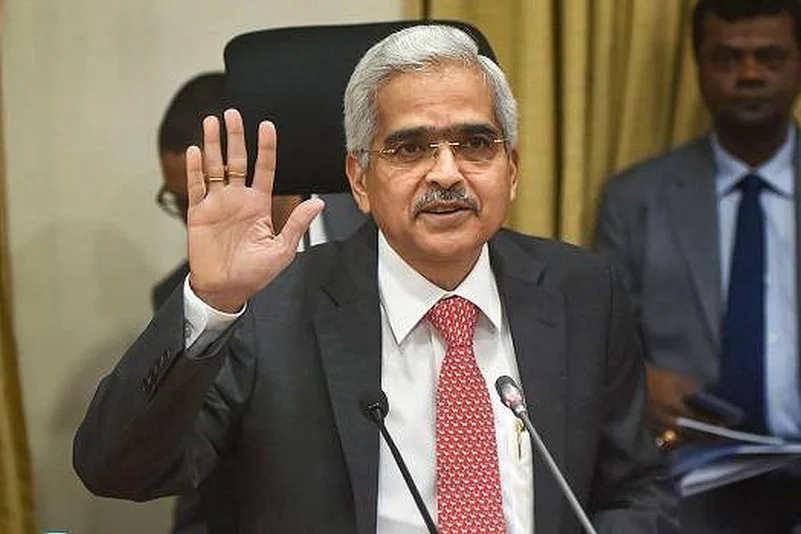

Reserve Bank governor Shaktikanta Das on Monday urged everyone to stop being the proponents of gloom and doom and look at the opportunities ahead even as he admitted that the economy was slowing down and facing challenges from both within and outside.

Addressing the national banking summit in Mumbai, Das averred that "when I read newspapers or watch business channels the mood is not sufficiently positive and optimistic.

One does realise that there are challenges in the economy, there are sectoral issues, and there are severe external global headwinds and that we cannot live in isolation.

"The mood today ranges from existential angst to a positive attitude. I think the sentiment is very important; and please look at the opportunities ahead of us. We do realise that there are challenges and difficulties coming from external and domestic sources but one has to look at the opportunities and capitalise on that."

The statement comes amidst reports that an increasing number of corporate honchos are livid with the Narendra Modi government, especially after a slew of initiatives in the recent budget, including higher taxes on the rich and foreign portfolio investors.

This had FPIs dumping domestic equities and debt like dung since the budget, pulling down the benchmarks by over 13 percent July 5.

Continuing their selling spree that began with the budegt and amidst the rising uncertainty over the FPI tax and global trade worries, foreign portfolio investors, and as per depository data, have sold equities worth Rs 10,416.25 crore between August 1 and 16 and debt worth Rs 2,096.4 crore.

This also comes continuing southward movement of all key macroeconomic datapoints-be it the IIP or exports or automobile sales, which hit a 19-year low in July plunging over 31 percent and eating away over 3.5 lakh jobs.

Das, however, added that he was not asking for anyone to maintain a 'Panglossian countenance.'

"I am not saying we maintain a Panglossian countenance and smile away every difficulty. But, in any real economy, the mood is very important. There are several opportunities amid the challenges we face today and together with the financial sector, the business community, the policymakers and the regulators we should address the challenges and look ahead with greater confidence," Das said.

Barring inflation numbers there seems no positive news coming in from any quarters and the Reserve Bank's four successive rate cuts to the tune of 110 bps to a nine-year low of 5.4 percent since February has not made any positive impact on the ground level.

All these negative news comes on the back of a four-year GDP print in March when the economy grew at low 5.8 percent, pulling down the full year growth to a low 6.8 percent and every analyst sees the June quarter growth to print in lower than the March numbers.

It can be noted that every economist, including those at the RBI have lowered thier GDP forecast to 7 or under 7 percent. Within two months, the RBI at the last policy review lowered its GDP outlook by 10 bps to 6.9 percent, while the general consensus is between 6.6 and 6.8 percent for FY20.