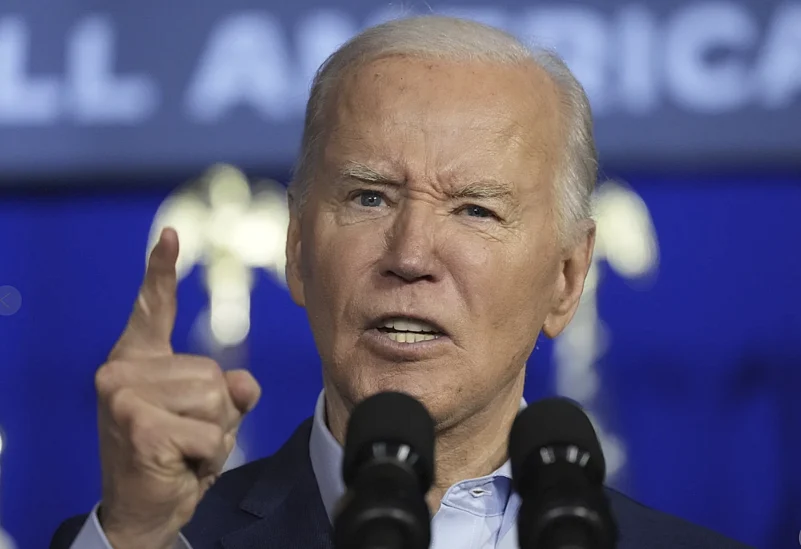

The move reflects the intersection of Biden's international trade policy with his efforts to court voters in a state that is likely to play a pivotal role in deciding November's election.

The White House insists, however, that it is more about shielding American manufacturing from unfair trade practices overseas than firing up a union audience.

In addition to boosting steel tariffs, Biden also will seek to triple levies on Chinese aluminum. The current rate is 7.5 per cent for both metals. The administration also promised to pursue anti-dumping investigations against countries and importers that try to saturate existing markets with Chinese steel, and said it was working with Mexico to ensure that Chinese companies can't circumvent the tariffs by shipping steel there for subsequent export to the US.

“The president understands we must invest in American manufacturing. But we also have to protect those investments and those workers from unfair exports associated with China's industrial overcapacity,” White House National Economic Adviser Lael Brainard said on a call with reporters.

Biden was set to announce that he is asking the US Trade Representative to consider tripling the tariffs during a visit to United Steelworkers union headquarters in Pittsburgh. The president is on a three-day Pennsylvania swing that began in Scranton on Tuesday and will include a visit to Philadelphia on Thursday.

The administration says China is distorting markets and eroding competition by unfairly flooding the market with below-market-cost steel.

“China's policy-driven overcapacity poses a serious risk to the future of the American steel and aluminum industry, "Brainard said. Referencing China's economic downturn, she added that Beijing “cannot export its way to recovery".

“China is simply too big to play by its own rules," Brainard said.

Higher tariffs can carry major economic risks. Steel and aluminum could become more expensive, possibly increasing the costs of cars, construction materials and other key goods for US consumers.

Inflation has already been a drag on Biden's political fortunes, and his turn toward protectionism echoes the playbook of his predecessor and opponent in this fall's election, Donald Trump.

The former president imposed broader tariffs on Chinese goods during his administration, and has threatened to increase levies on Chinese goods unless they trade on his preferred terms as he campaigns for a second term. An outside analysis by the consultancy Oxford Economics has suggested that implementing the tariffs Trump has proposed could hurt the overall US economy.

Senior Biden administration officials said that, unlike the Trump administration, they were seeking a “strategic and balanced” approach to new tariff rates. China produces around half of the world's steel, and is already making far more than its domestic market needs. It sells steel on the world market for less than half what US-produced steel costs, the officials said.

Biden's announcement follows his administration's efforts to provide up to USD 6.6 billion so that a Taiwanese semiconductor giant can expand facilities that it is already building in Arizona and better ensure that the world's most-advanced microchips are produced in the US.

That move could be seen as working to better compete with China chip manufacturers.

Treasury Secretary Janet Yellen, during a recent visit to China, warned against oversaturating the market with cheap goods, and said low-cost steel had “decimated industries across the world and in the United States”.

The Chinese, in turn, expressed grave concern over American trade and economic measures that restrict China, according to the China's official news agency. US Secretary of State Anthony Blinken also has an upcoming visit to China.

Also potentially shaking up the steel industry is Japanese Nippon Steel's proposed acquisition of Pittsburgh-based US Steel. Biden said last month that he opposed the move.

“US Steel has been an iconic American steel company for more than a century, and it is vital for it to remain an American steel company that is domestically owned and operated," Biden said then.

At a rally last weekend in Pennsylvania, Trump tore into Biden over Nippon Steel's efforts to buy US Steel, ignoring the president's objections to the merger.

“I would not let that deal go through,” Trump said.