The bad loans of Indian banks has hit a record high of Rs 95,00,00,00,00,000 or $145.56 billion at the end of June.

Reuters says that a review of the Reserve Bank of India’s unpublished data through an RTI query has revealed that loans, which included non-performing and restructured loans, rose by 4.5 percent in the past six months.

At a time when the country is going through an economic downturn, the debts have reportedly forced banks to reduce lending, especially to smaller enterprises.

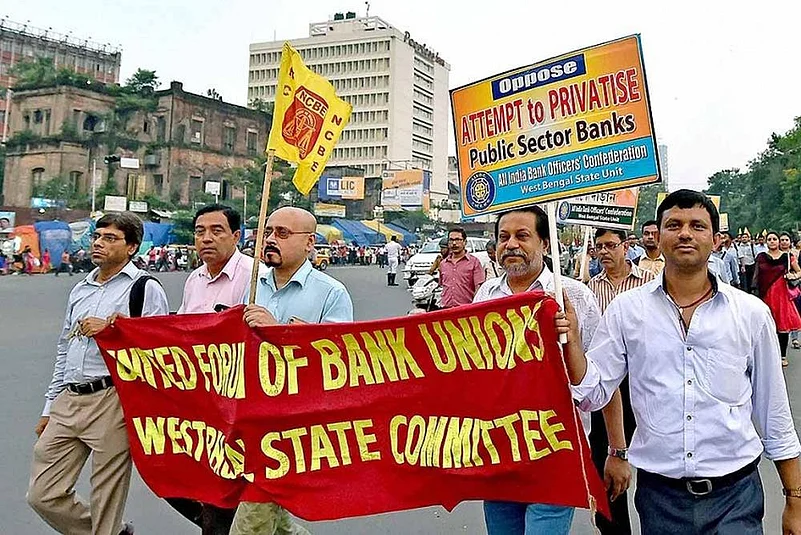

Most of the debt comes from public sector banks with banking unionstaking umbrage.

Yesterday, a union of bank employees from Hyderabad asked the Centre to order an investigation into the top 100 NPA account holders.

The probe in these accounts should be carried out by the Serious Fraud Investigation Office (SFIO) or any other competent agency, the Bank Employees' Federation of India (BEFI) said.

The non-performing assets (NPAs) of the public sector banks have increased to about Rs 8 lakh crore, of which 89 per cent pertains to corporate accounts, the BEFI (Andhra Pradesh and Telangana) said in a statement.

"We demand that Government of India institute a thorough investigation by the SFIO or any other agency into the affairs of top 100 NPA account holders, take all necessary steps to recover the bank dues, declare the names of corporate defaulters and save the public sector banks, taxpayers money and the Indian economy," the union said.

Most of the loans to corporates, which later became NPAs, were sanctioned by corporate offices and the boards of individual banks, it alleged.

Close to three weeks ago, Finance Minister Arun Jaitley had addressed the problem at the Indian Banks Association's annual general meeting on September 22.

"The government certainly stands one with the banking system. Whatever steps that are required to be taken to find a resolution to this problem (of stressed assets), we will expeditiously work with India's banking system in order to strengthen it," he had said.

The Centre is working towards strengthening its ability to support the banks through greater resource mobilisation, Jaitley was quoted saying then.

With Agency Inputs