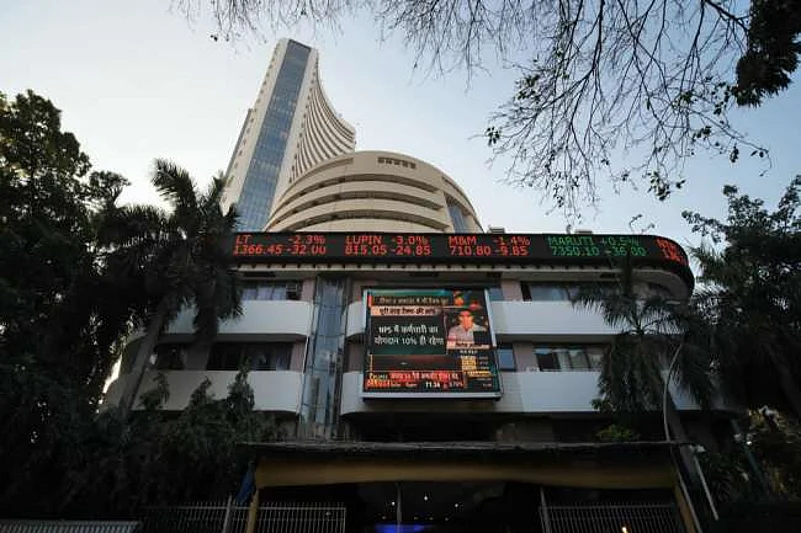

Sensex continued its winning for the consecutive day on Wednesday, rising 1,016 points on Wednesday with a boost provided by the apex regulator Reserve Bank of India maintaining benchmark lending rates amid concerns about the new mutated version of the coronavirus, Omicron.

The virus is believed to be less severe than the Delta variant, according to preliminary studies, removing investor anxiety about its impact on the economy.

BSE Sensex rose 1.76 per cent or 1,016.03 points to close at 58,649.68 points on Wednesday. The NSE Nifty too closed 1.71 per cent or 293.05 points higher at 17,469.75.

Bajaj Finance emerged as the top gainer on the Sensex, rising as much as 3.67 per cent. Maruti, State Bank of India, Bajaj Finserv, ICICI Bank, Infosys, Bharti Airtel, Tata Steel, IndusInd Bank and HCL were among the top gainers on the Sensex, rising between 2 to less than 4 per cent.

PowerGrid slipped 0.49 per cent and Kotak Bank 0.85 per cent to close in the red.

Bajaj Finance was the top gainer on the Nifty too, rising as much as 3.62 per cent. Maruti, Hindalco, State Bank of India and Bajaj Finserv closed in the positive on Nifty.

Early on Wednesday, the Reserve Bank of India Governor Shaktikanta Das that the rate-setting committee had decided to keep the repo rate unchanged at 4 per cent. Additionally, the MSF and bank rate was kept unchanged at 4.25 per cent and the reverse repo rate at 3.35 per cent. The enthusiasm among investors was reflected in markets today.

Further, the RBI kept the Real GDP growth projection for the current financial year unchanged at 9.5 per cent. The inflation target for FY22 was retained at 5.3 per cent, 5.1 per cent for Q3, 5.7 per cent for Q4. The target for the first quarter of the next financial year has been kept at 5 per cent.

Elsewhere in Asia, bourses in Shanghai, Hong Kong, Seoul and Tokyo ended with significant gains.

Stock exchanges in Europe were, however, largely negative in mid-session deals.

Meanwhile, international oil benchmark Brent crude inched up 0.60 per cent to $75.89 per barrel.

In a separate development, the rupee closed nearly flat at 75.46 against the dollar after recovering from intra-day lows.

The local currency opened strong before slipping into the negative territory at the interbank forex market on Wednesday. It touched an intra-day high of 75.36 and a low of 75.57 before closing flat compared to the previous day's close.

(With inputs from PTI)