special Rs 50,000 crore refinance facility for Nabard (RS 25,000 crore), SIDBI (Rs 15,000 crore) and NHB (Rs 10,000 crore)

- 60 per cent of ways and means advances allowed to states until September 30, 2020

- NPA classifications will exclude the three-month moratorium period till May-end

- NBFCs allowed to grant relaxed NPA classification to their borrowers

- Banks will need to maintain additional provisioning of 10 per cent on standstill accounts

- LCR requirement brought down from 100% to 80 per cent with immediate effect.

- LCR requirement to be restored to the previous level in a phased manner

- Banks won't announce dividends until further notice

- NBFCs' loans to delayed commercial real estate projects can be extended by a year without restructuring

- Loans given by NBFCs to real estate companies to get similar benefit as given by scheduled commercial banks

Other highlights of the Governor's address:

- Macroeconomic landscape has deteriorated since March 27, 2020.

- The global economy is going through the worst phase since the Great Depression.

- India is one of the few countries projected to hang on to - perhaps tenuously - 1.9 per cent GDP growth, according to the IMF.

- India expected to stage a smart recovery to grow at pre-COVID-19 pace of 7 per cent in FY21, according to the IMF

- Every data on monsoon, sowing, fertilisers bode well for agri and rural outlook but situation is sombre in other industrial sectors.

- The impact of Covid-19 has not been captured in recent IIP data.

- The RBI has taken several steps to ensure normal functioning of banks.

- No downtime has been observed for internet or mobile banking.

- ATMs have worked at 91per cent capacity during this period.

- Since March 27, surplus liquidity has increased sharply in the banking system.

Appreciating the effort of banks and other institutions in keeping the financial market operational, Das said there was no downtime of internet or mobile banking during lockdown and banking operations were normal.

Banks, financial institutions have risen to the occasion to ensure normal functioning during the outbreak of this pandemic, he said.