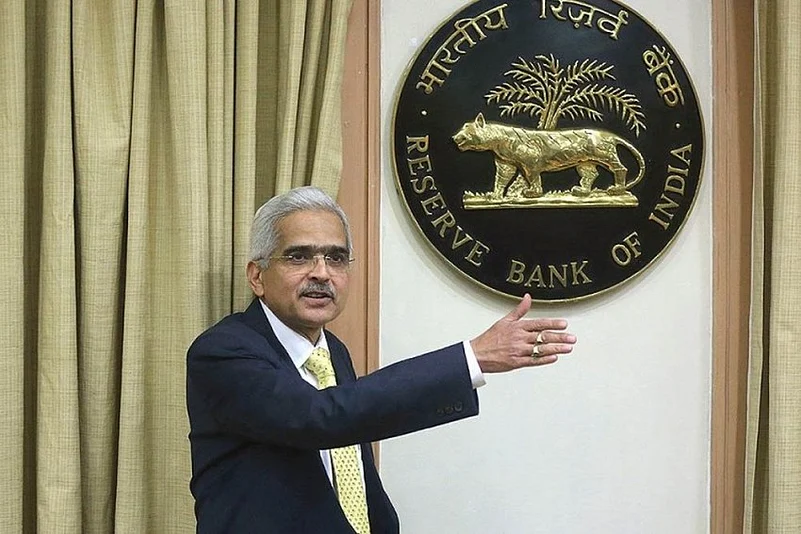

Addressing the digital divide triggered by the pandemic would be one of the major challenges in the post-Covid world, said Reserve Bank of India (RBI) governor Shaktikanta Das. He was giving the keynote address at the 48th National Management Convention of the All India Management Association (AIMA). The RBI Governor said, that though greater automation leads to overall productivity gain, however, it has the potential to create a slack in the labour market. The situation, therefore, calls for significant training of the workforce.

The pandemic inflicted severe damage to daily wagers, poor and vulnerable especially in emerging and developing economies. The central bank chief said this is of serious concern for inclusive growth. "In the medium to long-run, both efficiency and equity will greatly matter for sustainable growth and macroeconomic performance," he added.

"The pandemic induced several structural changes"

The governor said the pandemic altered significantly the way we work, live and organize businesses. With increaed transition to working from home, technology has helped boost productivity, saved up on travel time, spurt sales on online platforms and accelerated the pace of automation. Consumption patterns are now changing and companies are resetting their supply chains both globally as well as locally. These changes will have wider ramifications for the economy.

Automation and robotics would particularly threaten low-skilled workers and those in contact-intensive industries. "The shift to online has created new opportunities and challenges for employment-intensive sectors like travel, hotels, restaurants and recreation. Some of these changes are going to stay beyond the pandemic. These structural changes need to be kept in mind while formulating strategies for participative growth process," said the RBI governor.

Growing league of unicorns

Information Technology (IT) and IT-based services backed by entrepreneurial capabilities and innovations have emerged as the key strength of the Indian economy over the years, the governor stated. "There is a growing league of unicorns in India reflecting its potential for technology-led growth," he said.

According to him, the underpenetrated Indian markets and large IT talent pool provide an unprecedented growth opportunity for new age firms.

Trade and Production

Das said investors had shown confidence in the Production Linked Incentive (PLI) Schemes announced by the government. He added that India is now home to almost all the leading global mobile phone manufacturers and has transitioned from being an importer to an exporter of mobile phones recently. The RBI chief suggests the trend is likely to spill over to other sectors also.

"The presence of global players would help in enhancing India’s share in Global Value Chain (GVC) and building up a resilient supply chain network. Greater GVC participation would also enhance the competitiveness of India’s large and Micro, Small and Medium Enterprise (MSME) supplier base," he said.

In the post-pandemic world, trade would be of utmost significance for, suggests the RBI chief. Reflecting congenial policy environment and supportive external demand, the country's exports have rebounded. "To further strengthen the export potential, there is a need to enhance the share of high-tech engineering exports to achieve an ambitious engineering export target of US$ 200 billion by 2030"

Non-Banking Channels

The RBI chief said assets of non-banking financial institutions like NBFCs and mutual funds have been growing. Funding through market instruments like corporate bonds have also been increasing. According to him, this reflects a steadily maturing financial system which is moving from a bank-dominated financial system to a hybrid one.

Infrastructural push neccessary

Das said in order to achieve the objectives in all these areas, necessitates a sizeable push to infrastructure particularly in health, education, low carbon and digital economy in addition to to transport and communication.

The warehouse and suppy-chain infrastructure too would be critical. This would help create employment opportunities in semi-urban and rural areas and promote inclusive growth, according to the governor.