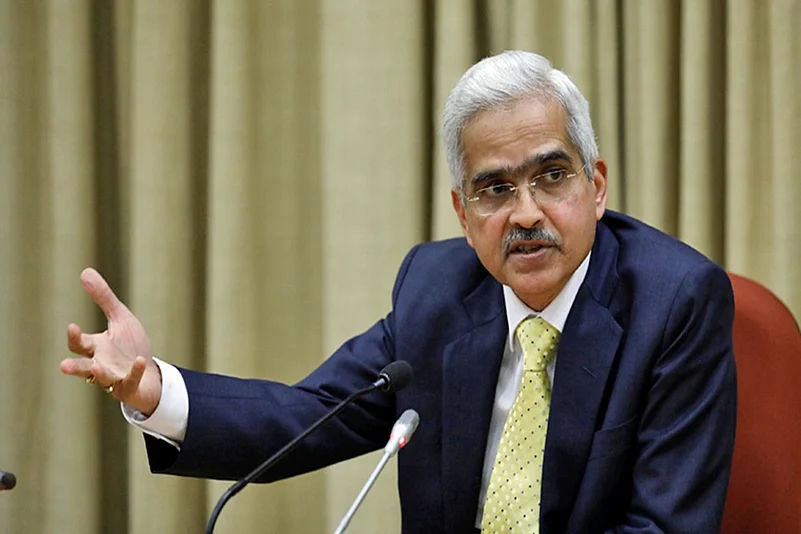

The Reserve Bank of India's Monetary Policy Committee maintained the key lending rate unchanged at 4 per cent on Friday, holding the rates at existing levels for a third straight review. The RBI governor announced that the decision was taken unanimously and added that the reserve repo rate too was kept unchanged at 3.35 per cent. Amid high levels of inflation and the country's shrinking gross domestic product (GDP), the status quo on monetary policy was as expected by most economists.

The central bank maintained an "accommodative" stance of policy, which rules out any hikes for now.

Since May, the repo rate - or the key interest rate at which the RBI lends money to commercial banks - has been kept steady at a 19-year low of 4 per cent.

Currently, the reverse repo rate - the rate at which the RBI borrows from banks - is at 3.35 per cent.

Inflation has remained consistently above the upper end of RBI's mandated 2-6 per cent target range every month barring March this year while core inflation has also remained sticky.