Indian pension regulator Pension Fund Regulatory and Development Authority (PFRDA) has advised pension funds to formulate detailed policy on investment in IPOs. As per PFRDA guidelines, investments can only be made in equity shares of such companies with a market capitalisation of Rs 20,000 crore and above. In an interview with Outlook, PFRDA chairperson Supratim Bandyopadhyay talks about pension IPOs and the pension business market in India.

Excerpts:

How do you see the growth of pension schemes and funds in India?

Pension was not a focus of any sector for years. Even if you look today there are PFRDA or maybe IRDA along with some other organisations who are giving some kind of pensions, maybe EPFO. The total pension asset base in India is about Rs 30 lakh crore or Rs 30 trillion. If you look at the figure, it looks great but if you compare the figure with GDP of the country, your pension asset vis a vis GDP of the country gives you some indication as to the progress that the country has made. And for India it comes to about roughly 14 per cent. If you compare it with developed countries many of them have pension assets of more than 100 per cent of the country's GDP. So, it shows that we have a long way to go. I believe there is a huge scope and untapped potential.

The reasons why we lack is because it was neglected for a long time, it’s a long term investment and younger population is not keen as the returns will come after 30-35 years. When I speak to people I get very interesting answers from a large part of employees that they are not going to retire. We will change jobs, we have specific skills, digital world and we will never retire. One has to understand that you have to retire. Working life also has come to an end after a certain period as you don’t have that kind of energy.

Another thing that one has to accept is longevity. In India, people are living longer. Today at the age of 60, data points that Indians are living for another 18-19 years on average, living upto 80 years. So what happens during that time? Your regular paycheck stops. Your business, regular income start. But living and medical expenses don’t stop, they keep on increasing. In addition, during the pandemic, you have already seen the cost of treatment. Medical science has been approved but that is available at a much higher high cost. Nobody can stop those expenses. So retirement planning and corpus is required to be independent and pension comes to play at such time.

With IPO being the flavour of the season, do you think it's the right time for pension funds too to go for IPOs especially with LIC also in the queue?

I don’t believe in the right kind of time or timing the market because after being in the market for the last 15-20 years what I have learnt is that market knows the best and much better than each individual would do. Ultimately, the market is nothing but a place where all kinds of demand, supply, necessities, biases and analysis come into play. What we did was that IPO was not allowed in the government segment and many parts of our fund are in the government sector. And equity all along, equity has been giving a tremendous return. By July, our CAGR was more than 12.5%. Therefore, we felt that we were missing on the opportunities of IPOs so why not go for it. Of course, we have some guidelines there like these things are necessary, post IPO immediately, the lowest of the price band, that is about Rs 17,500 crore and then you multiply the shares and take lowest of the price, you can go and take a call. IPOs are generally doing well, because of real hype in the market. For the first time scene, that a company making a loss year after year, the IPO has come and immediately, its market cap has cost Rs 1 trillion. We will be seeing many more instances like PayTM, Mobik. They have to take a call.

What is the idea behind the MARS scheme? How will subscribers benefit from it?

MARS was a requirement under our PFRDA act. Under section 22, one of the schemes available for the customers should be a minimum assured scheme but beyond that, it does not say what should be the minimum amount required. The act allowed the choice of the regulatory body to allow minimum return under the market conditions. So actually MARS is the scheme we thought of. Very few countries have such schemes. Maybe next fiscal it is available for consumers.

Are you looking at investment overseas?

Ans If you look at the insurance and pension sector there are certain provisions that discourage us from investing overseas. However, it does not mean, that we don’t have that opportunity. Interest rates in developed nations are low and they are not getting enough opportunities within the country. That is a reason why they are keen to come to India. Take the example of Japan where interest rate had gone negative and you cannot give zero return to investors. So they were forced to look overseas. They have come to countries where interest rates are high. Fortunately, we do not have such compulsions. Even I feel it is not bad to look overseas and maybe in years to come we may look. As of now, it is not possible.

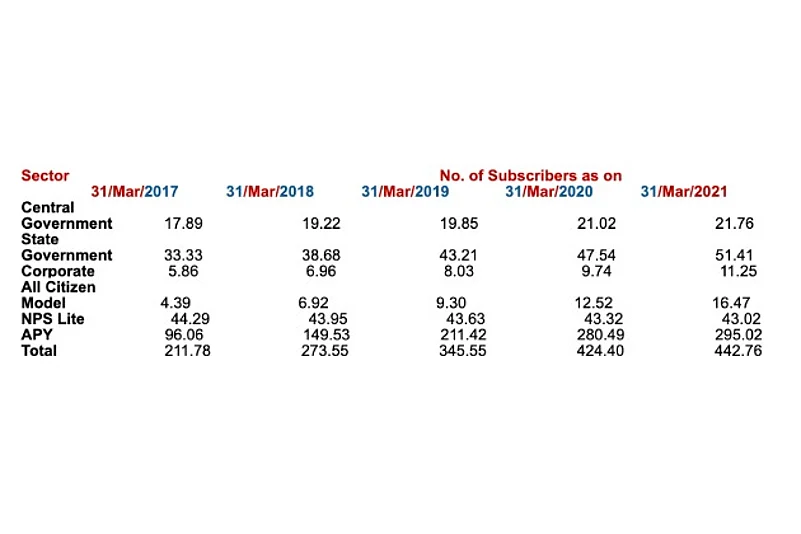

Graphic 1: Pension Subscribers in NPS & APY