It is that time of the year when employees of most companies start getting requests for declaring their tax-saving investments to their employers. But before doing so, you first need to choose whether you want to opt for the new tax regime or the old tax regime.

The Budget 2020 introduced a new tax regime under Section 115BAC of the Income-tax Act, 1961 that allows individual and Hindu Undivided Family (HUF) taxpayers to pay income tax at lower rates. From the financial year 2020-21, the taxpayer can choose to pay income tax either under the new tax regime or can stick to the old tax regime.

“If you wish to opt for the new tax regime, you will have to inform your employer through the declaration form. The employer will start deducting TDS monthly, accordingly. This declaration will be applicable for the entire financial year 2020-21. Those who do not inform their employer will continue to be taxed as per the old regime,” says Ruchika Bhagat, a chartered accountant and managing director of Neeraj Bhagat & Co., a chartered accountancy firm.

If you are confused about which tax regime to go for, here are three things that can help you make that decision.

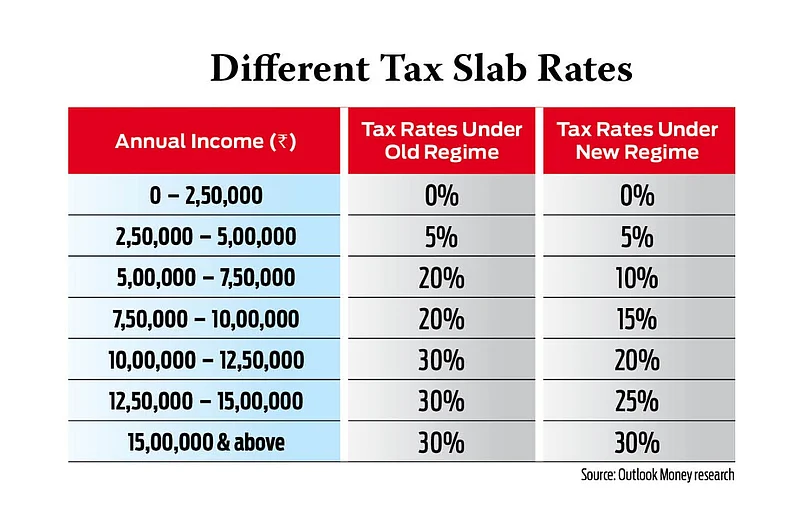

1. Consider The Slab Rates

The major difference between the old and the new tax regimes is the different slab rates.

Individual taxpayers pay income tax based on the slab system they fall under. The tax slab is based on the incomes of individuals. Typically, individuals with a higher income will need to pay more tax.

There is no difference between the tax rates for individuals earning up to Rs 5 lakh per annum. The difference in the rates start showing thereafter. For instance, those with income between Rs 5 lakh and Rs 7.5 lakh per annum, will pay tax at a rate of 10 per cent under the new tax regime against 20 per cent in the old tax regime. Similarly, those earning between Rs 7.5 lakh and Rs 10 lakh would pay tax at the rate of 15 per cent under the new tax regime compared with 20 per cent under the old regime.

The basic tax rate under both the regimes again becomes the same for those earning above Rs 15 lakh per annum.

2. Weigh The Benefits of Tax Deductions And Exemptions

Another major difference between the old tax regime and the new tax regime is the option to reduce tax.

There are no deductions allowed under the new tax regime. “A taxpayer has a lot of options in the old tax regime. While in the new tax regime one can claim zero deductions or exemptions,” says Bhagat.

On the other hand, under the old regime, taxpayers have almost 70 exemptions and deductions to reduce their taxable income. Deductions allow the taxpayers to lower the tax amount by investing, saving or spending on specific items.

The major deductions have been allowed under Sections 80C, 80CCC, 80CCD. Apart, from it one can claim deductions under section 80D, 80DDB, 80E, 80EE, 80G, 80TTA, 80RRB, 80IA, 80IB, 80JJA, 80JJAA, 80LA, 80QQB, 80RRB etc.

Calculate if the exemptions and deductions reduce your tax outgo enough to cover the extra tax rate you are paying before making a decision. Bhagat says that the benefit of the old tax regime or the new tax regime will vary from individual to individual. Only the kind of income and options available to a taxpayer can reveal which one is beneficial to him or her, she adds.

Mostly exemptions are part of one’s salary, like the house rent allowance (HRA) and leave travel allowance (LTA).

“This new tax regime takes away most of the deductions and exemptions otherwise available to the taxpayer. Thus, the taxpayer has to be very cautious and should compare whether his ultimate tax liability would be lower if he opts for the new tax regime,” says Nitin Mohan Kashyap, a chartered accountant associated with Coopers Tax Consulting, a tax consultation firm.

He clarifies how the new tax regime may seem complicated for many.

“People opting for the new tax regime need to prepare two sets of the tax computation to arrive at a decision, which again would be a challenging task for the taxpayer considering the complex tax laws. Again no straight-jacket formula can give a clear distinction between both the options in general, and it depends on case to case basis as to what fits best for a taxpayer,” says Kashyap.

The new tax regime may be mainly beneficial to taxpayers who do not claim deductions and exemptions as tax rates are lower under the new tax regime.