Kolavari in Tamil stands for murderous rage, the word itself being popularized by a song sung by the Tamil artiste, Dhanush. So why is this term relevant in the context of the Budget and Digital Payments?

The budget appears to have done an excellent balancing act between the acute pressures of government spending needed at this time of Wuhan virus-fueled economic de-growth and need for increasing defence spending, with the pressures on revenue collection, which have taken a hit due to the Wuhan virus. The budget has managed to support all key areas of the economy starting with infrastructure, healthcare, agriculture, education, startups etc. However, the budget seems to continue the regime of penalizing all non-UPI stack digital payment mechanisms.

To understand this discriminatory regime, one needs to understand the current PaymentTech dispensation. Enabling digital payments is a service. When one uses say a credit card to swipe and make a payment, the service of transferring money from the payer to the payee gets orchestrated by a series of players in the background, who in turn need to be compensated small amounts for their service. This compensation is termed as the Merchant Discount Rate or MDR, and is typically deducted from the payment being made to the payee, which is the merchant. If there is no compensation given to this background ecosystem, then one will not be able to make payment from cards.

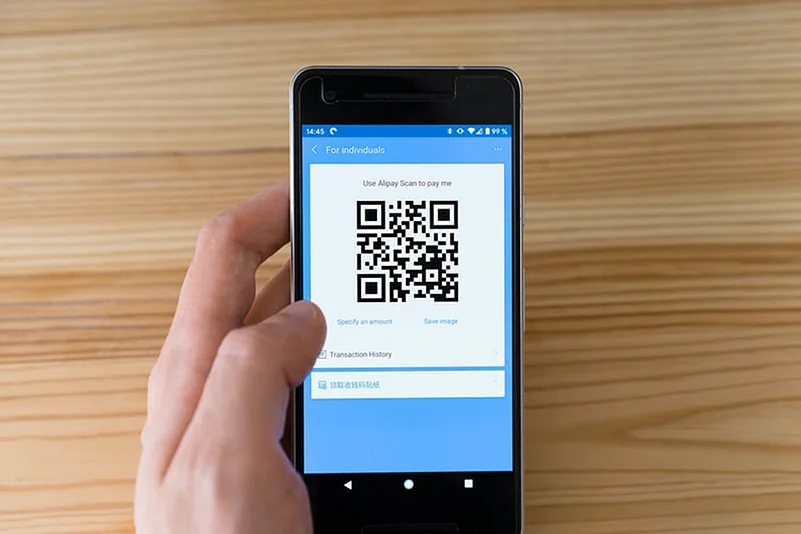

However, if one uses a UPI stack-based payment system, such as the popular UPI QR code-based payment that people use by scanning the QR code with their phone camera and making a payment from a bank that is linked to the app that is enabling the payment, then there is no MDR. That means there is no deduction made from money collected by the merchant (payee). So, does this mean that there are no costs involved in providing the UPI payment service? No. There is a cost involved in running the systems and platforms required to enable this payment. So, is the government absorbing the cost and subsidising these payments. Again, the answer is No. The government did subsidise the cost for payments below Rs 2,000, till December of 2019. However, post-December 2019, there are no subsidies.

So why is the cost of making a UPI-based payment zero? It is because the government has dictated so. The players have to absorb the cost. And they will do so till the time they are being funded by investors or they find a viable monetization model through adjacencies such as providing loans. However, no such model has yet proven to be sufficient to subsidise the burn rate of supporting free UPI transactions. Key players are burning millions of dollars per day to support these transactions, as their investors believe that they will be able to discover some business model, before people stop piling in more cash as investments into these digital payment entities.

The same is the case with Rupay debit cards. Rupay cards are built on top of the UPI stack. The government has dictated that no player can charge for transactions on Rupay debit cards. So why are payment players supporting Rupay debit cards? They are supporting Rupay debit cards because they are able to cross-subsidise them with transactions from other cards such as Visa and Mastercards. But if people switch to Rupay card en masse, then Visa, Mastercard and other card providers will become unviable in India. However, in a way, Rupay cards are parasitic as they depend on other cards for its survival, and like all parasites, if the host, in this case Visa, Mastercard and other cards, become unviable, then the Rupay card will also die, as no aggregator can support the card transaction cost.

To make matters worse, there is an additional penalty on the MDR of the non-UPI cards. So, if you are making a payment of above Rs 2,000 using a Visa or Mastercard debit card, not only do you need to pay a certain small percentage (MDR) to the card ecosystem, but you would also need to pay an additional 18 per cent on the MDR to the government. Taxing a sustainable digital payment enabling ecosystem is extremely counter-intuitive when one is keen to ensure that more transactions become digital.

So why is the government taxing a healthy, sustainable digital payment system that is also providing sustenance to the Rupay card? This is inexplicable. And hence, the question on why is there a Kolavari against existing digital payment systems, and why was it not rectified in the current budget.

It becomes even more perplexing when it is noted that the cards enable payments from the 360 million Jan Dhan accounts that were opened up by this government for ushering in universal banking. If the government charges a GST on MDR on the payments made by the debit cards of these banking accounts, then it penalises those who have just been brought in into the banking network, and who would otherwise have to take a day off and take a bus to the nearest ATM or bank, just to withdraw cash, thereby defeating the purpose of universal banking. It would also push people to stick to cash transactions as cash transactions is cheaper for the users (although it is not cheap for the RBI as the RBI spends almost Rs 5,000 crore annually to print money and to mint coins).

Another dimension of this cash versus digital payments conflict is the liabilities of those who enable these two payment mechanisms. In case of cash, the RBI enables the payment as it is the RBI that has printed the cash. But imagine you receive a payment by cash from your customer, and the customer did not like whatever you provided and thus files a complaint with the RBI, wherein the RBI is mandated to give back the cash to the customer, because you did not provide the right goods or services. Does this sound ridiculous? It is indeed ridiculous but that is the regime that the digital payment providers have to follow. If you receive a payment from a customer through his or her credit card or debit card, and the customer filed a complaint for your goods or service with the card issuer, then the card aggregator has to take up the liability for refunding the amount to the customer, if the investigations do indeed find that there was a lacuna in your goods or services and if you are a truant merchant and you do not pay up the amount back to back to the merchant aggregator, then the merchant aggregator simply suffers a loss.

But how can a payment aggregator be held responsible for a customer’s decision to make a payment? What if the customer made the same payment by cash in which case would the RBI be held responsible for it? Isn’t the principle of the Sales Act is “Buyer beware”? Isn’t a payment aggregator simply operating as an intermediary and hence should get safe harbour through regulatory support? How can digital payments grow if the providers of digital payments are penalised by GST on MDR and is exposed to massive liabilities?

The budget was a good opportunity to rectify these issues in the digital payments regime. It is hoped that in the subsequent weeks, these issues are looked at and rectified and that India gets a sustainable and vibrant digital payments ecosystem that is also atmanirbhar and has key domestic players.

(Dr Jaijit Bhattacharya is President of the Centre for Digital Economy Policy Research. Views are personal, and do not necessarily reflect those of Outlook Magazine)