Ministers of the BJP government are at pains to underscore that the fundamentals of the Indian economy are “strong”. Investment, consumption, savings and employment constitute an economy’s fundamentals. In India’s case, all these parameters are signalling grave distress. A combination of poor policy choices with the continuous and systematic dismantling of India’s institutions has led to the current impasse. The slow meltdown of the Indian economy is a project that has now been in the works for five years.

India’s nominal GDP is $2.61 trillion and is growing at 5 per cent—the slowest pace of growth in six years. The Index of Industrial Production of the manufacturing sector grew by 1.2 percent in June 2019, as compared to 6.9 per cent in June 2018. The manufacturing sector’s growth during April-June 2019 was 3.1 per cent as compared to 5.1 per cent during the corresponding period of the previous year.

In July 2019, the production of eight core industries grew by 2.1 per cent as compared to a growth of 7.3 per cent recorded in July 2018. Production of eight core industries grew by 3 per cent in April-July 2019 as compared to 5.9 per cent in the corresponding period the previous year.

Consumption is an important indicator of the health of any economy. External consumption, or exports, had peaked in 2013-2014 at $314.88 billion, but reduced to $262.2 billion before recovering partially to $303.3 billion in 2017. Merchandise exports and imports (in US$ terms) declined by 0.4 per cent and 3.6 per cent respectively in April-July 2019. In that period, oil imports declined by 5.7 per cent and non-oil imports by 2.9 per cent.

Until recently, internal consumption in sectors such as auto and FMCG had been growing at a healthy rate of 15-16 per cent. However, domestic sales of passenger vehicles dropped by 31.6 per cent in August 2019 to 1,96,524 units from just a year earlier, according to data from the Society of Indian Automobile Manufacturers (SIAM). It was the 10th straight decline and the worst since SIAM started compiling monthly sales data in 1997-98.

The farm sector too is struggling with a fall in agricultural prices, meagre incomes, low growth in agricultural output, and massive unemployment. Agricultural output grew at only 2.7 per cent during the last October-December quarter, which is the lowest in 11 quarters. With a slew of deflationary policy measures such as the removal of import duty on wheat, demonetisation and GST, the government has been very insensitive to the plight of farmers. The continuous fall in prices after demonetisation has created a scenario of negative incomes.

Private investments in 2018-19 dropped to Rs 9.5 lakh crore, their lowest in 14 years. The period from 2006-07 to 2010-11 had witnessed private investment of Rs. 25 lakh crore per year on an average. While private investments saw their share in overall investments drop to a low of 47 per cent, the economy was seemingly being dragged by just public investments. However, the government slammed the brakes on public investments at the end of the last fiscal, when the deficit started spiralling out of control. It ballooned when both direct taxes and GST collections fell short of estimates by Rs 40,000 crore and Rs 60,000 crore respectively, and expenditure increased due to new schemes that were introduced halfway into the fiscal year.

Falling private investments are a consequence of diminishing household saving rate in India. A decrease in savings is reducing the funds available for investments. Net financial savings available for growth reduced from 7.2 per cent of GDP in 2011-12 to 6.5 per cent in 2017-18. In a span of just five years, household savings have witnessed the biggest decline, from a healthy 23.6 per cent of GDP in 2011-12 to 17.2 per cent of GDP in 2017-18.

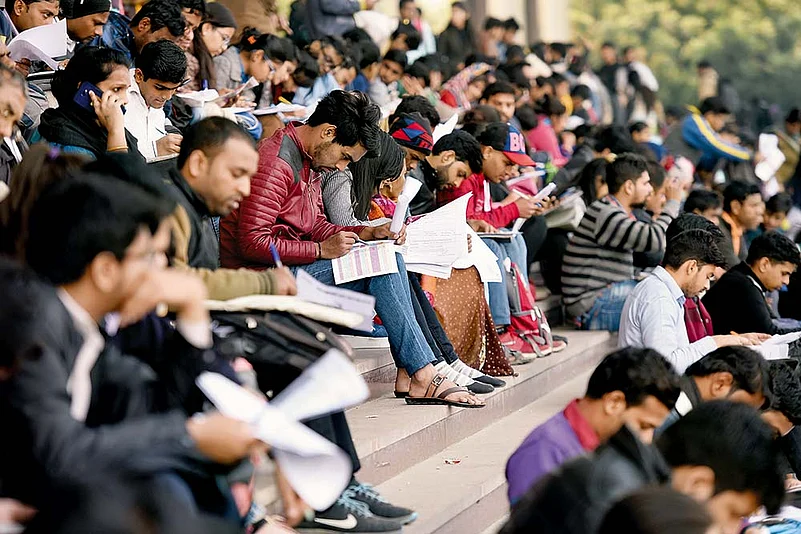

There could be further erosion in the country’s savings to gross domestic product (GDP) ratio if the unemployment situation worsens. There is a strong correlation between savings ratio and employment growth. The Periodic Labour Force Survey of the National Sample Survey Organisation (NSSO) pegged the overall unemployment rate at 6.1 per cent for FY 2017-18, an unprecedented 45-year high.

The NDA government has systematically undermined the finest economic institutions of this country—the autonomy of the Reserve Bank of India was the first target. Next came agencies associated with dissemination of statistical data like the NSSO and the National Statistical Commission (NSC). An upward revision of the GDP numbers and withholding of employment data by the NSSO after being cleared by the NSC led to resignations of two NSC members, including its chairperson, earlier this year.

While such institutions were earlier nurtured in an environment free of political pressure, all this changed after the NDA government assumed power in 2014. The uncertainty about the state of the Indian economy is also due to a general lack of confidence in NSSO data. That will further exacerbate the downturn in investments.

The Reserve Bank of India’s long-term view, as opposed to a shortsighted government focused only on the next quarter results, provides a fundamental counterweight. The capitulation of the RBI, as demonstrated by the transfer of an alleged surplus of Rs 1.76 trillion to the Government of India, will have grave repercussions on the global credibility of the central bank. Both the previous RBI governors had to end their tenure unceremoniously after falling out with a government hell-bent upon undermining the bank’s independence.

The fact that the government is clueless as to how to handle the economic free fall is best exemplified by a minister proclaiming that the yardsticks used by governments and institutions across the world to gauge the state of the economy should not be applied to India. This is the kind of reasoning that autocrats used in Zimbabwe and Venezuela, before they ruined the economies of their respective countries.

The biggest contributor to this economic malaise is the indiscriminate and coercive use of the investigative and taxation instruments of the government. It has created a situation where wealth creators prefer to just leave the country and set up shop elsewhere. Nobody is willing to live in a state of perennial terror by the state for engaging in legitimate business activities.

There is a correlation between social cohesion and economic progress. Money tends to shy away from countries in turmoil. It is worse if the government of the day is perceived as driving socio-political instability. The project to transform our nation into a totalitarian country has repercussions on the economy too. When lynchings in the name of cows make global headlines, they tend to scare away investment bulls around the world. When intellectuals articulate their trepidation of physical and virtual lynch mobs, it does not augur well for business, which prefers stability and peace.

As Donald Rumsfeld, the former US secretary of defence, said, “Those of who have worked in the business community understand intuitively the nexus between security and economic opportunity. As we all know, money’s a coward. It can flee. Companies tend not to want to invest in countries or regions that they believe are unstable or unsafe.” That’s what’s happening in India. In the first four months of the 2019-20 fiscal, outward remittances have already hit $5.8 billion. This is equivalent to the entire outward remittance during the five years of UPA-2. The total outward remittance since 2014, when the current government assumed office, is estimated at $45 billion. Money is leaving India faster than you can say Jack Robinson. The rot in the vitals of the economy is much deeper than what is discernible from outside.

(The author is a lawyer and Congress MP)