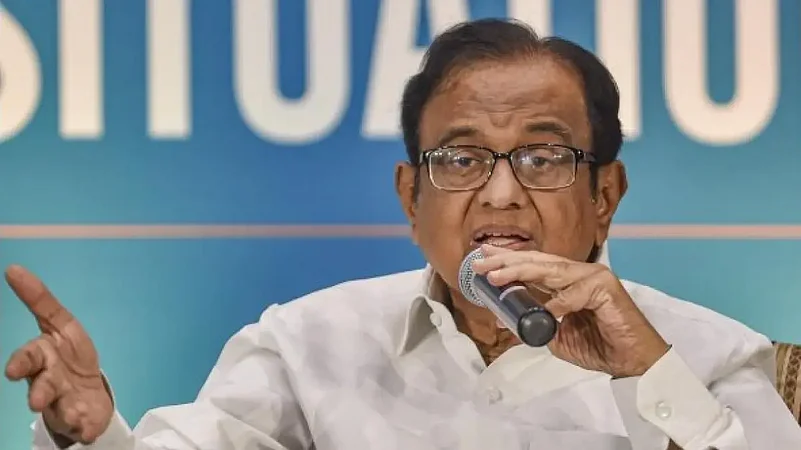

As the Pradhan Mantri MUDRA Yojana completed eight years, senior Congress leader P Chidambaram on Sunday said 83 percent of the loans given under the scheme are under Rs 50,000 which leaves him wondering what kind of business can be done today with a loan of that amount. Banks and financial institutions have sanctioned Rs 23.2 lakh crore to over 40.82 crore beneficiaries under the Mudra Yojana launched to fund the unfunded eight years ago.

Pradhan Mantri MUDRA Yojana (PMMY) was launched on April 8, 2015, by Prime Minister Narendra Modi to facilitate easy collateral-free micro-credit of up to Rs 10 lakh to non-corporate, non-farm small and micro-entrepreneurs for income-generating activities. In a tweet, Chidmabaram said that under the Mudra Loan scheme, loans of the value of Rs 23.2 lakh crore have been given in eight years which is "impressive" until you notice that 83 percent of those loans are under Rs 50,000.

"That is Rs 19,25,600 crore of loans have been given to borrowers at the rate of Rs 50,000 or less. It leaves me wondering what kind of business can be done today with a loan of Rs 50,000?" the former finance minister said. Loans under PMMY are provided by Member Lending Institutions (MLIs) -- banks, non-banking financial companies (NBFCs), microfinance institutions (MFIs), and other financial intermediaries, the finance ministry said in a statement on Saturday.