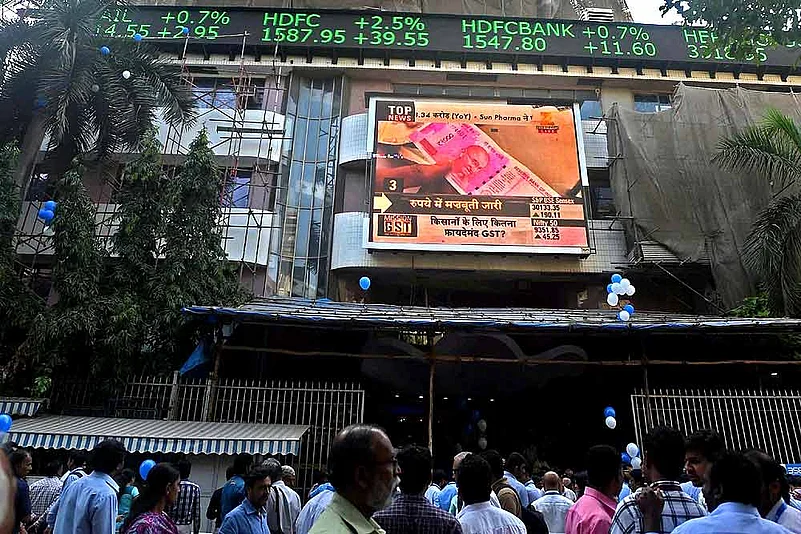

That bull at Dalal Street has been on a rampage. In the last few weeks, there has been nothing but cheer from the stock markets. The benchmark Bombay Stock Exchange Sensex has crossed the hitherto unprecedented level of 31,000 and the National Stock Exchange, NIFTY, is tantalisingly close to another unprecedented level of 10,000. At the time of going to the press, the sensex was well poised at 31,145 and the NIFTY at above 9,600.

Pushed by political and economic stability and a government that is showing strong intent to work coupled with a resolve to take the reforms process further, there is a lot of optimism in the market. This has brought back domestic investors, both retail and institutional, into the market, which has made it both robust and widespread.

What is heartening for investors is that the upward move has not rested yet and that the bull run will continue. Experts believe the market will rise further, at least in the short term. Goldman Sachs has predicted that the Nifty will cross the landmark of 10,000 by next year. Going by the current run, that might happen within this year itself. The sensex crossed the landmark of 25,000 in June 2014, soon after Modi’s ascension to power. In January it was at 27,600 and last week it went beyond 31,000 and is looking at 35,000. The last time it crossed 29,000 was in September 2016.

There has been more cheer with the news that monsoons have already hit the Kerala coast, which is expected to boost sentiments further and reflect in the markets in the coming months. Add to the fact that oil prices have remained subdued for the last two months and the Indian rupee has been strengthening steadily against the dollar, which is adding to the confidence of investors.

“India continues to do well riding on good liquidity,” says Andrew Holland, CEO Avendus Capital Alternate Strategies. “The risk that people saw on account of Trump and other factors has disappeared. The economy has stabilised and sentiments are up post UP elections. GST is certain from July and there is no uncertainty of any kind. The reform process has continued, and that is what the investors are liking. In fact, investors in India are already thinking ahead on whether Modi will come back in 2019,” he says.

One of the reasons for investor optimism was the rather positive proposals in the Union Budget 2017, which stood for fiscal disciple and inflation control. The budget announcement of fiscal deficit control created an impression that fiscal consolidation was intact. Immediately after the Budget, the BSE Sensex rose by 486 points. That winning spree has not dipped since then and the sensex has been gaining steadily. Add to that the clearance of the GST bills by Parliament which gave a signal that the government was serious about reforms. Along with this, the intent to clear other pending bills like taxation laws amendment, the National Commission for Backward classes Bill and the Nabard Bill are all radiating positive signs.

“Something is happening in the economy. There is unprecedented optimism despite no clear result being visible yet from the government measures,” says stock market expert and CEO, Value Research, Dhirendra Kumar. “We have a functional government. It fixed its own fiscal deficit, controlled the oil subsidy knocking off Rs 70-80,000 crore from its liability, and focused on inflation targeting. People are deriving optimism from this,” he adds.

Kumar believes the other significant development is the entry of the Employees’ Provident Fund Organisation into the market. In the last few months, the amount of incremental EPFO money going into the stock market has increased from five per cent to 15 per cent. According to rough estimates, about Rs 6,500 crore come into the market every month. Of this, Rs 2,000 crore are accounted for by insurance companies and EPFO. The remaining is coming from domestic and foreign investors though foreign investors are not as aggressive now as domestic investors.

There is another important reason for the markets to become buoyant. The Indian retail investors, who have been missing in the previous market rallies, have returned to the market. If the previous market rallies of 2007-08 were pushed by Foreign Institutional Investors (FIIs) alone, this time it is because of domestic retail investors and domestic institutional investors.

Jignesh Shah, registered investment advisor with Capital Advisors explains, “The two asset classes that worked before, have not performed now. Gold has remained around the same level and real estate has not gained in liquidity. With the economy stabilised and growing at a decent pace and with no other avenue to invest, the money is flowing into equity.” With the Real Estate Regulation and Development Act (RERA), 2016, kicking in, real estate investment opportunities have largely disappeared. That money is coming into the markets. Also, with fixed deposit interests coming down significantly, it has put old people in a difficulty forcing them to look at equity.

Of course FIIs and foreign portfolio investments have been active too. The first four months of this calendar year have seen significant activity from FIIs and portfolio investors. In fact, March has seen an exceptional amount of exposure of FIIs and portfolio investors have pumped in over Rs 31,300 crore into the stock markets.

However, most analysts feel that GST, which will come into force from July 1, could be a dampener in the great Bull Run and may cause disruption in the growth that the markets are seeing. They feel that though in the long run GST will be beneficial for the industry and economy, the initial phase could be difficult and was certain to affect the growth in the stock markets. “The immediate impact of GST will be negative. It will disrupt the market for at least three to six months,” says Holland.

So will the market grow beyond its current levels? Analysts are treading with caution but feel that there is scope to grow further. “Stock markets should grow at 15 per cent a year if interest rates remain steady,” says Kumar. “But from a level of 20,000 in January 2008, the sensex has grown by under 10 per cent till date despite interest rates remaining more or less stable. I would not be surprised if the market grows to 60,000 in the next 5 years provided company earnings go up proportionately.”

However, company earnings have not shown cheer and the last quarter results too have been largely subdued. Shah agrees and feels that with six to seven per cent GDP growth and inflation at four per cent and with a large number of industries working at 60-70 per cent capacity utilisation, there was room for companies to improve earnings in the coming months. If they improve, market valuations, which are too high now, will also not look very costly, he says.

The market is being pushed by mid caps and small caps while large caps have been less active in the market. Analysts feel that the small caps and mid caps have grown to a level that looks unreasonable. They are operating at a PE of 50 and 100 which is not reflecting in the sensex. In fact, most BSE 500 companies are operating at very high PE, which the sensex is not showing. And they are expected to continue at this rate.

One thing is certain. With the economy poised for further growth and monsoons scheduled to repeat last year’s good run, more good news is expected to come from the stock markets. The bright spot is that domestic retail and institutional investors are firmly in control of the market, and with mid caps and small caps active, the indices are certain to touch new highs soon.