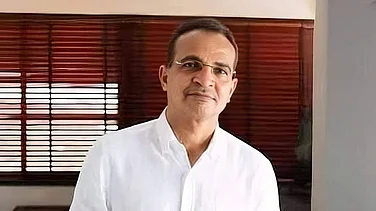

The Supreme Court ruling on applicability of GST Council's decisions is unlikely to materially impact the one-nation-one-tax regime as it is only a reiteration of the existing law that gives states the right to accept or reject the panel's recommendation on taxation -- a power that none has exercised in the last five years, Revenue Secretary Tarun Bajaj said on Thursday.

The Constitutional amendment that brought the Goods and Services Tax (GST) regime from July 2017 by subsuming nearly one-and-a-half-dozen central and state levies, provided for a Council of Centre and states for decision making. The recommendations of the GST Council, as per the Constitutional amendment, were always a guidance and never a mandatory compliance, Bajaj said.

States, even though differing on tax rates on a particular good or service in the Council, never went back and framed legislations that were not in line with the panel's recommendations.

And this practice is likely to continue unhindered, the official said soon after the Supreme Court ruled in the Mohit Minerals Ocean Freight case that the recommendations of the GST Council are not binding and only have persuasive value. It held that Parliament and state legislatures can equally legislate on GST.

"The GST law says that it will recommend, it had nowhere said that it will mandate. It is a constitutional body, executive body created by constitution which consist of Centre and state which will recommend and based on its recommendation we have created our laws on GST. This is the scheme of things," Bajaj added.

In last five years, he said, "even where states did not agree and in writing gave a dissenting note, they actually promulgated the recommendations in the manner that the Council mentioned and not in the manner of what they said."

-With PTI Input