Amid the growing uncertainty due to Covid, cryptocurrencies like Bitcoin and Ethereum have gained significant fame among investors. Investment in the crypto market has been growing across the globe. The cryptocurrency market size is expected to grow from $1.6 billion in 2021 to $2.2 billion by 2026, at a compounded annual growth rate (CAGR) of 7.1 per cent, as per a report released in April 2021 by Markets and Markets Research, a market research firm.

In many countries even banks have started buying cryptos, says the report. It mentions that banks in the US are creating their own blockchain-based systems, including digital currencies, to enable B2B cryptocurrency payments between their customers.

The increasing interest in cryptos has also led to financial scams and crimes, finds the Crypto Hacks & Scams Report 2021 by Crystal Blockchain, a firm involved in investigative analytics for blockchain and cryptocurrencies.

The Crystal Blockchain report published in December 2021, shows there were 115 security attacks, 40 attacks on DeFi protocols, and 26 fraudulent schemes till December 17, 2021, which resulted in the theft of approximately $10 billion worth of crypto assets in the year. While on one hand, there has been a huge loss of wealth through crypto assets, the latest research report by International Monetary Fund finds that crypto imposes a threat to the global financial stability.

The market value of the ecosystem increased dramatically in 2021 and expanded beyond Bitcoin. According to the IMF report, the financial stability challenge imposed by crypto broadly include operational, cyber, and governance risks, integrity (market and AML/CFT) risks, data availability/reliability issues and challenges from cross-border activities. Thus, with increase in crypto scams and frauds, the financial system will be more vulnerable.

Alarming Rise In Crypto Scams In 2021

With a rise of 81 per cent in crypto scams in 2021, they have led to the loss of over $7.7 billion worth of cryptocurrency worldwide this year, says a recent report by Chainalysis, a cryptocurrency exchange platform.

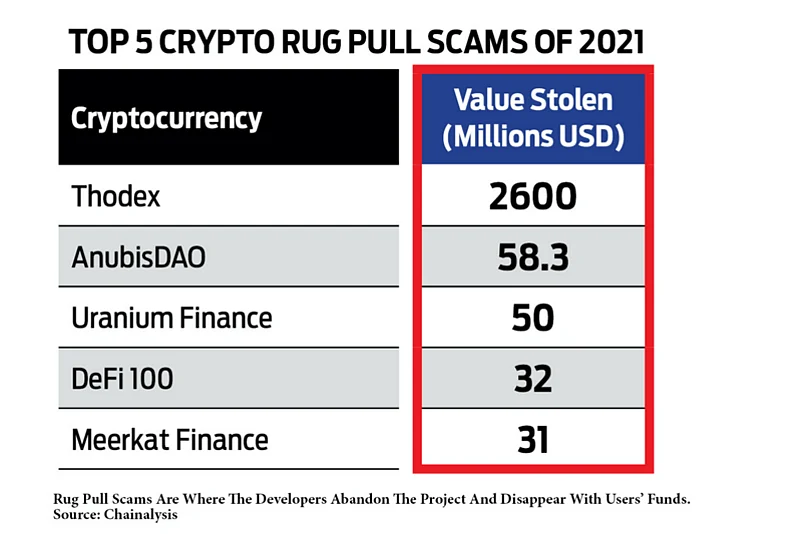

One of the major factors that led to the rise of the crypto scam is the emergence of rug pulls. Rug pull is a new type of scam where “developers of a cryptocurrency project — typically a new token — abandon it unexpectedly, taking users’ funds with them”, mentions the Chainalysis report. Despite a significant fall seen in crypto scams between 2019 and 2020, rug pull spiked the number in 2021. In all scams, users lost over $2 billion worth of cryptocurrency, which represents nearly 90 per cent of all value stolen in rug pulls.

The number of financial scams active at any point in the year rose by more than 60 per cent, from 2,052 in 2020 to 3,300 in 2021, says the Chainalysis report. Being active means their addresses are receiving funds.

“Several gullible people are investing in this fictitious currency and will be losing money as all trading is a zero-sum game. Crypto is fuzzy as there is no underlying that backs the price. For gold there is a metal, for equity there is share but for crypto, there is no such thing,” says Madan Sabnavis, chief economist, Care Ratings, a credit rating agency.

2021 Recorded The Highest Amount Of Crypto Asset Theft

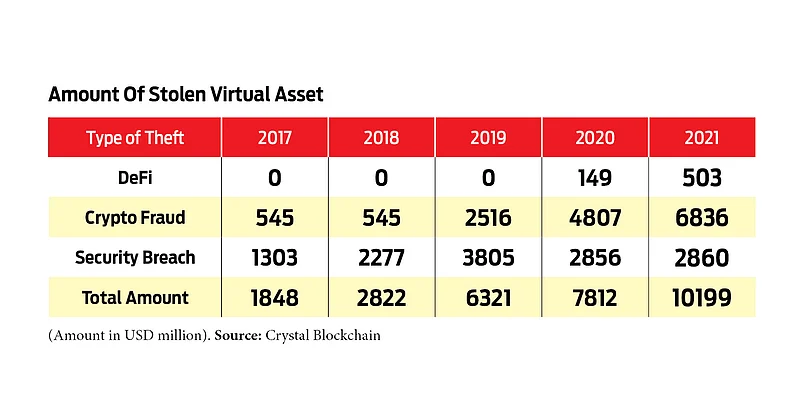

With assets worth more than $10 million being stolen, the year 2021 recorded the highest crypto-asset theft, shows the report by Crystal Blockchain. It also shows that there has been a steady increase in the amount being stolen through the theft of crypto assets. But the total number of reported incidents of thefts against crypto entities did not change much and stood at 31 in 2021.

DeFi hacks have become the most popular way to steal crypto during 2020-2021 and the total amount of stolen virtual assets in crypto being stolen through DeFi hack doubled in this period, finds the report.

The emergence of rug pulls, a relatively new scam type facilitated the growing DeFi hacks, reported Chinanalysis.

Apart from DeFi breaches, crypto frauds and security breaches are common. So far, $2.86 billion has been stolen through security breaches, while $6.8 billion has been stolen through scams and frauds. So, crypto scams or frauds account for more than 65 per cent of the total amount stolen.

While there has been a steady rise in the amount stolen through crypto-assets thefts, with an increase of more than 120 per cent between 2018 and 2019, the total amount stolen witnessed the highest spike between these two years, as per the data of Crystal Blockchain.

According to the Crystal database, over a third, or 39 per cent of all stolen funds (in Bitcoin or BTC) were distributed via fraudulent exchanges, which are defined as having been involved in exit scams, some illegal behaviour, or that have had funds seized by the government. Exit scams involve a cryptocurrency profiting from early investors by “pulling out” all their funds from the market.

The anonymity of crypto assets and limited global standards lead to significant data gaps for regulators. “The problem is that all such transactions are opaque and one cannot be sure if the money is being diverted to drugs or other illicit activity. Today a lot of financial savings are getting diverted to the crypto markets which is not good for the country,” adds Sabnavis.