Whenthe GST era dawned this month, online jokesters quipped that it was the most inscrutable thing after Duckworth Lewis. But paradoxically, it may have brought a disquieting clarity to another zone of universal experience. Amid the flurry of news reports detailing what would entail a higher tax of 18 per cent, there was the list of banking services. It read like a death roll: withdrawals, deposits, ATM transactions, ordering fresh cheque books, drafts, loan processing, locker charges, NEFT, SMS alerts, what not.

That’s when a lot of people realised what had already crept up on them: beginning this March, without much of a noise, banks had significantly hiked service charges on a range of things, and imposed new ones—like the charges for withdrawals and deposits after a prescribed free number. Trapped without anyone realising it, India’s vast bank customer base—all hundreds of millions of them—were already bleeding from a thousand small cuts.

Some folks, especially those engaged in business and therefore acutely aware of margins, had started feeling it. For Pasha, who has a fish business in Indirapuram near Delhi, the increased bank charges hit like a bolt. He has to withdraw money two to three times every week to pick up his supplies. After four withdrawals from his savings account, his bank charges him a minimum Rs 150 plus tax for each subsequent withdrawal. The number four is illusory too, for each act of deposit or withdrawal counts as one. The corollary: he has had to increase the price of fish to offset the damages.

Another cost-savvy customer, Mani Shekhar Jha, runs his own business in Old Delhi’s Sadar Bazaar, for which he needs to withdraw money several times in a month. Imagine just nine or 10 extra withdrawals each month, at even Rs 50 plus tax each time. His annual outgo on bank charges, he calculates, will be around Rs 6,000-7,000 at this rate.

Businessmen, traders and common people across the country share the predicament, whether they are aware of it or not. Those who are not, especially those brought newly into the banking system, won’t take long to figure the pact they’ve signed on to. The plethora of heavy charges they are subject to since both public sector and private sector banks, in a tightening pincer grip, decided to charge more for deposits and withdrawals not just from ATMs, but also via cash counters. In many cases, banks have reduced the number of free withdrawals. The use of cheque leaves beyond the first 25 issued free too costs money now.

Not that customers could have done much even if they knew—the cartel-like behaviour leaves one with zero choice. There’s, of course, no formal cartel. But private banks like ICICI, HDFC and Axis often work like an informal cartel, raising or reducing rates almost together, in close succession, leaving no room for customers to port their accounts. There are confusing variations in the way banks charge you too. For instance, ICICI has a complicated grid: Rs 5 for every Rs 1,000 you withdraw/deposit after the first four free times in your own branch, and a single free time in a different branch. That is, withdraw a lakh beyond the free quota in a month, and it costs Rs 500—that’s Rs 6,000 annually.

While the Reserve Bank of India (RBI) talks of porting, it’s far from reality now. Says Harsh Roongta, CEO, ApnaPaisa, “The regulator is doing tokenism. Porting is not easy as banks act as a cartel. The charges are the same everywhere.” Again, the variations make it seem different. SBI charges only Rs 50 plus tax for extra withdrawals from a savings account (but have only three free) and some, like Bank of Maharashtra, haven’t budged yet and are waiting and watching. In general, the graph moves the same way.

“RBI has deregulated bank charges, but as we move towards greater digitisation, costs of handling, transportation, safe keeping and dispensing of cash—internalised by the banks so far—are being made more explicit in terms of service charges,” says a senior finance ministry official. According to an SBI official, “Our charges are not high compared to the private sector banks. Some have been reintroduced.”

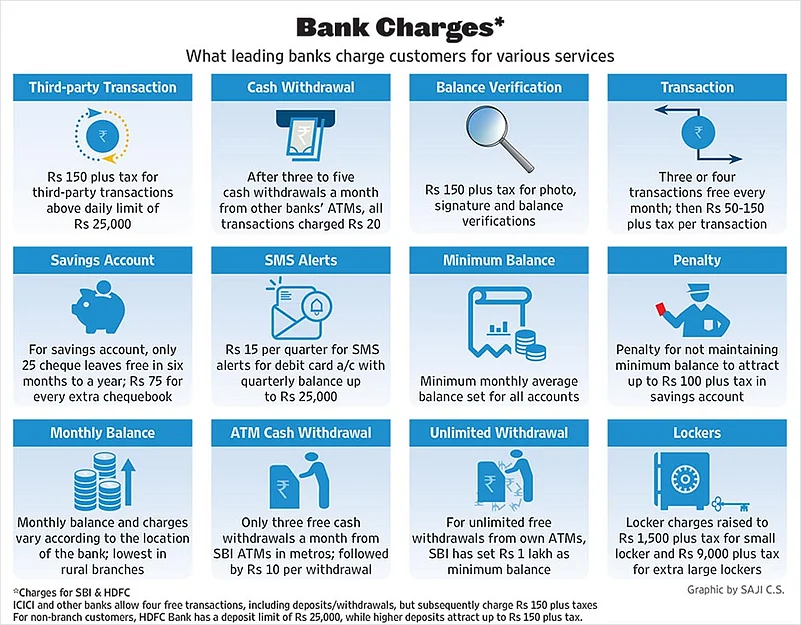

Banks, though, are not exactly transparent about these moves and, in most cases, customers have no inkling—they get to know only after being charged. (For the full panoply of charges, see graphic.) On top of that, rules have been put in that would make the new charges kick in more frequently. Most banks have increased their minimum balance requirement, forcing customers to lock up money in their accounts—especially vexing for people with multiple accounts. Worse, they have started imposing charges or hinting at doing so on accounts that had hitherto been free of charges (SBI, for instance, charges up to Rs 100 plus tax depending on the degree to which you dip below the minimum in metros.) Rather perversely, even Jan Dhan account holders are being informally ‘advised’ to maintain a minimum of Rs 1,000 in their accounts from March. A housemaid’s basic account in Delhi, for INStance, had been cleaned of its savings for failing to maintain this when her daughter went to check after her demise.

The government and the RBI have turned a blind eye to all this. And their silence on people’s pleas on this front is now triggering protests from informed citizens who say banks are fleecing customers to shore up their profits so as to offset the dead weight of their non-performing assets (NPAs). A campaign by the non-profit Moneylife Foundation—in the form of a citizen’s petition on change.org to RBI—has elicited a huge response from people across the country, with over 2.4 lakh signatures. At the time of going to press, RBI had not responded to Outlook’s queries on this.

Beyond this popular veto, the Moneylife Foundation campaign also has the support of all nine bank unions, with over eight lakh employees—a national bank strike called for August 22 shows the sharpening focus on the whole complex of issues pertaining to the banking sector. The new charges are central to this. The strikers are set against what they call “anti-people bank reforms”—essentially an argument against privatisation, mergers and, most importantly, against letting wilful corporate defaulters off the hook. The unions demand criminal action, and say corporate bad loans must be recovered and not written off. It’s this burden that banks are blithely passing on to small customers, they say, calling it a monumental rip-off. A white paper by online consumer group LocalCircles reveals 70 per cent consumers want cash transaction and debit card fee withdrawn, and credit card charges slashed to 0.5 per cent.

Uncommonly, this time, the strike has the support of leading consumer organisations, finance experts and lawyers—proof of the wide convergence of interests and points of view. The Moneylife Foundation is now carrying out a Twitter campaign to bring the central issue to the notice of Prime Minister Narendra Modi and the RBI. Among the lines in support of the TweetMorcha organised by Moneylife Foundation is: “Paying for our own cash? Is this what we get for going cashless?”

Says Jha, the Sadar Bazaar businessman: “Banks have limited the amount one can withdraw from an own bank branch ATM to Rs 25,000, and Rs 10,000 from other bank ATMs. So people in business are forced to withdraw several times beyond free limits, or go to a branch where too you are charged heavily after four transactions. They have closed all routes for us and trapped us. Now we pay for everything we do with a bank.”

The anger is legitimate. Says Gautam Mody, general secretary of New Trade Union Initiative (NTUI): “There’s a fundamental problem with this unearned income. Banks are making money out of non-banking business. This is entirely uncalled for. Banks are burdened with large NPAs and saddled with large deposits in a poor investment climate. They are not able to make money, so they are charging customers. They have not been transparent about this.”

Corporate debt does leave behind a scene of massacre. The total NPAs of the 21 PSU banks is Rs 6.06 lakh crore, with SBI alone accounting for Rs 1.12 lakh crore—a figure that’s about 10 times its net profit of Rs 10,484 crore last year! As for losses, IDBI Bank led with a net loss of Rs 5,158 crore last year, followed by Indian Overseas Bank (Rs 3,417 crore) and Central Bank of India (Rs 2,439 crore). Altogether eight PSU banks have been haemorrhaging due to NPAs, including Bank of India (Rs 1,558 crore), Bank of Maharashtra (Rs 1,373 crore) and Oriental Bank of India (Rs 1,094 crore).

Another twist of the knife: cash or currency availability in the banking system is 25 per cent less than desirable post-demonetisation. The cash shortage at ATMs means people are forced to do their transactions in bank branches, where these new costs have crept in. While the government is pushing people towards digital transactions, where the charges have not increased, it’s a fallacy to talk of a big shift to cashless transaction. Not many in business today use digital transactions for business as India still remains primarily a cash economy. It’s also a cruel irony that all this comes while the government is pushing people to adopt banking—what could be a bigger disincentive than making people pay more for handling their own money? Though these charges don’t apply on Jan Dhan accounts, few banks today are ready to open these no-frill accounts.

But there’s more. Just like there’s a clear link to corporate debt at one end, at the other the Jan Dhan scheme too has added to the burden that’s being palmed off to the common citizen. SBI chairperson Arundhati Bhattacharya recently said the new minimum balance rules were put in to offset the costs incurred on Jan Dhan accounts. This means ordinary customers’ pockets are being picked to pay for a social scheme launched by the government, which rightfully only the government should account for.

Also, when the government recapitalises banks, it’s taxpayers’ money that goes through the exchequer. That means the average tax-paying Indian is paying three times over for bad banking, bad loans and for enriching private banks: 1) higher charges; 2) recapitalisation through the exchequer; and 3) our regular tax—remember, even fixed deposits are taxable.

Bank protagonists, naturally, have rationalisations ready. Says former SBI chairman Pratip Chaudhuri, “These charges are necessary for banks to cover their costs…bank charges have been commensurate with the costs they incur. If customers find them high, they are free to go to banks that charge less.” This view is echoed by most bank chiefs and top executives who feel costs have to be recovered.

Animesh Chauhan, who retired as CEO and MD of the Oriental Bank of Commerce, says leaving aside Jan Dhan accounts, all others come with additional services like SMS, facilities of call back, etc. “Somehow the banks have to recover the costs of operations and services. These charges are not excessive, nor do they help wipe out the corporate bad loans,” adds Chauhan. “They are for recovering costs and overheads, not for making profits. In India, the charges have been lower than they are globally, as elsewhere they try to recover every expense.”

Experts, however, say the interest banks earn from their deposits not just compensates for their costs, but also helps them earn profits. “The bank charges are not justified at all. CASA deposits (current accounts/ savings accounts) are the most profitable segment for them. On an average, Indian banks earn a spread of six per cent on these, which is the highest in the world,” says Sucheta Dalal, Founder Trustee of Moneylife Foundation and the brain behind the petition and campaign.

“Banks lend at over 11 per cent, while savings interest is just four per cent. This should cover all costs incurred on behalf of customers and more,” she adds. “The worst exploitation is in the case of home loan borrowers, where banks seem to have RBI’s sanction to fleece customers on floating rate notes.”

Dalal sees no ambiguity: banks are extorting money from customers, she says. Public sector ones are using it to make up for their bad loans and NPAs. And private banks, following the same strategy, have become stupendously profitable and it shows in their salaries to senior executives, advertisement outlays, profits and share price. According to Moneylife’s petition, over the years, the RBI has remained silent on several anti-depositor actions of banks. The Banking Ombudsman’s rulings also tend to side with banks.

Ashok Rawat, consumer activist and former honorary secretary, All India Bank Depositors Association, too calls for RBI intervention. He says banks must be made to use their interest earnings for servicing CASA customers—their major (and cheapest) source of funds—instead of freely raising charges in the name of liberalisation. Banks tend to have captive customers, as people don’t keep changing banks on a whim, he says. It’s therefore the duty of the regulator to protect depositors’ interests.

“You can’t start charging for every small service. In the long run, that will be detrimental to the banking system and also self-defeating as far as the national goal of financial inclusion is concerned. People will get wary and rethink the advisability of keeping money in the bank. They may opt to operate by cash, which helps them get discounts,” Rawat says.

Theory apart, the quantum of charges itself is far too high for anyone to accept. Rs 150 plus taxes, as announced by HDFC, or variations thereof with ICICI and Axis, for every extra transaction after four in a month is absurd for smaller transactions of between Rs 500-1000, which is normal at the retail customer level. Says Lalita Joshi, joint secretary, All India Bank Employees Association (AIBEA), “It’s exorbitant. Earlier the charges were on operational costs and were fine. But now it’s unjustified. The banks are passing on the burden of bad loans they are saddled with onto the common man. The charges should be nominal; the aim should not be to make a profit from them.”

The Foundation’s petition calls attention to the unethical means by which this operates, like billing customers by stealth with opt-out clauses in fine print. For instance, HDFC Bank started levying charges for an invite-only program, which unilaterally assumes the customer is in and willing to pay for it. The levy is stopped only when the customer notices it and calls the bank to protest, which is no easy process. Banks also have one-sided terms and conditions in their agreements, with details buried in fine print that bleed customers. The RBI must draw up a basic model agreement that bars bankers from harming customers, the Foundation’s petition adds.

An HDFC Bank spokesperson, however, says, “There is no stealth in the opt-out option. The program offers the services free for one year and customers are provided adequate information on the services they enjoy and the charges.”

Says Vishwas Utagi, bank employees leader, “Banks are turning away small depositors. The hardest hit are pensioners who get just Rs 5,000 per month but have to maintain Rs 5,000 as balance. The charges were initially introduced when new technology was being deployed, and for the last 10 years there had been little or no change in them. This is absolutely wrong.”

Says Bapoo Malcolm, lawyer and signatory to the Moneylife petition, “No sane person wants to pay more. But the banks are a monopoly. The first step is prevention of cartelisation. Let each bank set its rates in perfect competition. Public sector charges must be in sync with their costs and efficiency. That data must be made public. Loss-making CEOs and MDs must be replaced. That will put an end to indiscriminate lending, aka political padding and corrupt loans. New accounts must come with warnings of specified escalations. Older accounts must be treated as sacrosanct contracts, not to be violated.”

C.H. Venkatachalam, general secretary, AIBEA, fills out the data: “Bad loans account for Rs 13 lakh crore, on which banks are losing an average 10 per cent or Rs 1.30 lakh crore every year as revenue. This is what’s being compensated. The increase in services charges is 20-100 per cent in some cases. It’s like robbing Peter to pay Paul.” The estimated Rs 13 lakh crore includes Rs 6.06 lakh crore NPAs of 21 PSU banks and Rs 78,991 crore of nine private sector banks as of March 2017. “The remaining are the NPAs shown as performing loans through corporate debt restructuring,” says Venkatachalam. With the RBI having directed banks to come clean on loans with no returns, greater clarity on NPAs is expected.

The banks counter that they cannot segmentise services to calculate losses in certain types of services and transactions, like cheque clearance. It’s just like banks give higher interest for fixed deposits as compared to savings accounts and charge varying interest on loans. For instance, housing loans go at around 9-10 per cent interest, commercial borrowings at around 12 per cent, and farm loans at an average 4 per cent. With loans for infrastructure projects, there is a gestation period varying from 5-25 years before the interest becomes payable. Education loans too have that gap.

The Foundation points out that for all the much-touted digital push, global best practices to protect consumers have not been adopted. On August 11, 2016, the RBI issued a draft circular on limiting customer liability and shifting the onus of proving customer fault on banks—and sought public feedback before August 31, 2016. However, it has not yet been converted into a Master Circular.

So what’s the way out? The Foundation wants a rollback. The NTUI suggests a graded system with charges set according to a person’s income and deposit in a bank. The real solution may be somewhere in between: where the charges cover the banks’ operational costs and also do not put a burden on customers. But the Centre and RBI must decide soon before the movement gathers a momentum that’s difficult to control.

By Arindam Mukherjee & Lola Nayar