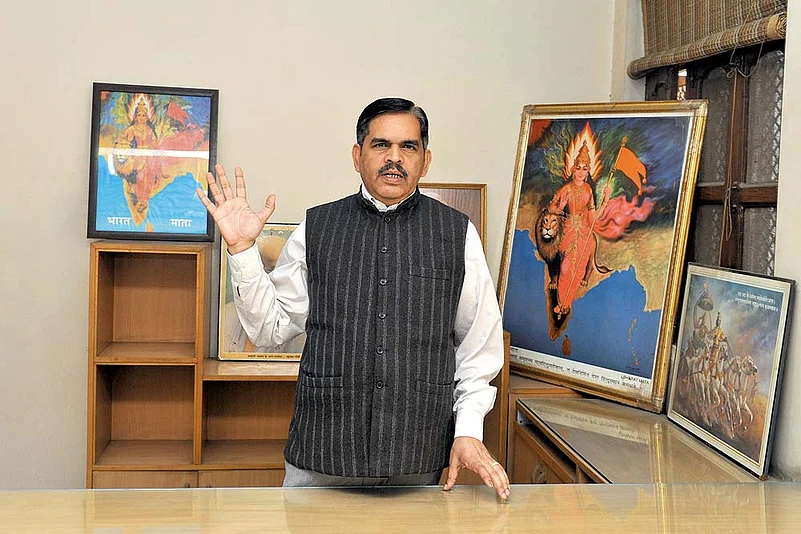

Much of the criticism of the Modi government’s economic policies are emanating from the ‘Right’ rather than the ‘Left’. Both the Swadeshi Jagran Manch (SJM) and the Bharatiya Mazdoor Sangh (BMS), affiliated to the RSS, have been critical of several policies. In an interview with Ushinor Majumdar, SJM national co-convenor Ashwani Mahajan explains why they are opposed to FDI in several sectors including e-commerce.

Did your pre-budget meeting with Jayant Sinha, MoS for finance, yield anything positive?

Well, we pointed out that though FDI isn’t allowed in e-commerce, there are still multinational e-commerce companies flourishing and expanding their business here. A few Indian e-commerce companies are also ‘foreign’ in the sense that up to 80 per cent of their capital comes from abroad. Other than the Congress and one or two small parties, no political party is in favour of FDI in multi-brand retail. The BJP was also against it earlier. E-commerce is not different from multi-brand retail and if FDI is not to be allowed in multi-brand retail, how can FDI in e-commerce be allowed? These grey areas need to be plugged.

Are you against e-commerce?

We are not against e-commerce...I book my air and rail tickets on the net. But these portals are trying to kill the competition, finish off domestic businessmen. They are using predatory pricing to kill the competition. It’s the duty of the government to address these unethical practices. They are not just working against competition but circumventing the law of the land.

But what about FDI and the ‘Make in India’ programme?

‘Make in India’ will draw in more FDI. After 24 years of liberalisation, what we are asking for—and we asked the previous regime this also—is a white paper on the costs and benefits of FDI.

What are the negative impacts of FDI?

Our banks are overflowing with funds but there are no takers. So we really don’t need FDI to supplement our resources. Ours is a savers’ economy. So if we have got US $20 billion FDI, it would be around Rs 1.2 lakh crore rupees. But our nation saves Rs 35 lakh crore on an average every year. We don’t need foreign investment to supplement our resources.

More than 15 per cent of listed companies’ shares are held by fiis today and in most sectors mncs are controlling domestic industries. We have given up the distinction between brownfield and greenfield investments. Earlier, Glaxo was the sole MNC in the top 10 pharma companies of India; today, there are three of them with many more in the queue. The mncs increase our import bill and evade taxes through transfer pricing and loss of foreign exchange. In 2013-14, FDI was US $2.6 billion and, as per RBI data, the outflow for royalty, dividend, interest and salaries was $34.4 billion. Na maya mili na Ram.

The NDA government has allowed or increased FDI in several sectors. You opposed it during the UPA regime but the sjm seems to be going soft now?

The BJP had opposed 49 per cent in FDI (the NDA-I government had allowed 26 per cent in 1998) when UPA had proposed it. We should start producing these goods at home and become more self-reliant. The countries that possess technologies, like the US and Israel, are not ready to transfer these technologies either. The argument that FDI in defence will bring in technology should be re-written. Since India is a large market and a strong economy, they should agree for technology transfer but this has not worked so far. Rather we have faced hikes in royalty in other industries, eg automobiles (Suzuki 5 per cent), cement (ACC 1 per cent). We would like the country to be self-dependent in defence but this is no way to do it.

What impact does FDI have on the value of the rupee?

Brownfield investments are not doing any good to the country; for example, Ranbaxy was sold to Daichi. Only greenfield investments should be allowed. And many FII are fly-by-night investors. They reap rich benefits and take the money and go away and we also face the brunt of their market crashes, which has also led to withdrawal of huge amounts of foreign investment being withdrawn. This hurts small investors.