There is now a sinking, morbid and sordid realisation that there are no immediate hopes for national economies across the world. Each one—the powerful US, fragile European countries and would-be superpowers like China and India—will suffer the worst economic disaster in almost a century. Here are the depressing, tsunami-like predictions for 2020:

- The US economy will shrink by negative 6-14 per cent, the worst contraction witnessed in at least eight decades

- China’s growth will be zero in the best-possible case, the lowest since the mid-1970s

- European Union as a whole will witness a growth rate of negative eight per cent; Germany, the UK and France will be the worst hit

- India too can enter negative territory; the last time this happened was a negative 5.2 per cent growth in 1979-80

Policy makers, businesses and consumers across the world are under the dark curse of extreme rational despair. There is a hopelessness about the near future—gloom and doom. Obviously, irrational fears kick into action as they reimagine a ‘new economic world order’. Everyone agrees that things will never be the same again; economies and businesses will undergo major transformations. The only doubt: will the new trends lead to deglobalisation, more globalisation or reglobalisation?

The quick answer: the coming decade—the goring Twenties—will be a combustible mix accelerating past trends and introducing new ones, which will change the economic equation between nations, regions and continents. The new century’s wave of economic nationalism, aided by protectionism, will rise and result in Cold War 2.0 or at least, Cold War 1.5. The attempts to reorganise the existing global chains and enthusiastically adopt technology will catapult us into an era of Industry 5.0 rather than Industry 4.0.

Think Local, Act Local: Rise Of Economic Nationalism

National economic recoveries, i.e., nationalistic interests, will be paramount. Policy makers will insist that goods be made in their respective countries, aim to protect local entrepreneurs, insist on localisation of goods to reduce imports and focus on attracting foreign investment. Nagesh Kumar, Director, South and South-West Asia Office, United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), feels the pandemic will enhance the retreat of globalisation.

Campaigns like America First, Brexit and Make in India will reach fever pitch and spread to other countries. Governments will ensure that local goods are consumed by their citizens. Kumar says, “Rising protectionist tendencies and global trade wars will reconfigure economic geography or patterns of globalisation.” D.K. Srivastava, chief policy advisor, EY India, agrees, “The models of global trade will change over the medium term, i.e., the next three years.” A period of supercharged nationalism will ensue.

Phrases like indigenous production and import substitution, which were popular during the Cold War in planned and socialist economies, will become the flavour of the near future. Listen to how Pankaj M. Munjal, the CMD of the $1.2-billion Hero Motors, describes his future course: “Till last year, we imported 10 per cent of our components and finished products for the Indian, UK and German markets. This will come down to three per cent in the next three years and reduce our annual import bill by Rs 900 crore.”

Obviously, such moves will increase costs as businesses shift to larger onshore models rather than outsourced ones because the latter were largely driven by savings and economies of scale. To dent this, nations will simultaneously woo foreign investment despite the growing nationalism. In fact, economic xenophobia will become the means to do so in a perverted and inverse globalisation. As was the case with Make in India—and now Make in Thailand and Make in Vietnam—nations will want MNCs to invest capital and introduce technology in faraway destinations.

In the past, globalisation was measured by the expansion of MNCs in other countries. With their clout and influence, MNCs acted like mini-governments. Today, globalisation is seen from the lens of the recipients of foreign investments. The receivers of foreign inflows are at the centre of things, the nuclei around which capital revolves. The power of FDI destinations will grow in the near future, as MNCs try to combat the twin pressures of protectionism and localisation.

Decoupling Effect: Disruptive Distribution

Clearly, nations will continue to depend on imports for a long time; everything cannot be made locally. One cannot simply reverse globalisation, which is now a matter of reality, not choice. Ravi Sehgal, chairman, Engineering Export Promotion Council of India, says that if the UK wants to reduce its dependence on imported goods from 90 per cent to 50 per cent, it will take a minimum of three to four years of concerted efforts. And it will be grossly expensive. A few years ago, Apple found that its initiative to make one product solely in the US flopped because of the lack of world-class screws in America.

However, COVID-19 proved the fragility of global supply chains, which, in some cases, were monopolised by countries like China. Nations realised that a medical or any other crisis can break down these global channels and, hence, there is a need for alternate ones. This overdependence on a single distribution chain for supply of components, finished goods and services and sensitive products will undergo a sea change. Henceforth, many governments will insist on at least a second, even a third and fourth, supplier.

Ramesh Arunachalam, a strategy adviser to several nations, explains, “Supply chains were disrupted globally because of the virus. However, having suffered because of the shortages (during the lockdowns), most countries don’t wish to be in the same situation again. Hereafter, there will be no preferred location of suppliers and vendors.” Different nations can adopt different tactics to diversify and minimise the risks. The options will range from complete “reshoring” to multiple supply chains.

Academician Shannon K. O’Neil thinks that smarter nations and businesses will strive to make the global distribution links “redundant” rather than abandon them. Such an approach implies, more vendors, more inventories, more back-up options and strategic stockpiles of critical reserves like oil, medical equipment and minerals. Such redundancies will prove to be extremely expensive, but they will also “increase reliability and resilience, benefitting countries, companies, and consumers alike”.

Some nations, like Thailand, Vietnam and India, which can present themselves as alternative FDI destinations compared to China, will benefit from the decoupling effect and short-term disruptions in distribution. They can turn into the new global vendors. Contrary to expectations, China may not suffer much. According to some studies, “Chinese economy is less dependent on exports as an engine of growth”. Its exports, as a percentage of annual GDP, slipped to 19.5 per cent in 2018, compared to 32.6 per cent a decade ago.

Big Bullies, Maybe Half-Giants: Cold War 2.0 Or 1.5

There are two theories as to what will happen to the global superpower (the US) and aspiring ones (China and Russia) in the post-COVID-19 world. Former Australian Prime Minister Kevin Rudd wrote in a recent article that “China and the United States are both likely to emerge from this crisis significantly diminished”. They will look like giant-size pygmies or half-giants. There will be no Pax Americana, Pax Sinica or Pax Muscovo. Richard Haass, President, Council on Foreign Relations, USA, predicts a “world in even greater disarray”. International anarchy will reign.

Others disagree. In the new confrontation over geopolitics, diplomacy and economics, China, which had lost the plot in early 2020, has bounced back with a winning blueprint. Kurt M. Campbell and Rush Doshi wrote that Beijing moved “quickly and adeptly” to take advantage of the US’s mistakes. The “sheer chutzpah of China’s move is hard to overstate”. In a new world of ever-weakening economies, many more may end up depending on China despite the moves to decouple from it.

A few commentators say the US economy was written off several times in the past and the doomsayers were wrong. In 2010, most predicted that the US wouldn’t recover from the 2008 financial crisis. As writer Fareed Zakaria said, the problem lay more with the “rise of the rest (of the world)”. Contrary to expectations, points out writer Ruchir Sharma, “the United States traversed a full decade (2010s) without suffering a single recession” for the first time in the past 150 years.

Irrespective of whether these powers remain or maintain their global weights, they may act like “big bullies” who leave no stone unturned to discredit their enemies. The battle lines were drawn a few years ago; they will become more permanent. Welcome to a new era—Cold War 2.0, or at least 1.5. Trade, investments and national economic policies will be managed by governments and not dictated by markets.

Industry 5.0: Structural Reforms And Labour Lessons

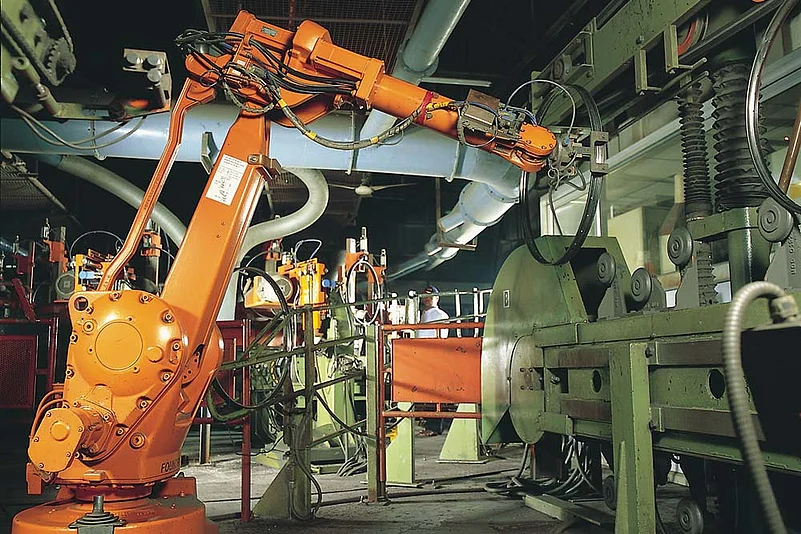

One thing is clear. COVID-19 possibly signifies an end to the age of industrial revolution, which was largely driven by mechanisation, factories and services driven by fuels like coal, oil and renewables. The coming decade will be dominated by automation, robotics, AI, 3D printing and smart techniques that will aid economic nationalism, protectionism and localisation. Technology will help reduce costs and make it worthwhile for nations to locally make more components and finished products.

For example, the textiles sector may revive in Europe as automation takes away the cost advantage of lower wages enjoyed by developing nations like Sri Lanka and Bangladesh. One-time investments in technology will be justified by stable local supplies at competitive costs. If this happens, there will be a paradigm shift or realignment in global manufacturing. Already, manufacturing is on the rise in the US and Germany and others like Japan and South Korea find themselves back in the race.

Another thing is obvious: in the near term, the contours of offices and the organisation of employees will undergo dramatic changes. This is clearly the last stages of a period of regular 9-5 jobs. Post-crisis, nations will seek opportunities to reform and change labour as well as laws that govern it. Some, like India, will hope to please businesses at the expense of labour. Recently several states increased the work hours in factories and made it easier to sack workers and more difficult to form trade unions.

Others, like China, hope to provide more freedom to its workers. At present, millions of Chinese labourers travel huge distances every day from rural peripheries to their places of work in, or nearer to, cities. Beijing wishes to allow them to live in cities. It will be a huge change in mindset for a dictatorship that believed in strict controls over labour. Land reforms in the near future may also lead to migration to urban areas.

For many leaders in developing countries, especially India and China, this is an opportune time to push through relevant structural reforms. While they will give an edge to their economies over the next few years, they will bolster the purchasing power of their respective middle classes. The process began a few years ago. Last year, China reduced and rejigged its taxes to put more money in the hands of consumers to boost local demand. Other countries like the US and India did the same in the recent past.

Such moves are crucial because they will allow nations to reduce dependence on exports and foreign markets, curtail imports or foreign suppliers and enhance economic nationalism through local consumption of domestic goods and services. In the recent past, several export-oriented economies discovered that they need an internal focus. In fact, in the run-up to the next five-year plan to be unveiled in 2021, there is a huge debate in China regarding focusing even more on internal demand at the expense of exports.

These transformations will enable nations to leapfrog from Industry 3.0 to Industry 5.0 and bypass the intermediate stage. But, as one can imagine, it will not result in standalone, independent economic entities. There will be certain dependencies, but of varying and differing natures. Nations will be more independent, at least in crucial areas. Certain redundancies will creep in, specific inefficiencies and crisis-driven risks will vanish. In the new reworked world, economic nationalism will join hands with globalisation. The hyperlocal will aggressively surf over past glocal waves.