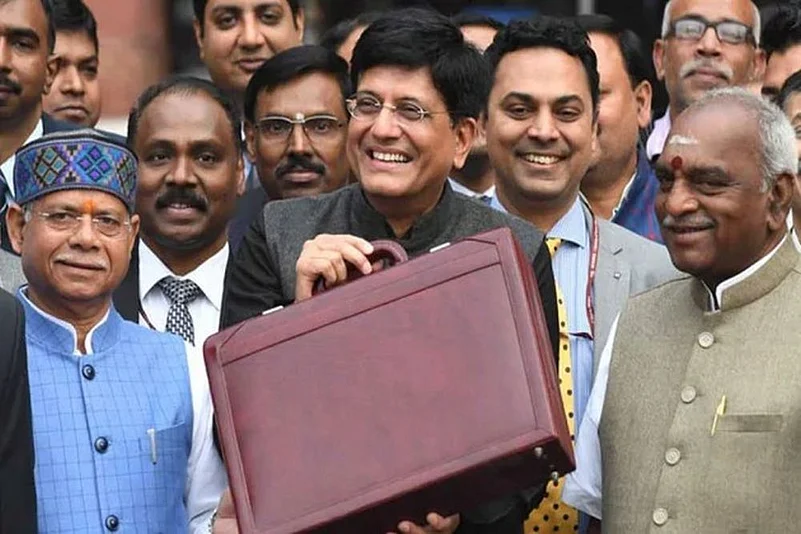

The Lok Sabha on Monday passed the Interim Budget, amid walkout by key Opposition parties which alleged that the government had deviated from established conventions and rolled out several incentives to woo voters ahead of the general elections. Replying to the debate on the Budget, finance minister Piyush Goyal said the NDA government has done a lot to improve farmers' economic condition and refuted the criticism on the Rs 6,000 annual direct income support to them being meagre.

"The Budget provides for a substantial benefit to small and marginal farmers," Goyal said.

Under the Pradhan Mantri Kisan Samman Nidhi Yojana, 12 crore farmers with less than two hectares of land holding will get Rs 6,000 per year. The amount in three installments will go directly into their bank accounts, he said amidst continuous slogan shouting by some opposition members.

Goyal said the scheme will be effective from December 1, 2018, and cost Rs 75,000 crore. On the other hand, he said, the UPA government had waived off Rs 52,000 crore for farmers in a span of 10 years.

The Congress-led UPA committed a breach of trust with the people of India. They did nothing for the poor,ÂÂ said Goyal, adding that there is no accounting jugglery in the Budget for 2019-20 under the leadership of Prime Minister Narendra Modi.

The overall expenditures in the Budget are at Rs 27.84 lakh crore, 13 per cent larger than the last year's figure. The expenditure for defence has been increased to Rs 3.05 lakh crore from Rs 2.85 lakh crore in 2018-19.

Individual taxpayers having taxable annual income up to Rs 5 lakh will get full tax rebate. All the applicable income tax rates have also kept unchanged.

Further, individuals having an annual income of Rs 6.5 lakh can also save income taxes, provided they invest a sum of up to Rs 1.5 lakh in prescribed savings schemes under Section 80C of the Income Tax Act such as Public Provident Fund (PPF), Equity-Linked Savings Scheme (ELSS), National Saving Certificates (NSC), insurance schemes, and so on.

An individual is also eligible to claim income tax deductions from of up to Rs 2 lakh on interest home loans, education loans, National Pension Scheme (NPS) contributions, medical insurance, medical expenditure on senior citizens.

Goyal also provided to increase the standard deduction by Rs 10,000 to Rs 50,000 from the present Rs 40,000. Therefore, going forward, all the salaried persons can claim a standard deduction of Rs 50,000 on their respective taxable income.

Key POINTS OF 2019 INTERIM BUDGET

* Rs 12 crore small and marginal farmers to be provided with an assured yearly income of Rs 6,000 per annum under PM-KISAN

* New separate Department of Fisheries for the welfare of 1.5 crore fishermen

* Two per cent interest subvention to farmers for animal husbandry and fisheries activities.

* Rs 60, 000 crore allocation for MGNREGA in BE 2019-20

* Income up to Rs 5 lakh exempted from Income Tax

* More than Rs 23,000 crore tax relief to three crore middle-class taxpayers

* Standard deduction to be raised to Rs 50,000 from Rs 40,000

* TDS threshold for deduction of tax on rent to be increased from Rs 1,80,000 to Rs 2,40,000

* Fiscal deficit pegged at 3.4 per cent of GDP for 2019-20

* Capital expenditure for 2019-20 BE estimated at Rs 3,36,292 crore

* 25 per cent additional seats in educational institutions to meet 10 pc reservation for the poor

* Defence budget to cross Rs 3,00,000 crore for the first time ever

* Capital support of Rs 64,587 crore proposed in 2019-20 (BE) from the budget

* Tax collections nearly doubled in five years- from Rs 6.38 Lakh crore in 2013-14 to almost Rs 12 lakh crore this year.

* 80 per cent growth in tax base-from 3.79 crore to 6.85 crore in five years.

(With inputs from agencies)