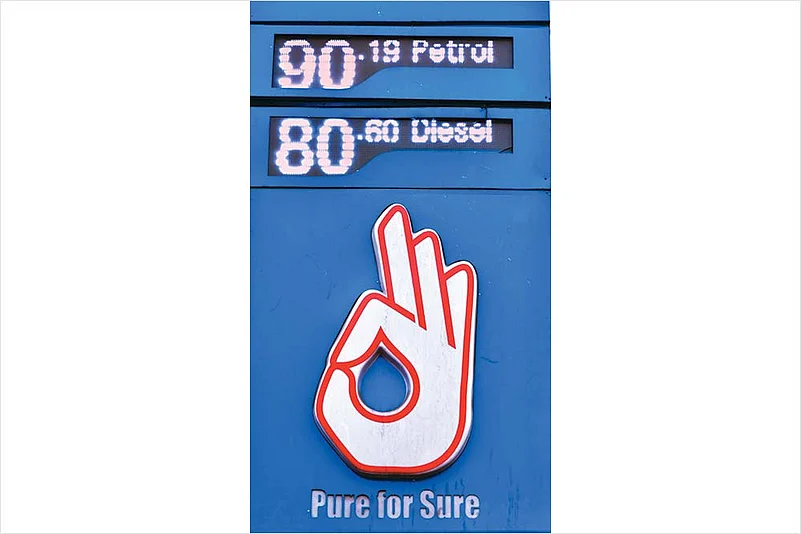

Petrol Prices In Delhi

Feb 23 - 90.93

Feb 16 - 89.29

Feb 12 - 88.18

Feb 10 - 87.64

Feb 8 - 86.99

Jan 31 - 86.30

Jan 1 - 83.71

***

On February 20 this year, a radio jockey in one of the Delhi-based FM stations asked listeners why they were not raising their voice against the steady rise in fuel prices. She later complained of being trolled and abused on social media but promised to continue raising the issue as “it impacts masses”. The jockey’s question was not without basis. Even as fuel prices touched Rs 100 a litre in some places in the country recently, the usual celebrity chatter was surprisingly missing. Even a large section of the common gentry, mostly those supporting the ruling party at the Centre, argued that the price rise was for the “good of the country”. Celebrities like Amitabh Bachchan have been conspicuous by their silence, more so given the fact that he had criticised the previous government during a similar period of fuel price rise.

Fuel price rise in February has drawn special attention as rates have touched an all-time high. Petrol prices in Delhi have risen from Rs 86.99 per litre on February 8 to Rs 89.54 per litre on February 17. Just 400 km away, in Sri Ganganagar in Rajasthan, petrol price touched Rs 100, triggering a flood of memes on social media. At present, taxes levied on petrol and diesel by the Union government and state governments comprise custom duty, excise duty and VAT. While the Centre determines custom duty and excise duty, the state governments fix VAT. The custom duty on petrol and diesel is 2.5 per cent plus 3 per cent social welfare surcharge. Excise duty was raised by the central government in May 2020 during the pandemic and is currently at Rs 32.98 for petrol and Rs 31.83 for diesel.

Petroleum minister Dharmendra Pradhan has been blaming oil producing nations of supplying less fuel to stock up for times when prices rise. Crude oil prices have risen from around $40 per barrel in October last year to over $60 a barrel and are expected to rise further. In India, the cash-starved Centre and state governments are banking on huge revenue from the petroleum sector to shore up resources. The petroleum sector’s contribution to central and state exchequer is around Rs 6 lakh crore, almost 35 per cent of the tax collection.

Over the past three years, the total contribution to Central and state exchequer by the petroleum sector was Rs 5,43,026 crore (2017-18), Rs 5,75,632 crore (2018-19) and Rs 5,55,370 crore in 2019-20. The first quarter of the current fiscal fetched the government Rs 81,921 crore based on figures from 16 major oil and gas companies in India. Currently five petroleum products are out of GST—crude oil and natural gas, petrol, diesel and aviation fuel.

Robert Vadra rides a bicycle to office in protest against rising fuel prices. He was trolled, including by some BJP leaders, for his suit and for his “diesel-guzzling Land Cruiser” and bodyguards in tow.

However, the whole scenario is contrary to the government’s commitment two decades back of a free market for fuel. The government continues to manipulate the prices, earlier on a fortnightly basis and now on a daily basis. It’s a point the opposition has tried to hammer home. “The whole principle of deregulation and dynamic pricing is predicated on the principle that reductions in crude oil prices will proportionately benefit the end consumers. The fact that your government fails to do so implies a deliberate and conscious decision to deny the common man his legitimate due,” Congress president Sonia Gandhi said in a letter to Prime Minister Narendra Modi. “To put it in context, the crude oil price is nearly half of what it was during the UPA government’s tenure. Therefore, your government’s act of raising prices (continuously for 12 days till February 20) is little less than a brazen act of profiteering.”

Politics apart, even experts agree. Sajal Ghosh, associate professor at the Management Development Institute, says, “Petrol and diesel are price inelastic in the short-term. So, it is logical for the government to impose tax on these products. Unfortunately, high current taxes, particularly on diesel, have a cascading impact on industry, transport and agricultural sectors. The consumers are also not getting any benefit from the price deregulation of petrol and diesel due to the regular increase of tax components on these products.”

The bigger worry for the common man is the resultant price hike of essential commodities which often happens along with such steep rise in fuel prices. For the government, trick is in finding the right balance in tax collection and keeping inflation under check. With a majority of the people still not out of the economic rut created by the pandemic and resultant job losses and pay cuts, the signs are not too good.

CARE Rating chief economist Madan Sabnavis says the worst is already upon us. “Higher fuel prices are already getting reflected in higher food prices, as most products are transported by diesel-powered trucks. Manufactured products’ inflation too has increased quite sharply, a part of which can be attributed to transport costs. Therefore, this process will be continuous and continue to exert pressure on a regular basis as long as prices increase.” He also feels that with the RBI focussing on growth, tackling inflation has become the “secondary target”. D.K. Srivastava, chief policy advisor of EY India, fears that higher petroleum prices might push retail inflation closer to 6 percent on an average in the next few quarters. This will also have an adverse impact on growth

The political cost of the steep fuel price rise could be heavy. No wonder several states— both ruled by the BJP and other parties—are doing it on their own to provide relief to the people. In January, Rajasthan reduced VAT on petrol and diesel by two per cent while poll-bound West Bengal cut VAT by Rs 1. Similarly Assam—another state goes to the polls—has also withdrawn additional tax of Rs 5 imposed in 2020 to generate revenue during the Covid crisis. Meghalaya has given the biggest respite by reducing Rs 7.4 per litre on petrol and Rs 7.1 on diesel, along with VAT cut of Rs 2.

Experts say that the government might have missed a trick by not reducing fuel prices when global crude prices were low during the height of the pandemic. This, they say, could have added one or two per cent to GDP growth. However, as things stand, both the central and state governments have entered into a vicious cycle—if the economy does not revive, tax collection will not rise; and if tax collection is sought to be improved through higher petroleum taxes then the economy will be impacted, thereby hitting revenue collection.

What has also come as a surprise for many, like Sunjoy Joshi, chairman of Observer Research Foundation, is the fact that the government has not been open about the whole issue. “The fact the government is striving to hide the tax component in the petroleum products prices by not displaying it on their websites shows that the whole process of fixing the retail prices is no longer transparent,” Joshi says.