The grim backdrop. Only 33 million or just 11 per cent of the Indian workforce, basically in the government and the organised private sector, has access to any kind of pension system. This leaves millions of economically vulnerable people to fend for themselves in their old age. Worse, Indians are now living much longer. An average Indian who crosses the age of 58 can expect to live till 76. This means 18 years of retired life with no old age income security since no social security system exists in our country. The situation looks even more grim given that Indian women tend to outlive their spouses and are on an average five years younger than their husbands. They too need old age income security. The problem doesn’t end here. Existing pension systems also have their share of problems.

Most existing pension systems, especially those of the government, are based on the principle of defined benefits. This means you get a life-long pension based on some benchmark like your last drawn salary. What you contribute in your lifetime from your salary in the form of deductions becomes immaterial. With the financial position of both central and state governments worsening, honouring these pension liabilities has been steadily becoming a burden. For other schemes like the Employees’ Provident Fund, the government has been providing a high-assured rate of return. In a declining interest rate scenario, meeting these commitments was becoming onerous. Realising the gravity of the situation, the government set up two committees, the Bhattacharya Committee and the Old Age Social and Income Security (OASIS) to look into the issue of pensions in the government and unorganised sector respectively.

Pension reforms agenda. While the OASIS committee submitted its report in 2000, the Bhattacharya Committee report came out two years later. The OASIS report inspired considerable discussion and debate. Several other reports followed, namely reports by the World Bank, by the adb on reforms in epfo, by the irda and by a team of consultants to the finance ministry.

Among the major recommendations of the two committees was a movement to a defined contributions system where a person would get retirement benefits in the form of annuity—regular monthly income—on the basis of pre-defined contributions made from his salary in his lifetime. The other major area of reforms suggested was to give greater freedom to invest pension money with a choice among safe income, balanced and high growth plans. In the past, strict investment guidelines prevented pension money from not being invested in safe triple A rated debentures.The OASIS committee suggested that freedom to invest in such instruments and shares be given and people allowed to choose the kind of instruments they wanted their pension invested in. Besides, the OASIS committee also suggested that few competent fund managers be appointed to manage the pension money so that the resultant competition leads to better administrative efficiency and management cost reduction. Free mobility among products as well as among fund managers was also recommended to help an individual change not only his plan depending on his age and risk-taking ability but also take advantage of high-performing fund managers. Another important recommendation of the OASIS report was the setting up of a Pension Regulatory Authority with considerable focus on development and promotion among the unorganised sector.

Long road ahead. Jaswant’s twin announcements of the new scheme and the setting up of a pension regulatory authority signals the beginning of pension reforms in the country. Instead of two schemes, Jaswant has come up with one scheme for both the government and the unorganised sector. However, the reforms road promises to be a long one. After the regulatory authority is set up, it will take roughly 6-9 months for the body to set up rules governing the pensions sector. The rules will have to cover areas like selecting fund managers and fund management guidelines. Other arrangements like the appointing of a central record-keeping agency will have to be made so that individuals can access information about their pension account from anywhere in the country.

As far as the new pension scheme is concerned, the state governments need to emulate the Centre and announce that they will subscribe to the new scheme, instead of coming up with a new one. Thus all new government employees, both at the central and state level, will be part of this scheme. The very presence of government employees will inspire confidence among those in the unorganised sector. It is now up to the regulatory authority to come out with details and provide an inspiring scheme. We only hope this will be done in a time-bound manner. Too much discussion has already happened. We need action now.

Budget Impact

Restructured scheme for govt employees; applicable to others on voluntary basis

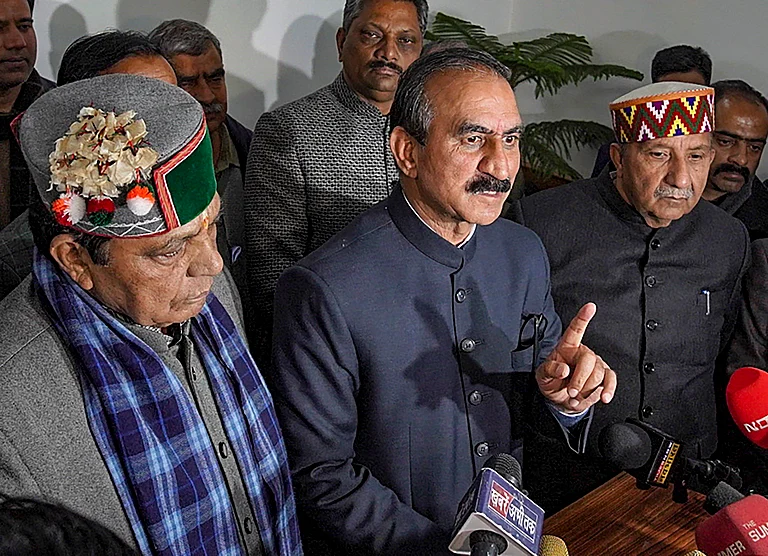

(The author, former UTI chairman, is currently chairman of the OASIS Foundation.)