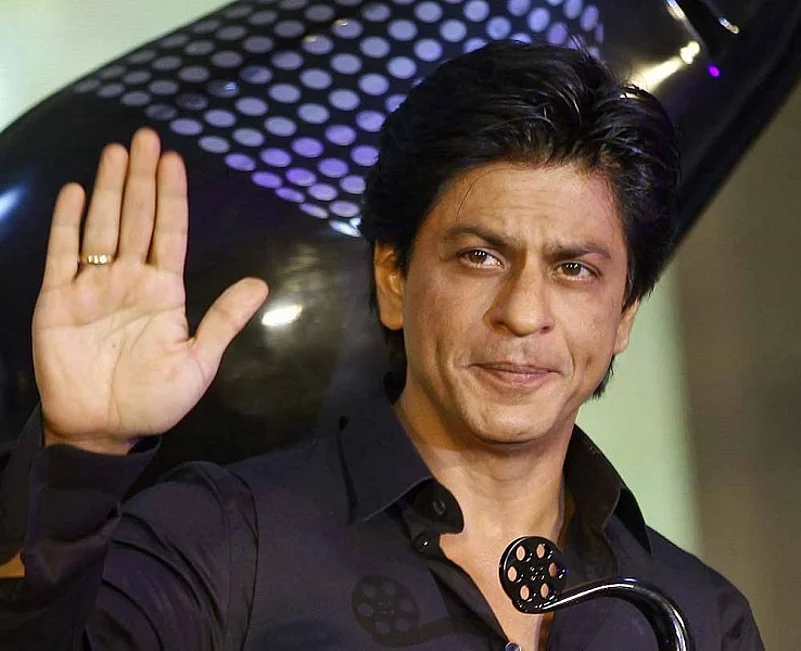

The Income Tax department has provisionally attached actor Shah Rukh Khan's farmhouse in Alibaug under the Prohibition of Benami Propert Transactions (PBPT) Act.

According to a Business Standard report, Khan allegedly purchased the agricultural land via Déjà Vu Farms, but instead he constructed a farmhouse for personal use. Shah Rukh Khan's father-in-law Ramesh Chibba, mother-in-law Savita Chibba and her sister-in-law Namita Chibba are directors of Deja Vu Farms.

The Alibaug farmhouse in news, according to the tax department, is a luxury property--spread over 19,960 sq metres and has amenities such as a swimming pool, beach and a private helipad. Its circle rate is Rs 146.7 crore, however, the BS report added that the market price would at least be five times more.

Till date, according to the investigation report, the farm has not been able to show any agricultural income as is demanded in such cases. The only source of income of the farm was by way of the loan advanced by Khan to his company, which ultimately was owned by the actor himself.

"The said transaction falls under the definition of benami transaction as per the Section 2 (9) of the PBPT Act, where Déjà Vu Farms has acted as benamidar for the ultimate benefits of Khan. Thus, the actor is a beneficiary for the said under the prescribed law," said I-T investigation report accessed by the newspaper.

The issue came under the tax department's scanner after Raigad District Collector Vijay Suryawanshi said last year that a bungalow purportedly owned by the actor was among 87 properties on which his office had sought legal opinion so that it could take action for coastal regulatory zone violations.

A complaintwas also filed at a Mumbai police station alleging that Khan had violated the Maharashtra Tenancy and Agricultural Lands Act — that bars transfer of agriculture land to a non-agriculturist without the permission of the collector or state government.

The Benami Transactions (Prohibition) Amendment Act, 2016 spells out rigorous imprisonment of up to seven years, and a fine which may extend to 25 per cent of the fair market value of the benami property.

What is a benami property? Benami, which means property without a name, is the person who pays for the property does not buys it under his/her own name. The person on whose name the property has been purchased is called the benamdar and the property so purchased is called the benami property. The person who finances the deal is the real owner.

“Property held in the name of spouse or child for which the amount is paid out of known sources of income b) A joint property with brother, sister or other relatives for which the amount is paid out of known sources of income c) Property held by someone in a fiduciary capacityThis means, by law, if you buy a property in name of your parents, too, can be declared as benami.”