- Barring Kolkata Knight Riders, no other franchisee likely to make money in this year's IPL

- KKR's fortunes pushed by SRK rather than team performance, value

- IPL TV telecast biggest winner; average TVR at a handsome 4.7

- IPL started with 30 sponsors, but it rose to over 100, creating clutter

- Mixed track record for brands, Coke, Bajaj Allianz failed to leverage IPL

- Franchisees hope to break even in 2009, will review sponsorship rates

***

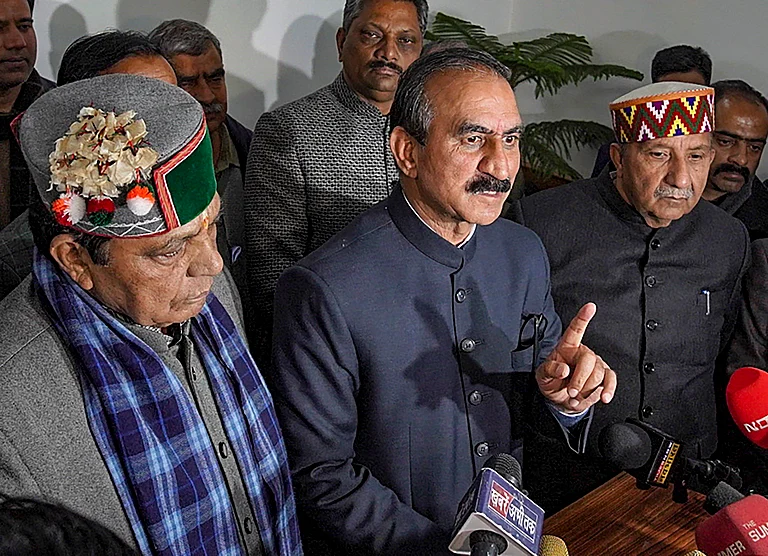

High jinks: The IPL overshadowed all

For now, after all the hype, cheerleaders and night-long parties, franchisee owners, even among the top teams, are settling down to the stark realities. Barring Kolkata Knight Riders (KKR), none of the teams has broken even—not even, it is learnt, the winning team Rajasthan Royals. For most, the returns just didn't match up with the hefty price tags for the team and players, apart from sundry expenses. Says Joy Bhattacharya, director, KKR: "Kolkata Knight Riders would end up positive in their balance-sheet and would probably be the only team to do so as we have managed to meet our revenue targets."

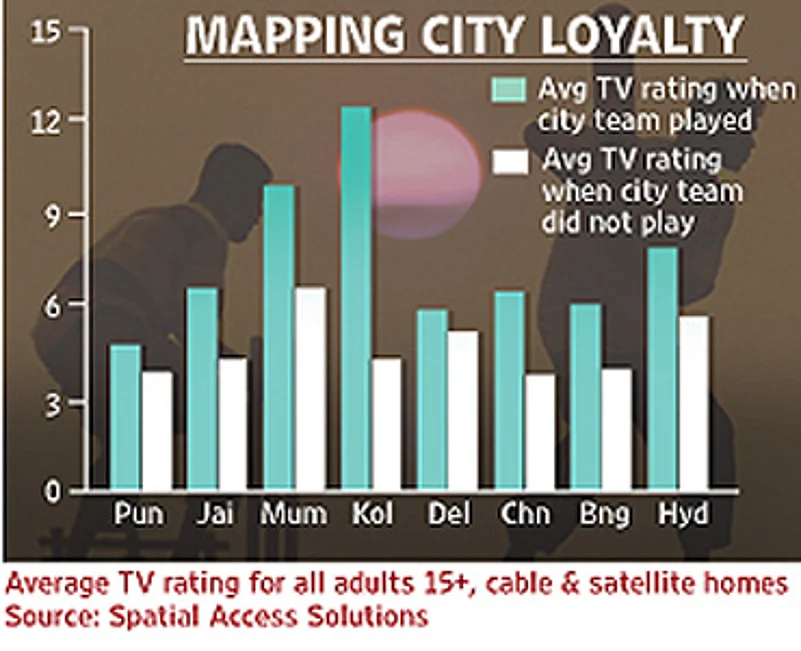

According to market sources, KKR is reported to have garnered revenues of about Rs 75-80 crore against expenses of around Rs 60-65 crore and much of that, agree analysts, was because of the Shahrukh Khan magic. Sandeep Goyal, chairman, Dentsu India, says: "The break-even of Knight Riders is more an SRK outreach and brand halo rather than a direct business success of the team." It also helped that Khan roped in his personal sponsors, boosting the team's kitty. KKR, not surprisingly, showed the highest city-specific loyalty (followed by Mumbai).

Obviously, other teams have not been that lucky. Even Mohali's Punjab King's XI, which made it to the semis, lost money. Says co-owner Mohit Burman of Dabur: "We will lose about Rs 21 crore this year. Gate receipts were poor, especially in the first 3-4 games, and we did not have time to sell the corporate boxes. There was also no merchandising this year even though there was demand for it." While owners like Reliance (Mumbai) and UB Group (Bangalore) didn't want to talk about their performance, others said they hadn't worked out the sums. In any case, as Sathyamurthy N.P, joint president, Lintas, puts it, "As is the case with most long-term associations, it is difficult to break even initially for any stakeholder. However, given the high degree of interest, many should earn reasonable profits from Year 3. "

No doubt, the mood is distinctly upbeat. Venu Nair, CEO, World Sports Group (WSG), which bagged IPL's global media rights for $1 billion, says, "This year's experience will lead to more revenues next year and advertisers are lining up to get into the IPL space. Companies are even looking at IPL-specific budgeting." Mohali, for instance, is already talking to top apparel companies to develop merchandise. The franchisee expects to double revenues to $10 million in Season 2. All its sponsorship deals would be reviewed. Then, KKR plans to plough back its slender profits into the franchisee to look at a bigger season next year.

Analysts feel that with the IPL brand equity established, franchisees would have new revenue streams to tap in future. "The franchisees would have to build their fan following further and monetise it to build revenue streams," says kpmg associate director Dushyant Singh. Here, the decent numbers on city-wise loyalties is encouraging. Even after discounting the Shahrukh factor for KKR, other cities have shown the germ of distinct loyalties when it comes to TV watching (see table). Clearly, Mohali and Delhi have the most work to do here.

The franchisees' optimism stems from IPL's success on TV. During the 6-week period, IPL changed India's TV-viewing trends. All competing genres suffered, particularly fare on general entertainment channels. The all-India television rating (one TVR means the telecast reaches 1 per cent of the total audience) for the tournament (excluding the final) was 4.7 per cent. The semi-final TVRs crossed 6 per cent. Most media analysts felt TVRs would average anywhere between 2.5 and 4. They were wrong. "States like Gujarat, MP and UP, that had no teams, have done phenomenally well (in TVRs)," says SET's Gangadhar. That's good news for franchisees as TV ratings for one-day international games have been dropping consistently.

While industry estimates that SET Max is well on course to break even in two years, advertisers and sponsors have had mixed results. "IPL was more of a success for the on-air sponsors than it was for the team sponsors and I think that's primarily because there were too many team sponsors involved," says Meenakshi Madhvani, managing partner, Spatial Access Media Solutions.

With over 100 brands, it was critical to break through the clutter. Not many achieved that—and even those that did (Vodafone was the most visible brand) faced consumer fatigue thanks to inadequate rotation of ads. "We have feedback from the field that our involvement with the event has opened doors for agents and the level of brand awareness has been high," avers Anisha Motwani, executive vice president, Max New York Life, whose "Sanju" commercial attracted considerable attention throughout the tournament.

What then is the take-away from the first episode of IPL? And will next year's tournament be able to match the pace? Warns Dentsu's Goyal, "The euphoria actually needs some realism...KBC 2 or 3 were far harder to sell compared to version 1.0. IPL events through the year to keep spectator interest alive will count the most. You cannot just be a 44-days-a-year turn-on if you have to build long-term loyalty and brand franchise."

Also, while central revenues would be the same, certain costs could go up—like the cost of star players after three years. Next year, IPL team-owners feel the number of team sponsors and sponsorship rates will go up. The increased price tags may actually end up reducing the number of sponsors. Expectations will also be higher. The key lies in increasing revenues by building on team loyalties. A good beginning certainly helps.