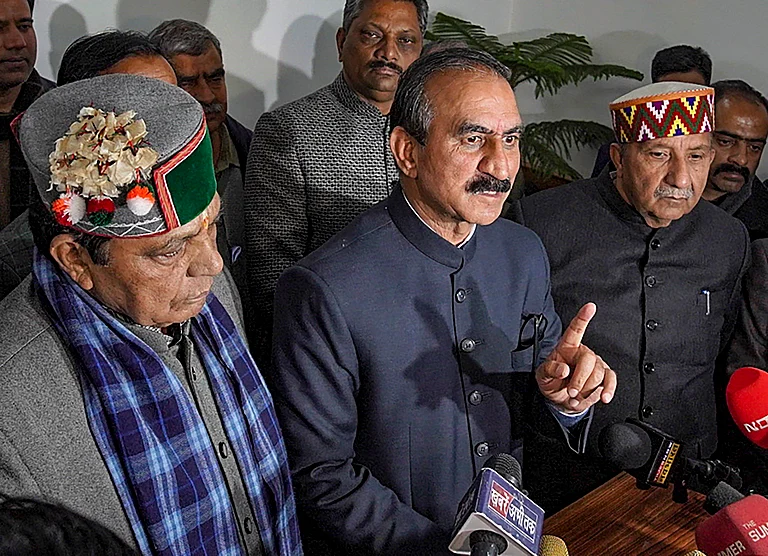

He moves fast. Parliament had scarcely cleared the New Telecom Policy last autumn that Sunil Mittal was on the prowl. Within weeks, hed scooped up JT Mobile, the cellular service provider in Karnataka and Andhra Pradesh, for Rs 400 crore. The ink hadnt even dried on that agreement when he was busy finalising another to buy out SkyCell, Chennais cellular provider, for Rs 125 crore. From the time the Bharti group thought of acquisitions in the south, to their completion, it took only one-and-a-half months. And earlier this month, Mittal threw the isp world into a tizzy when he began offering free Mantra Online connections to Airtel phone owners in Madhya Pradesh. Theres more to come. "Our next move will be acquisitions and greenfield projects in western India. That way well be covering most of the country," says Mittal, chairman of the Rs 1,000-crore Bharti group.

Telecom is the only game he knows, and thats how he plays it. Fast and with passion. "The earth moves below your feet every day. You have to keep pace," says the 42-year-old who wants to rule Indian telecom. Just how does he plan to do it? "We have everything but a listing on a stock exchange. I need the stock as a currency for further growth. We are a solid story, not one of those fluffy dotcom valuations." Indeed, it isnt. His Delhi cellular operations alone are worth $400 million.

So, while Ludhiana might be a long distance from NASDAQ in the US, thats where this Ludhiana lad, with a "plain-vanilla BA degree", is going to be in a few months from now. Try this for size, and also for what this listing will mean for his telecom companies. The group plans to raise $150-200 million on the NASDAQ. Simultaneously, its foreign partners will be investing an equivalent amount in the group. With close to $400 million in equity, his companies have the potential to leverage another $600 million in debt. Thatll give it a war chest of close to a billion dollars. Whats it that gives him this awesome confidence? "We are Indias largest private sector telecom player. We have an unparalleled telecom footprint in India, covering Himachal Pradesh, Delhi, MP, Karnataka, Andhra and Chennai. Theres no story like ours in Asia today," says he.

Empty bluster? Not at all. The states that he has just mentioned account for 33 per cent of Indias total telecom spend. After the state-owned telecom monoliths, the Bharti group is by far the largest telecom player in the business with close to 4 lakh customers for both phone and Internet services. This month, Bhartis Delhi cellular circle will be the first private sector telecom player in the country to wipe out all accumulated losses. Today, his group has investments of over Rs 2,000 crore on the ground, enabling itself to offer a complete range of telecom solutions, ranging from the manufacture of cables, telephone instruments, v-sats, Internet services, telecom software, to cellular and basic services.

The industry seems to repose trust in his confidence. Says an investment banker involved with the telecom sector: "For an ipo, you need to show size. No other Indian company has that. Nobody looks at turnover on the NASDAQ, its a size game. Itll be easy for him to sell the story of the largest private telecom player in India." Adds the chief of a rival telecom group: "Bharti will be the first Indian telecom company to list on the NASDAQ. I believe the NASDAQ has a demand for about $500 million of Indian telecom paper. Mittal wont find it difficult to raise the money."

Right now, Mittal is deciding which company to make public. One option is Bharti Telecom, the holding company for his operating companies (see chart). His family company - Bharti Enterprises - owns a 95 per cent stake in this company, so the opportunity to dilute stake is greater. But Bharti Telecom is two steps removed from operating companies, and the more the distance from operations, the less the valuation the ipo will receive. So, the bet is Bharti Televentures, in which Bharti Telecom owns a 61 per cent stake, will be the one to go on NASDAQ. "We can raise 20 per cent in Bharti Televentures and still give Bharti Telecom a 51 per cent stake," says he.

But just how is Mittal where he is? To begin with, hes one man who has stood conventional Indian telecom wisdom on its head. While Indian telecom has been a whining story for the past five years, Mittal is the only person who hasnt wasted time. When every Indian business group jumped headlong into telecom and bid huge licence fees, Mittal was content with lower fees and stuck to MP for basic services, and Delhi and Himachal for cellular phones. Where virtually every second Indian telecom company has fallen out with its foreign collaborators, Mittals partners are actually hiking stakes and pumping in more money into his ventures. Where everybody struggled to stay afloat, Mittal has been creating value.

How has he managed this? "Telecom is 80 per cent finance and 20 per cent technology," says Mittal, who has used a two-pronged approach to finance his telecom ventures. Most important, he has kept costs low. It cost him Rs 315 crore to set up his Delhi cellular operations. In contrast, industry sources say, it cost rival Essar Cellphone Rs 450 crore. Thats because he has avoided vendor finance, which is one of the most expensive financing options. "I wont go for vendor financing because my project is viable. I would rather ask for a discount. Vendor financing is most expensive, but it cant be identified because it is built into the cost of equipment," says he.

That gives his foreign partners confidence, and all his ventures are in collaboration with foreign partners, who bring in the money and technology. In Delhi, British Telecom owns 44 per cent of Bharti Cellular, while Telecom Italia paid $90 million for 30.2 per cent of Bharti Telenet, the operating company for MP and Himachal. The strength of his projects and the brand of the foreign partner have allowed Mittal to raise one of the lowest-cost short-term loans in the industry. This money is then used to build assets on the ground. "And as you spend time in the business, the risks reduce and you can get better refinance opportunities," says an investment banker. So, not only can Mittal use the ipo money to acquire fresh assets, it can also be used to retire old debt.

But the key to all this is keeping foreign partners happy. Thats what others in the telecom business and many Indian industrialists havent managed. "The key to this is transparency," says Akhil Gupta, group director, finance and corporate affairs. Every report sent by an operating company to the Bharti group headquarters goes to the foreign partners involved with the project. Budgets and targets for each project are approved by the foreign partner concerned, and then its left to the operating team, which reports as much to the Bharti group as it does to a foreign partner.

Next comes honesty. "Im well aware of the habit Indian promoters have of dipping their hands into the companies tills. I stopped signing cheques 10 years ago. Plus, I havent sold even one of my shares to a foreign partner. Its all been issue of fresh equity," says Mittal. Due to this, the money that foreign partners bring in goes to the company and not to Mittals coffers.

Besides, what impresses most foreign partners is his focus. "We breathe, eat and drink telecom. No other Indian group is as focused. So we understand the sector better than anyone, and since telecom is our only priority, decisions happen faster," says Mittal. Another factor is his willingness to take a smaller piece of a larger pie, rather than keep a big pie for himself.

If anything, Mittal is looking to reduce the number of foreign partners in his consortium. The acquisitions of JT Mobile and SkyCell bring with it about four new foreign partners. "We want to restrict ourselves to three or four partners. One strategic investor, a financial investor and another providing technology," says Mittal. He wants British Telecom and Telecom Italia to be strategic investors, Warburg Pincus as a financial partner, while Intel, which has recently picked up a 20 per cent stake in Bharti Telespatial - the holding company for v-sat and Net operations - for nearly $20 million, will be the technology partner. If anything, hes going to find it difficult to convince foreign partners to sell their stake to him.

So, whats next for Mittal? "We need to track telecom spends. For instance, anybody acquiring operations in Mumbai gets a share of 17 per cent of Indias total telecom revenue," says he. Hence, the decision to look westward. He also intends to be a big player in long-distance services, the rules of which are now being written. "Weve set up a 3,000-km backbone in MP and are setting up another for 4,000 km in the south," says younger brother and joint managing director, Rajan.

Theres another factor that makes the Bharti group tick. With such rapid growth, its imperative to put in place management teams in double quick time. Not only has Mittal managed, hes been able to make his managers stick with him. "Its tough to find people for so many projects. For me, its most important that a manager fits into a culture of high integrity. I dont recruit people from the public sector (despite the strong reservoir of technical knowledge they bring) for I cant allow that culture in my organisation." And managers stick despite Bharti not paying the highest salaries. "We arent the best paymaster. On a scale of 10, my salary grade would be at seven. But every Monday morning people at Bharti want to return to work." Thats because he allows a high degree of professional freedom. After thrashing out budgets and targets, teams are left on their own.

Are there any caveats to the man? "His acquisition of JT Mobile will put him to great test, because its for the first time he will develop circles of this nature. Running a metro circle in Delhi is far easier," says a rival. Mittal points to the success he has achieved in his fixed line circle in MP. Says Rajan: "MP was a very tough circle to do, as fixed-line services are difficult to implement. But it has gone beyond our expectations and we should be touching a subscriber base of 100,000 by March-end." Thats 80,000 more than the nearest private sector basic phone competitor.

NASDAQ listings and billion-dollar projects are a far cry from the Rs 20,000 he borrowed in 76 to set up a bicycle parts manufacturing business from his father. Congress MP late Satya Pal Mittals legacy is one battle Sunil has had to fight. Most people believe that in the initial years, he used his fathers clout to get him government contracts from DoT. "Yes, I come from a political family. It helped in getting plane and rail tickets, and maybe appointments with government officials. But bureaucrats wont do much if you dont pay them."

After bicycles, it was a hard drive into manufacturing push-button phones and answering machines with foreign collaboration. He recounts the days - all through the 80s - when he scoured the corridors of Sanchar Bhawan, DoT headquarters, trying to get government orders. That was until the government opened telecom to private participation in the mid-90s, and Mittal grabbed his moment.

If anything, Mittal is a trifle awkward with his success. "People tell me its time to buy a plane. But honestly, I feel embarrassed to have my own jet." Thats now. But Mittal is clearly tomorrows man.