Just when the industry was beginning to look positive about growth in demand, there is a lingering fear of the third COVID-19 wave in India. The government has confirmed the entry of the Omicron variant in the country. Unlike the second wave when the developed world was relatively doing better in economic activity, the new variant is likely to spread in most countries—leading to muted growth in the world economy.

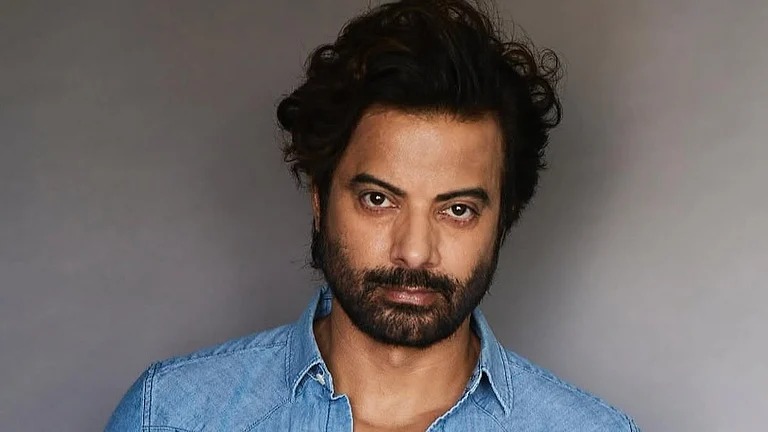

So, how will it impact the Indian industry’s domestic and exports performance? Outlook Business spoke with Vineet Agarwal, president of the Associated Chambers of Commerce and Industry of India (ASSOCHAM) to understand how prepared Indian businesses are to deal with new challenges.

Edited excerpts from the interview:

What is the outlook for industry growth against the backdrop of the looming third wave in the country in this financial year?

Agarwal: For the full year, we are estimating about 9.5 to 10.5% in terms of our GDP numbers. The second half is the better half of the year, so if something like a third wave does not happen, then even with some amount of disruption, I think we are looking at 9.5 - 10% GDP growth.

The house is divided on how to deal with Omicron. Some people are saying that there’s no need to panic, the others are asking to be overcautious to avoid a situation like the second wave. What is your view and do you think a third wave will be as devastating as the first two waves for businesses?

Agarwal: We've learned a lot from the first two waves of the pandemic. Clearly, some things are disrupted more dramatically. For example, the services sector gets impacted right away. Hospitality, tourism and other sectors are going to get hit if there's a third wave despite the learning from the previous waves. The other thing that gets impacted is short-term and mid-term demand because consumers tend to then pull back a little bit and try to save a little bit or the expenditure goes into medical expenses and so on. So, the proportion and basket of expenses tend to shift. This will happen irrespective of the learnings. But what we have learned is that in keeping the industry running, the containment management systems and the vaccination programme have reduced the risk factor quite dramatically. All these will help if there is any successive wave.

Of late we have seen the price of crude oil going up in the international market and inflation is up across the world with even the US struggling. The Indian economy has always been held ransom to the crude oil prices—be it the ’70s, ’90s or even 2008. If the prices go beyond $100 per barrel in future, what is the hedge of the Indian industry against it?

Agarwal: There are two related issues. One is the oil price and one is inflation. Even though the profits are going up, the margins are coming down because inflation is eating into the margins. Inflation also has an impact on commodity prices. So, if prices of other commodities like palm oil or cement go up, that also has an impact on inflation. Over the last several decades, I think our Indian economy has become a lot more resilient, a lot larger than in the ’70s, ’80s to absorb this kind of a shock.

On the question of what happens if crude oil price crosses $100 a barrel, I would say that the high price of crude oil does impact the industry because high fuel prices have an impact on freight and on consumer prices. But we are seeing that prices have already started to moderate, and food inflation has come down, too. The non-food inflation is slightly higher though, but I think it's starting to moderate globally and commodity prices have started to flatten. However, this will be a little bit of a challenge for the next few quarters.

Is there a way that an economy can hedge itself against the rising crude prices in the coming quarters?

Agarwal: Well, the hedge itself is not a direct hedge. The velocity of the economy automatically becomes a hedge because with an increase in the business that's happening and the movement that happens with money, in turn, helps beat that inflation. To some extent, the high fuel prices create an automatic hedge as witnessed in the shift towards renewables. So I think that the momentum is high and that we'll catch up. It is just a matter of time for renewables or alternative energy sources—be it methanol, bio-ethanol, electric vehicles or, at some point, hydrogen—to start delivering in the medium term to long term.

India has set some very aggressive targets for carbon emission cuts. Its impact will actually be felt by the industry also as there will be many rules and regulations that will be coming in to cut the intensity of carbon emission. How prepared is the Indian industry for it?

Agarwal: The fact that climate change is a reality is known to everyone. I think the building of awareness in corporations, companies, industries and businesses in the country is very important and it has picked up a lot. So, I think it's a matter of time that we will all have to adopt electric vehicles. If you are a very heavy polluting industry, then there has to be a support mechanism for climate financing. There would be a need for a concentrated and holistic action between government and industry because there could be some industries that can get negatively impacted. So we have to balance out that impact.

Have you made any proactive presentations to the government on this?

Agarwal: We have various committees that are working with various government agencies because it impacts every single type of industry. It's an ongoing process with the government but with the country chasing the net-zero carbon emissions target by 2070, all industries will now start aligning to that goal. And I guess the action plans will now start originating and getting more and more deeply integrated.

Exports are doing well after two years now but it is largely the demand for raw materials that has gone up for India. Why are we lagging behind in terms of promoting our manufacturing sector?

Agarwal: Merchandise exports have gone up, so it is not necessarily only commodities that are getting exported. We are also seeing good traction for engineering goods. Pharmaceuticals have been doing quite good as well. Merchandise exports have moved away from raw materials which I think is a good sign and should continue. There is a lot of action that's happening on the ground related to exports as there is a clear shift that's starting to happen with China plus one strategy for a lot of corporations of which India is a direct beneficiary.

We are also seeing certain kinds of industries where India is getting more proficient and globally competitive. The PLI (production-linked incentive) scheme is there and that will start building up export competitiveness. So overall, it looks quite good for exports for the next few quarters for sure. And of course, we have to keep recalibrating our policies based on how other nations are working. So if we are working towards certain free trade agreements (FTAs), I think those will definitely help Indian exporters.

But in the past, the FTAs that India negotiated with other nations turned out to be one-sided and the country did not benefit from them.

Agarwal: I think the way we negotiate these FTAs has to be looked at and we have to negotiate from a position of strength versus a position of weakness. If we've made mistakes in the past, we must ensure that we do not make the same mistakes again. I believe selective FTAs with certain nations will be beneficial and we, as ASSOCHAM, feel that will be very important.

China is ceding its exports market and becoming more inward-looking as an economy. The market that should be coming to India is actually being taken over by the likes of Bangladesh, Vietnam, Indonesia and Thailand. How can India meet the challenge from these smaller but more competitive nations in exports?

Agarwal: Our government has launched the PLI scheme that is targeted at addressing these issues of competitiveness. We are still a big call centre hub of the world, we are still amongst the top five nations in terms of textile exports and we are definitely increasing our capacity in all of these areas. The move towards value addition is such that it's not just call centers now but very high levels of service-related exports. Of course, we know our IT exports are doing phenomenally well and like this, the value addition in our exports has started to increase. The fact that we have been able to take some market share from the Chinese companies is very evident as the amount of imports from China has reduced. All of this gives a lot of confidence that the pros are higher than the cons in the exports sector.

If we are competitive, why did Ford Motor, the only company exporting to the US from the India market, shut its business in India?

Agarwal: Ford India had very small capacity. If you see Hyundai and other players, they are exporting in large numbers. Look at the two-wheeler market, the three-wheeler market and the tractor segment—those are doing extremely well in terms of exports. Some of the earthmoving equipment companies are doing very well. So, I think the overall ecosystem has a lot of potential to scale up and we're moving towards high-value exports.