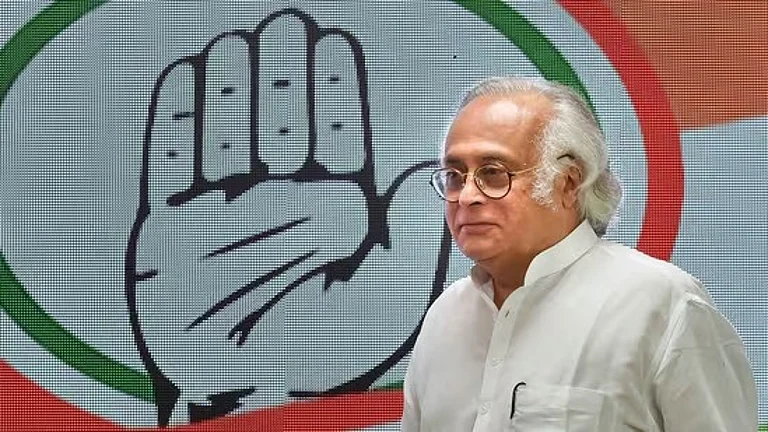

Amid the escalating war of words between the Bharataiya Janata Party (BJP) and its arch rival Congress, the grand old party's overseas wing in-charge Sam Pitroda's remarks citing US inheritance tax sparked a fresh controversy on Wednesday.

The BJP used Pitroda's remarks as fodder to establish its anti-Congress narrative maid the ongoing Lok Sabha polls.

What did Sam Pitroda say?

The controversy stemmed from Pitroda's interview with news agency ANI where he said, "In America, there is an inheritance tax. If one has $100 million worth of wealth and when he dies he can only transfer probably 45 per cent to his children, 55 per cent is grabbed by the government. That's an interesting law."

Inheritance taxes in US: Today's talking point

Under US federal law, an inheritance tax is defined as a form of a state tax imposed on the money or property of an individual inherited from a deceased person's estate.

The inheritance tax differs from the federal estate tax as, in this case, instead of the estate, the beneficiary is responsible for paying the tax. Ranging from less than one percent to as high as twenty percent, the rate of inheritance tax varies widely.

At this momemnt, only six states across the US including Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania enforce an inheritance tax. However, several beneficiaries despite residing in one of these states, are exempt from paying this tax

Modus operandi of inheritance taxes

As per law, the inheritance tax comes into play once the deceased allocates the assets to the beneficiaries. The exact amount of tax to be paid is calculated separately for each beneficiary.

In some of the above-mentioned states, the amount of inheritance taxes is determined by how closely the beneficiary is related to the deceased. The closer the relationship is, the better are the chances to be exempt from paying the taxes.

Calculation of inheritance tax

Here's a brief idea of the number crunching. In simple math, if a state imposes a five percent tax on inheritances exceeding two million dollars, for an asset of five million dollars, the beneficiary would be taxed on the amount exceeding the two million dollars, which is three million dollars in this case and the amount of tax to be paid would stand at 150,000 USD.