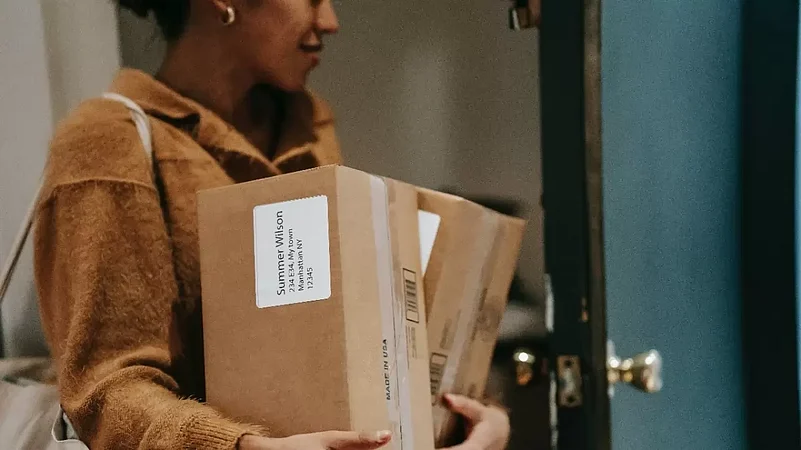

The holiday season is fast approaching, and if you're still checking off your gift list, you're in luck. Major U.S. retailers, including Walmart, Target, and Amazon, are gearing up to provide faster deliveries, giving you more time to get those last-minute presents.

The "shipping wars" and Amazon's dominance

As the demand for swift deliveries grows, these retail giants are entering what industry experts are calling the "shipping wars." In this fierce competition, Amazon stands out for its remarkable success in setting new standards for rapid shipping.

Amazon's recent achievements in quicker deliveries can be attributed to its innovative distribution model. The company has divided the country into eight regions, shipping items primarily from nearby warehouses. This strategic move minimizes travel distances and touchpoints, resulting in expedited deliveries and cost savings. Amazon reported in July that 76% of customer orders were fulfilled within their respective regions, a significant increase from 62% before the distribution model change.

Investments and strategies of retail giants

In response to Amazon's dominance, competitors like Walmart and Target are making substantial investments in upgrading warehouses and establishing new facilities to narrow the gap in delivery speed.

Walmart, with over 4,000 stores functioning as fulfillment centers, plans to add 40 parcel stations across nine states by year-end. The company is incorporating automation into its strategy, with plans to automate all 42 regional distribution centers and construct four automated warehouses for perishable items. Walmart aims to double the number of daily customer orders fulfilled and expand next- and two-day shipping to cover nearly 90% of the U.S.

Similarly, Target is investing $100 million in its sortation centers to enhance shipping speed. These centers, which receive packages for online orders from surrounding stores, are expected to double their delivery volume to over 50 million packages this year. Target aims to increase the number of sortation centers from 10 to at least 15 by early 2026, with a goal of delivering 9 million packages during the holiday season.

Despite these efforts, industry experts, including Jason Goldberg from Publicis, emphasize the significant lead Amazon holds in terms of warehouse space and transportation infrastructure. According to Goldberg, "It’s almost hard to imagine you could ever catch up with Amazon’s model."