Warren Buffett’s two main rules of investing are:

Rule 1: Never lose money | Rule 2: Never forget Rule No. 1

This underlines the importance of managing one's downside risk and how this helps in the long-term wealth creation.

Here's an example...

You have the following two options.

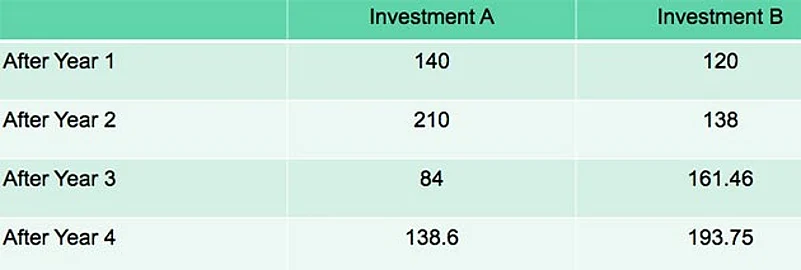

Each option is a portfolio whose annual returns over the next four years are:

Investment A: 40%, 50%, -60%, 65%

Investment B: 20%, 15%, 17%, 20%

Which option would you prefer?

Many whom I asked, preferred Investment A as it looked more exciting.

Sure...'A' has a higher average return of 23.75 vis-a-vis 18% for 'B'.

Unfortunately, this calculation ignores the effect of 'compounding'.

This is what happens to our returns when we compound the two Investments...

Assume we invest Rs.100 in both.

As we see, 'B' returns far more than 'A' after four years. The negative return in Year 3 destroys the overall long-term returns in the latter.

Investors should be aware of this phenomenon as large draw-downs (losses) can adversely affect their long-term returns.

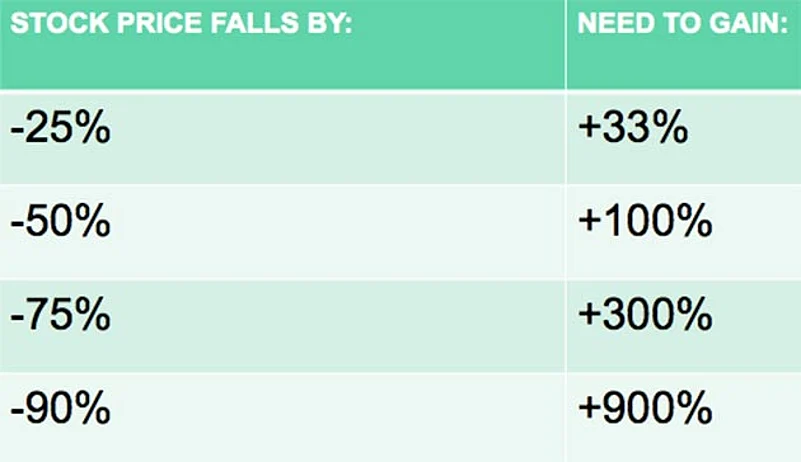

Here's another way how negative returns can impact you:

(Assume initial stock price of Rs.100)

As we see, if an investment falls by 25% (100 to 75), it needs to rise 33% merely to reach the original purchase price. The more you lose, the tougher it is to even regain your cost price.

So what should investors do to avoid the big negative returns?

First, the recipe for successful investing is preservation of capital and earning a ‘reasonable’ rate of return on that capital for a long period. Any uncontrolled or unreasonable growth in our body is called cancer. Similarly with investments, any unreasonable growth is not sustainable over a longer term.

Avoid fancied stocks, highly priced IPOs / current fads (remember bitcoins!) and sectors which have already run up and are trading at expensive valuations. You only pay a fancy price for these and when the fancy ends, you are left with a fancy loss. Instead look for bargains and good businesses which are out of favour.

Investors often commit their biggest mistakes during bull markets when everything is going smoothly and there is a tendency to get overconfident. During such times they will tend to throw caution to the winds and indulge in irrationally optimistic behaviour.

Also, the FOMO (Fear Of Missing Out) factor is at its peak during such periods. Hearing stories of your friends and neighbours making easy-money in the markets, may generate feelings of envy / greed and tempt you to buy stocks on tips, without conducting adequate research. This usually ends badly...

Also remember that people often prefer to highlight their victories, sweeping their losses and failures under the carpet.

Investing should be about optimising returns instead of maximising them. This means attempting to earn the most effective return for every rupee of risk taken. This ensures we avoid permanent loss of capital and attain our financial goals over the long term.

Disclaimers: Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Views are personal.

Neil Parikh, Chairman and Chief Executive Officer, PPFAS Mutual Fund